Atlantic Lithium Limited, the Africa-focused lithium exploration and development company, has announced significant new exploration results from its Rubino and Agboville licences in Côte d’Ivoire, where extensive lithium-in-soil anomalies have been delineated over several kilometres.

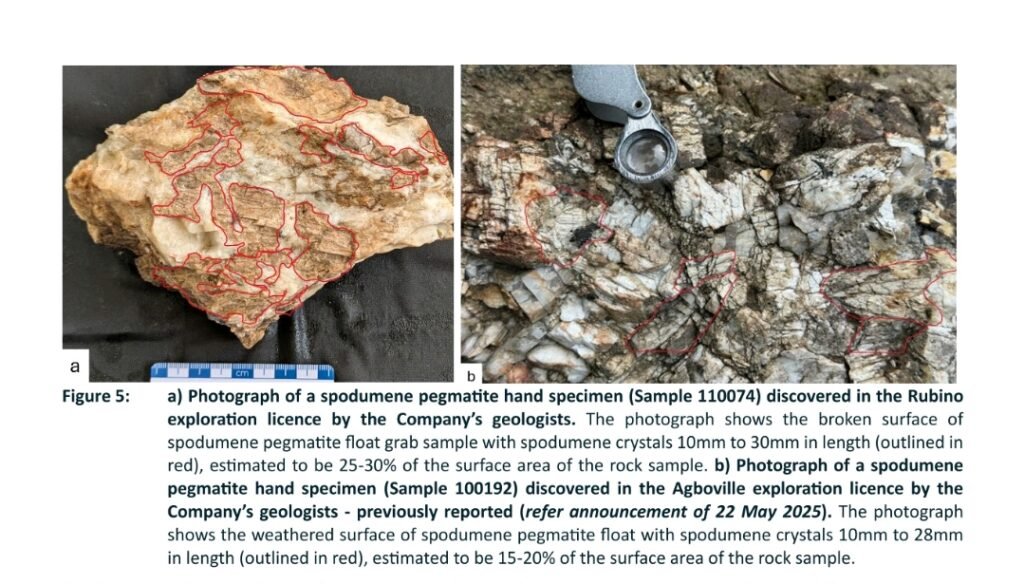

The company said the results demonstrate the growing potential of Côte d’Ivoire as an emerging frontier for lithium exploration. The findings stem from Phase 2 and Phase 3 soil sampling programmes conducted by Atlantic Lithium’s wholly owned subsidiary, Khaleesi Resources SARL. The company also reported the discovery of spodumene pegmatite occurrences from geological mapping within the Rubino licence area, a sign of strong mineralisation potential.

Chief Executive Officer Keith Muller described the results as a major boost to the company’s regional exploration ambitions, reinforcing the strategic value of its West African assets.

“The latest results from the Company’s ongoing exploration programmes across its 100%-owned Rubino and Agboville licences further underscore the prospectivity of its tenure in Côte d’Ivoire.

“Phase 2 and Phase 3 soil sampling results have delineated pronounced lithium-in-soil anomalies extending over several kilometres across the two licences, with several trends warranting further evaluation.”

Chief Executive Officer Keith Muller

According to Muller, the Rubino licence has shown particularly promising outcomes. The lithium-in-soil anomaly, previously identified in earlier phases, has now expanded to cover an area of approximately 6.0 kilometres by 2.5 kilometres, marking a substantial increase in the target zone for further exploration.

Meanwhile, the Agboville licence has revealed a linear anomaly more than 5 kilometres in length, alongside other anomalous features.

One of these anomalies is associated with spodumene pegmatite float discovered by the company’s geologists a clear indicator of mineralisation that merits immediate follow-up evaluation.

“Through mapping and rock-chip sampling, we have also discovered several new spodumene pegmatite occurrences in rock float, in addition to previously reported outcrops within the Rubino licence.

“Further mapping has now commenced across both licences to support the evaluation of the anomalies identified in the Phase 2 and 3 soil results and to assist in defining follow-up auger drill programmes.”

Chief Executive Officer Keith Muller

Côte d’Ivoire’s Untapped Lithium Potential

Atlantic Lithium’s discoveries highlight the untapped lithium potential of Côte d’Ivoire, a country with a growing reputation for mining-friendly policies and regulatory stability.

Despite its rich mineral base, Côte d’Ivoire remains underexplored for lithium, positioning the company as one of the first movers in what could become one of West Africa’s most promising new lithium provinces.

The latest data, combined with earlier exploration results, strengthens the company’s strategy of developing a pipeline of lithium projects across West Africa.

This approach complements Atlantic Lithium’s flagship Ewoyaa Lithium Project in Ghana, which is currently under advanced development and expected to become one of Africa’s leading spodumene producers.

“The Company believes that its licences in Côte d’Ivoire demonstrate significant value potential through lithium exploration.

“To be undertaken alongside the advancement of our flagship Ewoyaa Lithium Project in Ghana, we have commenced a formal process to explore funding options including minority, project-level investment or partnerships to accelerate exploration of the two licences.”

Chief Executive Officer Keith Muller

To advance its Côte d’Ivoire exploration programme without diluting shareholder value, Atlantic Lithium has engaged a specialist corporate advisor to identify non-dilutive funding options.

This move reflects the company’s prudent approach to capital management as it seeks to fast-track exploration while preserving long-term shareholder returns.

Industry analysts have welcomed the announcement, describing the discoveries as an important step toward unlocking Côte d’Ivoire’s potential in the fast-growing battery minerals sector.

Global demand for lithium, a critical component in electric vehicle batteries, continues to surge, with West Africa emerging as a strategic supply hub.

Growing West African Lithium Powerhouse

Atlantic Lithium’s dual focus on Ghana and Côte d’Ivoire places the company at the forefront of West Africa’s transition into a global lithium production corridor.

The Ewoyaa project in Ghana already in the advanced development stage is expected to become the company’s first producing asset, providing both operational experience and cash flow to fund future exploration across the region.

The Côte d’Ivoire licences, meanwhile, provide a strategic growth pipeline, giving Atlantic Lithium a foothold in two of the continent’s most stable and resource-rich jurisdictions.

The combination of strong geological potential, improving infrastructure, and supportive government policies makes the company’s regional strategy both timely and well-positioned to benefit from rising lithium demand.

Atlantic Lithium plans to continue detailed geological mapping and rock-chip sampling across both licences in the coming months to further define high-priority targets for auger and reverse circulation (RC) drilling.

The company’s next phase of work will focus on confirming mineralisation continuity and identifying potential zones for resource definition drilling.

“We look forward to providing further updates in due course. “Our aim is clear to build a sustainable pipeline of lithium assets across West Africa that supports the global energy transition and delivers long-term value for our stakeholders.”

Chief Executive Officer Keith Muller

With lithium prices remaining strong amid surging electric vehicle demand, the company’s expansion into Côte d’Ivoire signals a new phase of growth.

The combination of geological success, strategic funding initiatives, and regional diversification strengthens Atlantic Lithium’s position as a leading force in Africa’s emerging lithium industry.

READ ALSO: BoG’s $1.15bn FX Injection Sparks Clash with IMF and World Bank Over Cedi Stabilization