Ghana has signed a new bilateral debt agreement with the Federal Republic of Germany, marking what the Finance Minister described as another significant step in the country’s ongoing economic recovery and fiscal stabilisation efforts.

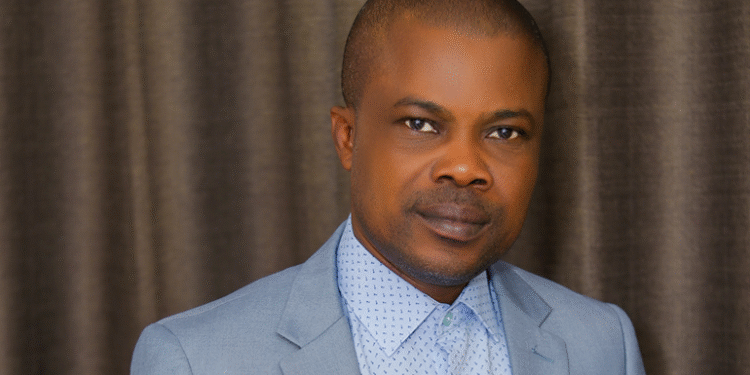

The agreement, signed earlier today between Finance Minister Dr. Cassiel Ato Forson and German Ambassador Frederik Landshöft, becomes the sixth major bilateral deal concluded under Ghana’s current debt restructuring programme.

In a statement released after the signing ceremony, Dr. Forson described the development as “yet another critical milestone in our economic recovery journey.” He emphasised that the agreement deepens the foundations of fiscal stability and strengthens Ghana’s long-term path toward resilience and sustainable growth.

According to him, the deal reflects both technical progress and renewed confidence from Ghana’s international partners. “Together, we are building a stronger, more sustainable economy, one step at a time,” he said, expressing gratitude to the Government and people of Germany for what he called their “steadfast partnership and confidence in Ghana’s future.”

Ghana’s Stable Macroeconomic Environment

Ambassador Landshöft congratulated Dr. Forson and commended the government for stabilising the macroeconomic environment despite global and domestic challenges.

He reaffirmed Germany’s commitment to strengthening its bilateral cooperation with Ghana, describing the reform momentum as encouraging and worthy of continued support. The German envoy noted that the agreement aligns with Germany’s broader interest in supporting economic stability and development across Africa.

The signing comes at a time of growing optimism around Ghana’s economic outlook, occurring just days before the presentation of the 2026 Budget to Parliament on Thursday, November 13, 2025. Officials have suggested that the agreement adds credibility to Ghana’s fiscal roadmap ahead of the budget presentation, reinforcing confidence among development partners and investors.

The positive sentiment surrounding the agreement also coincides with a major international endorsement of Ghana’s financial recovery. S&P Global Ratings recently upgraded the country’s long- and short-term foreign and local currency sovereign credit ratings from CCC+/C to B-/B, with a stable outlook.

The ratings agency also raised Ghana’s transfer and convertibility assessment to B- from CCC+. In its assessment, S&P attributed the upgrade to improvements in external liquidity, continued fiscal reforms, and stronger performance across key sectors of the economy.

According to S&P, Ghana’s balance of payments has strengthened considerably, supported by improved export receipts, a narrower current account deficit, and more disciplined fiscal management.

A Significant Boost to Ghana’s Reputation

Analysts say the upgrade represents a significant boost to Ghana’s reputation on the international financial markets and signals increasing confidence in the government’s reform agenda.

Since taking office under what many economists described as one of the most challenging macroeconomic environments in recent memory, the administration has worked to reverse a cycle of rising inflation, instability in the financial sector, and persistent currency pressure.

Inflation, which had soared to multi-decade highs, has now dropped sharply to 8 percent—the first return to single digits since 2021. Analysts note that the decline has been both rapid and sustained, with further easing expected before the end of the year.

Interest rates, previously driven upward in an attempt to curb inflation and stabilize the currency, have also begun to decline, creating an improved environment for private sector expansion.

Business sentiment surveys point to increased confidence, with firms reporting better access to credit and more stable operating conditions. Economic growth has similarly strengthened, driven largely by robust performance in non-oil sectors.

These sectors, which account for the bulk of employment opportunities, have benefited from targeted government initiatives aimed at stimulating production, improving market access, and restoring investor confidence. The renewed expansion has been described by policymakers as evidence of a broad-based recovery rather than a temporary rebound.

Cedis Stability

Perhaps the most notable sign of economic stabilisation has been the performance of the cedi, which has long been vulnerable to fluctuations triggered by global market turbulence and Ghana’s external financing needs.

The currency has shown strong stability in recent months, trading at GHS 10.9 to the US dollar. Economists attribute this resilience to disciplined fiscal consolidation efforts, stronger foreign exchange inflows, and improved balance-of-payment conditions.

These gains have also helped the government achieve a budget surplus—an outcome that few observers predicted at the beginning of the year. The surplus, combined with progress in public debt restructuring, has contributed to a meaningful reduction in the country’s debt burden.

Another major milestone came with Ghana’s attainment of a fifth IMF Staff-Level Agreement under the ongoing three-year, US$3 billion Extended Credit Facility programme. The IMF Executive Board is expected to meet in December 2025 to consider the agreement’s approval.

If endorsed, Ghana would receive an additional US$385 million, reinforcing external buffers and advancing the reform agenda. Many analysts believe that the anticipated approval is further validation of government policy and a vote of confidence in its management of the economy.

With today’s agreement, Germany becomes the latest partner to reaffirm support for Ghana as it navigates the next phase of its economic recovery. Government officials maintain that the signing strengthens the momentum behind ongoing reforms and further anchors Ghana’s position as a stable economic partner within the international community.

READ ALSO: Baffoe-Bonnie’s Chief Justice Nomination, a Grave Breach of Constitutional Order – NPP