Hollard Ghana has once again raised the nation’s flag high on the global stage as its innovative Asomdwee MSME Insurance clinched the Impact Award at the prestigious 2025 Tokio Marine Group Awards in Tokyo, Japan.

The recognition celebrates Hollard Ghana’s pioneering approach to strengthening the resilience and sustainability of Micro, Small, and Medium Enterprises (MSMEs) in Ghana through accessible, comprehensive, and flexible insurance coverage.

This international accolade positions Hollard Ghana as a trailblazer in crafting insurance solutions that go beyond traditional coverage, addressing the real challenges that small businesses face in an unpredictable economic environment.

MSMEs are the lifeblood of Ghana’s economy, accounting for a significant share of employment and innovation. However, many operate without adequate protection from financial shocks, natural disasters, theft, and other business disruptions. Recognising this vulnerability, Hollard Ghana, in partnership with the Ghana Enterprises Agency (GEA), developed Asomdwee MSME Insurance to fill this critical gap.

The product offers wide-ranging protection, including employee welfare, permanent disability, critical illness, fire, burglary, third-party liability, and death cover. What sets Asomdwee apart is its flexible tiered structure, with Bronze, Silver, and Gold packages, allowing business owners to choose coverage that matches their size, risk exposure, and financial strength.

This innovative approach ensures that Ghanaian MSMEs no longer have to settle for “one-size-fits-all” insurance but can access customised protection that safeguards their growth and stability.

A Vision Rooted in Empowerment

Speaking on the award, Patience Akyianu, Group CEO of Hollard Ghana, expressed pride and gratitude for the recognition, highlighting the company’s purpose-driven mission.

“This award affirms the difference we are making in strengthening the backbone of Ghana’s economy—our MSMEs. With Asomdwee, we set out to remove barriers that have long left small businesses exposed to risks they cannot recover from. It’s about enabling entrepreneurs to thrive, safeguarding livelihoods, and building resilience for the future.”

Patience Akyianu

Her statement reflects Hollard Ghana’s broader mission—to not only protect but empower small businesses to grow confidently amid uncertainty.

The Tokio Marine Group Awards, an annual global event celebrating ethical leadership and innovation within the insurance industry, selected Hollard Ghana’s Asomdwee product after a rigorous evaluation process led by Tokio Marine Group CEO, Masahiro Koike.

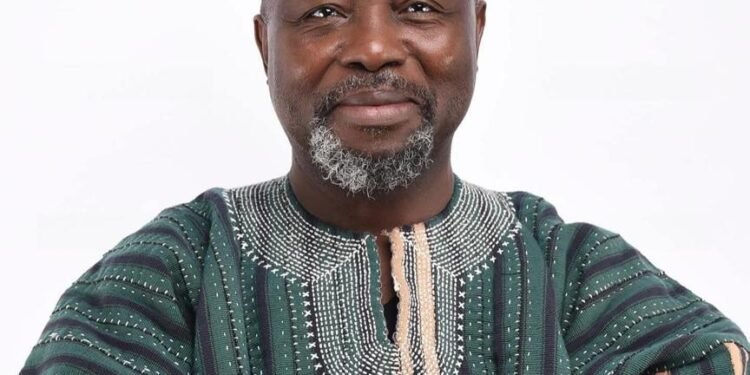

Pravin Kalpagé, CEO of Hollard International, commended the Ghanaian subsidiary’s forward-thinking approach.

“We understand that MSMEs face different pressures compared with larger businesses. Our solutions are designed to address these specific challenges to enable MSMEs to confidently navigate business and life’s uncertainties. This recognition reflects our commitment to driving resilience not only in Ghana but across Africa.”

Pravin Kalpagé

The award underscores how local innovation can have global relevance, demonstrating the power of context-driven solutions in addressing economic challenges across emerging markets.

The Power of Public-Private Collaboration

The success of Asomdwee MSME Insurance is also rooted in the effective collaboration between Hollard Ghana and the Ghana Enterprises Agency (GEA). Through this public-private partnership, the product has reached thousands of entrepreneurs, many of whom are accessing formal insurance protection for the first time.

This partnership model is now being viewed as a replicable framework for other African economies, showcasing how cooperation between government institutions and private sector players can deliver tangible results for small business sustainability.

By combining the GEA’s grassroots reach with Hollard’s expertise in product design and risk management, the initiative is transforming the way MSMEs perceive and engage with insurance.

For Hollard Ghana, winning the Impact Award is not the end of the journey—it marks a new beginning. The company plans to expand the Asomdwee MSME Insurance offering to more regions in Ghana and, eventually, to other African markets where MSMEs face similar risks.

Kalpagé reaffirmed this ambition, stating, “We want to play our part in enabling resilience and sustainability for MSMEs in Ghana and across the continent. Partnerships like the one we have with the Ghana Enterprises Agency remain central to our strategy.”

The long-term goal is to ensure that no small business is left without a safety net. By offering accessible and affordable insurance coverage, Hollard Ghana aims to help entrepreneurs build resilience, protect jobs, and strengthen the foundation of Africa’s growing economies.

READ ALSO: Auditor General Uncovers GHS 2.2bn Ghost Names Scandal at NSA