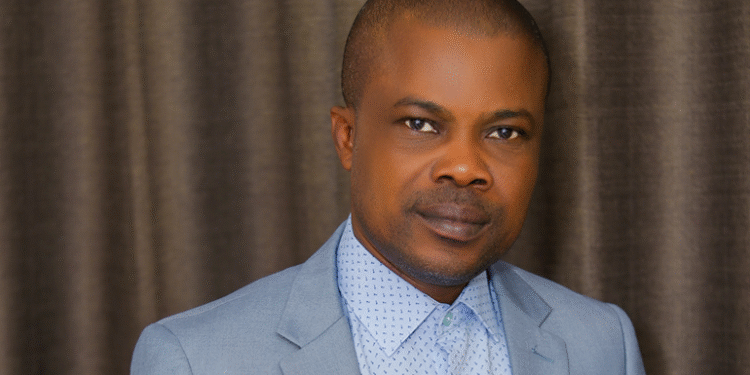

The Chief Executive Officer of the Financial Intelligence Centre (FIC), Kwadwo Twum-Boafo, has raised serious concerns over the growing use of mobile money platforms to facilitate illicit financial transactions in Ghana.

Speaking at a recent engagement, he revealed that as regulatory controls in the formal banking sector become stricter, individuals involved in suspicious financial dealings are increasingly turning to mobile money and other virtual financial channels to move funds undetected.

According to Mr. Twum-Boafo, the situation poses a significant threat to the integrity of Ghana’s financial ecosystem. He explained that while regulatory tightening within the traditional banking sector has helped reduce the circulation of illegal funds, it has also created a shift toward less-regulated digital payment systems.

“The banks have tightened their regulations. The Fintech and Innovations Department of the Bank of Ghana and the Financial Stability Department are very strict on financial transactions. Indeed, in Ghana today, you can’t give a third party a cheque of more than GH¢5,000.”

Mr. Twum-Boafo

This tightening, he noted, has effectively forced individuals seeking to launder money to explore alternative platforms, with mobile money emerging as their preferred choice.

Regulatory Clampdown in the Banking Sector

Over the past few years, the Bank of Ghana has strengthened its regulatory oversight of financial transactions. Measures such as stricter Know Your Customer (KYC) protocols, enhanced due diligence, and tighter foreign currency controls have significantly reduced loopholes within the formal banking system. Mr. Twum-Boafo acknowledged that these measures have been successful in curbing suspicious activities.

“As we speak, you can’t even transfer foreign currency to an individual without certain checks on the individual. So, they are very strict,” he remarked. However, he added that while banks have largely achieved compliance, the challenge now lies in extending similar levels of scrutiny to the rapidly expanding digital finance sector.

Mobile Money: A Growing Channel for Illicit Finance

Mobile money, once celebrated for promoting financial inclusion and accessibility, has become a double-edged sword. The FIC boss disclosed that the virtual nature and relative anonymity of mobile money transactions make them increasingly attractive to criminals and money launderers.

“The platform that most of them use will be the mobile money platform, which is more or less virtual. As for virtual assets, it is more difficult to monitor,” he said.

He revealed that the FIC has developed technical capabilities to monitor and freeze mobile money accounts suspected of being used for illicit financial activities. However, he emphasized that the effectiveness of such interventions depends heavily on the compliance levels of telecommunication companies that manage mobile money services. “We are able to freeze mobile money accounts. They (Telcos) are enjoined to be compliant, but them being fully compliant—that’s another discussion for another day,” he noted.

Mr. Twum-Boafo commended the banking industry for maintaining high regulatory compliance standards but expressed disappointment in the performance of telecommunication operators. According to him, while the banks have adopted a proactive approach to Anti-Money Laundering (AML) and Counter-Terrorism Financing (CTF) compliance, telcos appear to be lagging behind.

“I talked about the front-foot approach that we need, and they (Telcos) in particular are not in compliance as much as I would like. The banks are, but Telcos, no,” he said. This, he warned, could create a dangerous regulatory gap in Ghana’s financial ecosystem. With mobile money transactions now surpassing GH¢1 trillion annually, weak compliance by telecom operators exposes the system to significant risks of fraud, cybercrime, and money laundering.

According to data from the Bank of Ghana, mobile money transactions have grown exponentially over the past decade, reflecting the increasing adoption of digital financial services among Ghanaians. While this growth has driven financial inclusion and supported small business operations, it has also expanded the scope for illicit activities.

Analysts have cautioned that without robust monitoring systems and stronger coordination among regulatory agencies, the country could face mounting challenges in tracing and intercepting illegal transfers. The ease and speed of mobile transactions, coupled with limited identity verification in some cases, have created vulnerabilities that criminal networks can exploit.

Strengthening Collaboration for a Safer Digital Economy

Experts say effective collaboration among the FIC, the Bank of Ghana, and telecommunication companies is critical to tackling this growing threat. A coordinated approach that integrates data sharing, real-time transaction monitoring, and enhanced KYC compliance could help close regulatory gaps and improve oversight.

The FIC’s warning also serves as a reminder that digital innovation must go hand in hand with security. The rapid expansion of fintech solutions, mobile wallets, and digital lending platforms requires regulators to constantly adapt and invest in new technologies that can detect and prevent financial crimes.

Mr. Twum-Boafo stressed that while the FIC possesses the technical ability to act swiftly against suspicious transactions, it needs stronger cooperation from all stakeholders to ensure the effectiveness of its actions. “We can freeze accounts, but the system must be built to identify and flag suspicious activities quickly,” he said.

As Ghana continues its digital transformation journey, maintaining trust in the mobile money system is vital. The FIC’s warning underscores the need for both regulators and service providers to stay ahead of evolving financial crime tactics.

READ ALSO:Oil Prices Slip as Supply Outlook and Russian Sanctions Weigh on Market