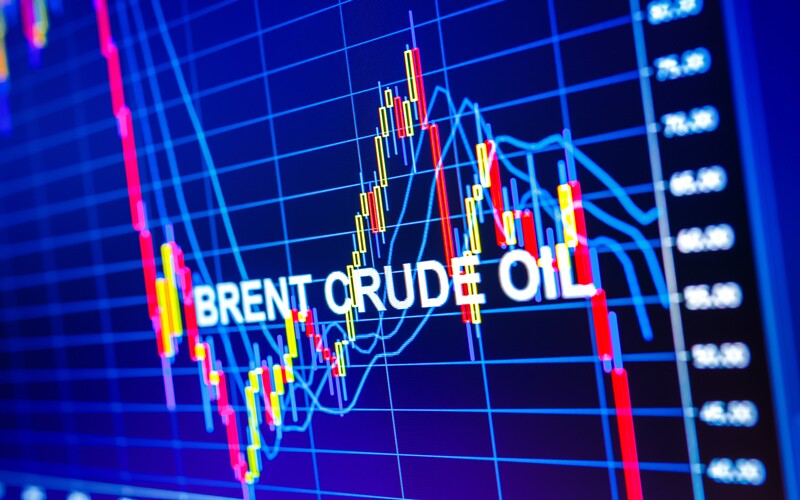

Global oil prices edged lower on Tuesday as market concerns shifted from geopolitical supply disruptions to the growing likelihood of a significant crude surplus in 2026. Although sanctions on Russian oil exports continue to cloud the supply outlook, analysts say forecasts of rising production and softer demand are weighing more heavily on market sentiment.

Brent crude futures fell by 0.5% to $63.04, while West Texas Intermediate (WTI) also declined 0.5% to $58.52 at the time of writing.

The dip follows a modest rebound on Monday, when both benchmarks climbed 1.3% amid renewed doubts about a peace deal between Russia and Ukraine, which had briefly raised expectations for eased sanctions and increased supply flows.

However, those geopolitical concerns have since taken a back seat as traders and analysts turn their attention to what many now see as a looming oversupply environment in global crude markets.

“In the short term, the key risk is oversupply and current price levels seem vulnerable,” said Priyanka Sachdeva, senior market analyst at Phillip Nova.

Her remarks reflect a growing consensus among market observers that even if Russian shipments face tightening restrictions, the world may still be awash with oil.

The sanctions landscape remains fluid, with Western restrictions affecting oil majors Rosneft and Lukoil, as well as regulations prohibiting the sale of oil products refined from Russian crude to European markets. These measures have prompted some Indian refiners, particularly private-sector giant Reliance, to scale back purchases of Russian oil.

With fewer buyers available, Russia is attempting to pivot more aggressively toward China. On Tuesday, Russian Deputy Prime Minister Alexander Novak confirmed that Moscow and Beijing were in talks to expand the flow of Russian oil into the Chinese market.

Still, uncertainty lingers regarding the ultimate impact of Western sanctions. “Market participants still are trying to figure out if the latest European and U.S. sanctions will impact Russian oil exports or not,” said UBS analyst Giovanni Staunovo, noting that enforcement challenges and shifting global trade routes complicate the picture.

Analysts Forecast Bearish Oil Market in 2026

While many traders are focused on the geopolitical tug-of-war, energy analysts say the more enduring story lies in the expected supply-demand imbalance.

According to a new assessment from Deutsche Bank, the global oil market may face a surplus of at least 2 million barrels per day in 2026, with no clear path to deficits even the following year.

“The path forward into 2026 remains a bearish one,” said Deutsche Bank analyst Michael Hsueh, citing a combination of strong supply growth and lacklustre demand expansion.

This outlook has overshadowed the peacetime prospects in the Russia-Ukraine conflict. A potential deal would likely usher in a wave of previously restricted Russian crude, further adding to the global supply glut. But even without such a resolution, the market appears headed toward excess production.

Despite the bearish fundamentals, oil prices are receiving some support from growing expectations that the U.S. Federal Reserve may cut interest rates at its policy meeting scheduled for December 9–10.

Lower interest rates typically encourage investment and consumer spending, factors that tend to support energy consumption.

A Market Caught Between Risks and Reality

As 2026 approaches, the global oil market finds itself suspended between conflicting narratives. On one hand, geopolitical tensions, sanctions and shifting alliances threaten to disrupt supply chains. On the other, a clear and increasingly convincing oversupply outlook looms over market projections, nudging prices downward.

For now, traders remain cautious, weighing external shocks against the structural forces that may define the coming year.

Whether interest rate cuts or geopolitical developments can counter the rising tide of oversupply remains to be seen, but market analysts continue to warn that the fundamental trend is turning bearish.

The months ahead will test how resilient oil prices can remain in the face of persistent uncertainty, both political and economic.

READ ALSO: T-bill Undersubscription Trend Persists as Tight Liquidity Chokes Market