Ghana’s debt accumulation has declined from a positive figure in 2024 to a negative figure, reflecting the government’s commitment to a sustainable growth path for the economy.

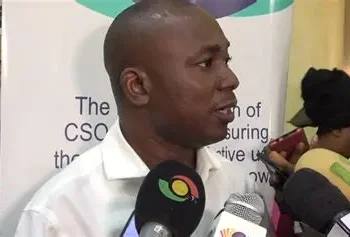

During the reading of the 2026 Budget Statement, Dr. Cassiel Ato Forson, the Minister of Finance, emphasized that the government’s debt strategy is working as its debt accumulation turned negative, falling from 19.1 percent in 2024 to a negative 13.3 percent by October 2025.

“For the first time in over a decade, the rate of debt accumulation has turned negative, falling from a positive 19.1 percent in 2024 to a negative 13.3 percent by October 2025. It is a powerful signal that Ghana’s public finances are on a sustainable path once again.”

Dr. Cassiel Ato Forson

He noted on the floor of Parliament that this complete reverse is one of the steepest improvements in Ghana’s debt metrics in recent history, and a negative record not seen over a decade in Ghana. This he associated with “reflects disciplined fiscal management, prudent borrowing, effective liability operations, and a strong performance of the Ghana cedi.”

The Minister declared that not only is the government’s debt management strategy working, but its fiscal consolidation is also delivering expected results. This indicates the government’s commitment to prudence, economic restoration and growth, as well as sustainability.

Domestic and External Debt

The Ghana Cedi’s appreciation, the government’s fiscal discipline, and reduced borrowing reduced Ghana’s external debt, according to the Minister, by GH¢97.6 billion (23.4 percent), from GH¢416.8 billion in December 2024 to GH¢319.2 billion in October 2025.

With the current economic performance and progress, Ghana’s integrity in the international market has increased.

The Minister stated that the domestic debt, however, increased slightly from GH¢309.8 billion to GH¢311.0 billion. “As a result, the debt mix has improved significantly, with domestic debt now representing 49.4 percent of total public debt, up from 42.6 percent,” he added.

This he attributed to controlled domestic borrowing to support the 2025 Budget. This shift, he assured, underscores the government’s commitment to deepening local financial markets and reducing external vulnerabilities.

Prioritizing domestic financing over external borrowing accrues many benefits to the economy. It mitigates exchange rate risk, debt is serviced in the local currency, promoting economic autonomy, insulates from foreign capital flow reversals, develops the local financial market, interest payments are transferred within the local economy, and strengthens the link between the government and the citizenry, promoting accountability.

Debt Restructuring

The Minister reiterated the government’s steadfastness on the part of a comprehensive debt restructuring. According to Dr. Forson, “on October 13, 2025, the Memorandum of Understanding with Official Bilateral Creditors became effective, following the completion of all conditions precedent.”

He further explained that “bilateral agreements have already been signed with China, Finland, France, Germany, Spain, and the United Kingdom, with the remaining countries expected to finalize theirs by December 2025.”

On the commercial debt front, he mentioned that “the government has reached Agreements in Principle (AIPs) with several major lenders. The Official Creditor Committee (OCC) has confirmed that these AIPs meet the Comparability of Treatment principle, paving the way for broader participation.”

He assured that negotiations will continue with the remaining creditors to conclude the process, ensuring Ghana’s debt profile remains equitable and sustainable.

Domestic Debt Market Recovery

In his budget reading, Dr. Forson, who triplets as a Member of Parliament, Minister for Finance, and Acting Defense Minister, mentioned the strong performance of the domestic debt market on the back of macroeconomic stability and renewed investor confidence.

Total issuance increased, with over 90 percent coming from treasury bills, he said. He assured Ghanaians that the government has paid all coupons under the DDEP in cash and in kind.

“By October 2025, total issuance reached GH¢234.0 billion, with GH¢229.6 billion coming from Treasury bills. Importantly, the Government honored all coupon payments under the Domestic Debt Exchange Program, amounting to GH¢20.3 billion, of which GH¢16.8 billion was paid in cash and GH¢3.6 billion in kind.

“We [government] are also current on all debt service payments to non-tendered bondholders. These timely payments have reinforced credibility, restored trust, and revitalized participation in the domestic market.”

Dr. Cassiel Ato Forson

A New Era of Debt Sustainability

Dr. Forson assured the country that “Ghana’s debt trajectory has shifted decisively toward sustainability,” adding that “the combination of sound fiscal reforms, effective debt management, and restored investor confidence has set Ghana on a clear path to debt stability.”

He further expressed the true intention behind the moves of the government regarding Ghana’s debts, stressing that the government is reclaiming and rebuilding its sovereignty, integrity, and discipline.

“We [the government] are not merely reducing debt; we are reclaiming Ghana’s financial sovereignty and credibility in international markets. The government’s actions are rebuilding trust, strengthening our fiscal institutions, and positioning Ghana as a model of responsible economic stewardship.

“The message is clear: Ghana is rebuilding with discipline, delivering results, and ensuring that debt serves development, not the other way around.”

Dr. Cassiel Ato Forson

He, therefore, called on all Ghanaians to remain confident and support the government because the government is working hard to fulfill its commitment to the good people of Ghana.

READ ALSO: Domestic Production Drove Economic Growth in 2025H1 to 6.3% – Ato Forson