Accra has once again taken centre stage in Africa’s banking sector as the Bank of Ghana (BoG), in collaboration with the Bank of England (BoE), hosts a high-level gathering of central bank governors and senior policymakers from across the continent.

The two-day engagement, themed around banking regulation and leadership in modern central banking, marks a new chapter in Africa’s pursuit of financial stability, independence, and institutional credibility.

The meeting forms part of the BoG–BoE Technical Cooperation Programme, a partnership established in 2018 with the support of the UK Foreign, Commonwealth and Development Office (FCDO). Over the years, this collaboration has become a cornerstone of capacity building and technical excellence among African central banks—covering areas such as macroeconomic modelling, financial stability frameworks, climate-risk supervision, and institutional communication strategies.

The 2025 Conference is not merely a continuation of past cooperation but a strategic platform for leadership dialogue—bringing together both current and former African central bank governors and deputy governors. It is designed to foster collective reflection on how African central banks can sustain credibility and independence amid growing political and economic pressures.

At the heart of the discussions is a shared recognition that Africa’s central banks are at a pivotal moment. Post-pandemic recovery, accelerating digital transitions, and new global shocks demand not only technical proficiency but also principled leadership and resilient governance structures.

Participants are engaging in peer-to-peer learning sessions on decision-making, institutional accountability, and communication—examining real experiences of navigating high-stakes policy environments. The sessions also delve into how central banks can build trust among political leaders, the media, and the public while preserving operational independence.

Leadership and Credibility in Uncertain Times

One of the conference’s key objectives is to deepen understanding of how independence and accountability can coexist to strengthen policy credibility. African central bank governors are exploring how reforms, legal frameworks, and governance structures can reinforce autonomy while ensuring accountability to the public and legislature.

The discussions raise critical questions: How do independence and accountability coexist in practice? What role does transparency play in maintaining legitimacy? And how will digital currencies and climate risks reshape future debates on central bank independence?

Through these conversations, the conference seeks to move beyond technical regulation and into the character of leadership—focusing on how the next generation of African central bankers can lead with credibility, discipline, and a shared sense of purpose.

High-Calibre Speakers and Global Perspectives

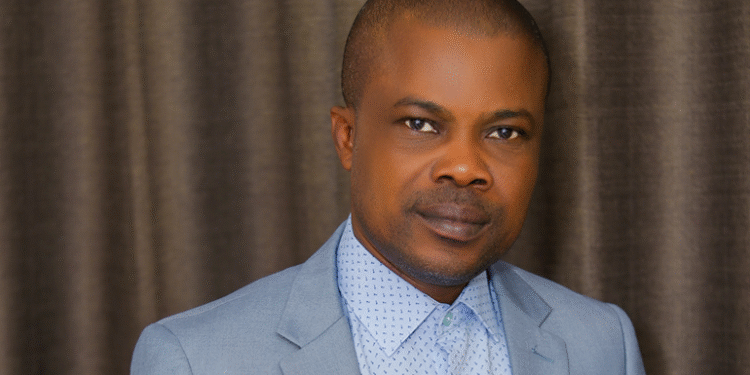

The event features an impressive lineup of international thought leaders and financial experts. Among the key speakers are Dr. Johnson Asiama, Governor of the Bank of Ghana; Clare Lombardelli, Deputy Governor of the Bank of England; Stefan Ingves, former Governor of the Central Bank of Sweden; and Abebe Aemro Selassie, Director of the African Department at the International Monetary Fund (IMF).

These renowned figures bring invaluable perspectives from different regions, combining Africa’s lived experiences with international best practices. Their insights underscore the importance of cross-country learning, where lessons from European central banks merge with Africa’s unique realities to shape sustainable policy outcomes.

Reinforcing BoG–BoE Cooperation and Regional Impact

Since its inception, the BoG–BoE partnership has extended its impact beyond Ghana, reaching around 20 African central banks through regional workshops on macroprudential supervision and policy design. The programme has become a model for long-term collaboration and institutional capacity building, blending technical training with policy dialogue.

The 2025 Conference seeks to capture practical recommendations for institutional strengthening, leadership development, and policy resilience across the African central banking community. By emphasizing trust, communication, and governance, the conference reinforces the idea that strong institutions, not just strong individuals, are the foundation of financial stability.

The Future of Central Banking in Africa

As Africa’s economies evolve amid digital disruption and climate-related risks, central banks must adapt to new realities. The conference offers a forum to explore how digital currencies, fintech innovations, and green finance can be harnessed without undermining monetary stability or policy independence.

Moreover, participants are challenged to rethink the future of central banking as not just a technocratic function, but a moral and institutional mission—anchored in transparency, credibility, and public trust.

By hosting this historic meeting, Accra cements its role as Africa’s financial nerve centre, driving the conversation on leadership, accountability, and innovation in monetary governance. The collaboration between the Bank of Ghana and the Bank of England serves as a powerful reminder that international cooperation and shared learning remain vital to Africa’s economic resilience.

As the conference concludes, one message resonates clearly: the strength of Africa’s financial future lies not only in sound policy frameworks but also in the quality of leadership guiding its central banks.

READ ALSO:Next 2 years Critical as Ghana Faces Possible Downgrade – S&P Global