Atlantic Lithium Limited has reaffirmed its commitment to delivering Ghana’s first lithium mine, assuring investors of steady progress despite global price volatility and delays in mining lease approvals.

The Africa-focused lithium exploration and development company is expected to share its latest updates during its online Annual General Meeting (AGM), where Neil Herbert, Chairman of Atlantic Lithium will highlight strategic measures undertaken over the past year to maintain the project’s momentum.

In the prepared AGM address, Atlantic Lithium acknowledges that the past year has presented significant challenges for the global lithium market, with prices dropping to cyclical lows before recovering modestly.

According to the Chairman’s statement, the company responded with decisive cost-management strategies to protect shareholder value and maintain operational focus.

“Over the past year, our focus has been on positioning the Company to deliver value for shareholders and lasting benefits for our partners in Ghana.”

Neil Herbert, Chairman of Atlantic Lithium

He explained that “despite the delay to the Ewoyaa Mining Lease ratification and continued volatility in the lithium market,” the company made strong progress by reducing leadership salaries, cutting non-essential spending, and streamlining operations in both Ghana and Australia.

These measures, the company says, were aimed at ensuring operational discipline while safeguarding the long-term viability of the Ewoyaa Lithium Project.

Ewoyaa Lease Ratification Nears Parliamentary Consideration

A major point of interest for investors has been the ratification of the Ewoyaa Mining Lease, which is seen as a crucial milestone for development to commence. The Chairman revealed that the revised lease has now advanced to Ghana’s Parliament.

“The revised Mining Lease has now been submitted to Parliament and referred to the Select Committee for consideration.”

Neil Herbert, Chairman of Atlantic Lithium

He expressed confidence that the approval process is nearing completion, describing the project as strategically important not only to the company but also to the Central Region and the broader Ghanaian economy.

To bolster its financial capability, Atlantic Lithium secured two funding agreements with Long State Investments Ltd, providing the company with access to up to £28 million over the next two years.

According to the Chairman, these agreements offer financial flexibility while helping to reduce dilution risks for existing shareholders.

“To strengthen our financial position, we secured two funding arrangements… giving the Company access to up to £28 million over 24 months.”

Neil Herbert, Chairman of Atlantic Lithium

He noted that Long State’s commitment serves as a “strong endorsement” of the company’s long-term strategy and the potential of the Ewoyaa Project.

Exploration Success Continues in Côte d’Ivoire

While Ghana remains the cornerstone of Atlantic Lithium’s portfolio, the company is steadily expanding its exploration footprint in West Africa.

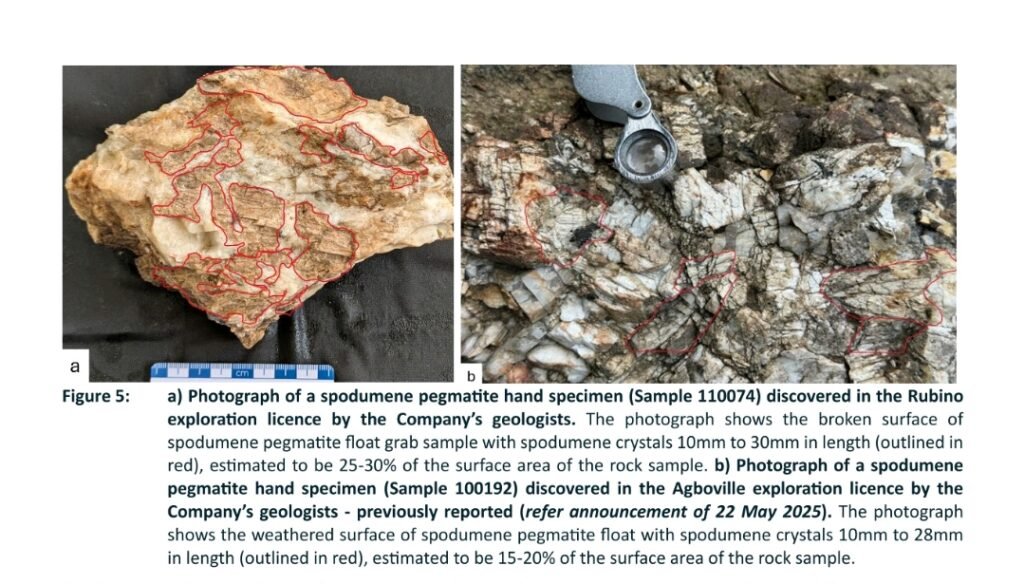

The AGM statement highlights positive early-stage exploration results from Côte d’Ivoire, particularly across the Agboville and Rubino licences.

The Chairman shared, “Beyond Ghana, our exploration work in Côte d’Ivoire has delivered encouraging results,” emphasizing that the progress underscores the skill and consistency of Atlantic Lithium’s exploration teams.

These findings, although preliminary, point to additional long-term growth opportunities for the company in a region gaining increasing prominence for lithium discoveries.

Although near-term prices remain below the thresholds typically required to incentivize new supply, Atlantic Lithium remains optimistic about the global demand trajectory.

The Chairman reiterated that long-term fundamentals are driven by accelerating trends in electric vehicle adoption and the expansion of renewable energy storage systems.

“Despite near-term price pressures, the fundamentals for lithium remain robust,” he noted, positioning Ewoyaa as a “low-cost, near-term development opportunity” set to benefit from a market rebound.

Looking Ahead to a Promising 2026

The AGM statement concludes on an optimistic tone, commending the resilience and professionalism of the company’s staff and partners who have navigated a period of uncertainty.

With the mining lease ratification expected soon and strengthened financial backing in place, Atlantic Lithium says it is poised for a pivotal year ahead.

“The resilience of our team has been exceptional through challenging conditions… With Mining Lease ratification expected soon, we look ahead to a promising 2026 and beyond.”

Neil Herbert, Chairman of Atlantic Lithium

He further acknowledged the crucial support of Ghanaian authorities and local stakeholders, emphasizing that the company remains committed to delivering transformational opportunities for the Central Region and lasting value for all.

READ ALSO: Women Hold the Key to Ghana’s Rural Banking Transformation- Matilda Asante-Asiedu Declares