Former Minister for Lands and Natural Resources and Member of Parliament for Damongo, Hon. Samuel Abu Jinapor, has raised alarm over the apparent abandonment of local value addition requirements in the revised Ewoyaa lithium lease agreement.

As the global economy pivots toward a green energy transition, the lawmaker argued that any mineral arrangement must serve as a “foundation and anchor” for national development rather than a mere extraction exercise.

The controversy centers on the revelation of a scoping report previously unknown to key stakeholders which purportedly labels the establishment of a domestic lithium refinery as economically unviable, a sharp departure from the industrialization goals initially set for the project.

“The issue of the refinery, the issue of the value addition, there is an indication that scoping is already being done, and the scoping report has indicated that it would not be viable to have a refinery here in Ghana. Why so? And why is it the case that when the first arrangement was made, there was an insistence on the establishment of some form of value addition in Ghana? “

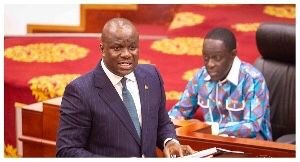

Hon. Samuel Abu Jinapor

The lithium debate intensified as the revised agreement proposes a base royalty rate of 5%, a significant reduction from the 10% rate previously touted as a landmark achievement for Ghana’s “green minerals” policy.

Critics and extractive experts, including the Minority in Parliament and civil society organizations like IMANI Africa, questioned why the government is settling for lower fiscal terms when global lithium prices remain higher than when the initial 10% peg was established.

This “regulatory limbo” has sparked a standoff between the government’s desire for swift ratification to unlock investment and the opposition’s demand for a “constructive engagement” to ensure the transaction is structured in the sovereign interest.

“If the price of lithium today is more than the price when the royalty was pegged at 10%, why do we start at a base rate of 5%? These are legitimate questions which have to be answered,” Hon. Samuel Jinapor fumed.

The Scoping Report Controversy and Value Addition

At the heart of the dispute is the “issue of the refinery” and the commitment to local beneficiation. Hon. Jinapor revealed that during his tenure, the lease presented to Parliament explicitly captured that value addition would follow a rigorous scoping process.

However, a new report has emerged suggesting that a refinery in Ghana would not be viable a claim the former Minister says he was not aware of. This shift is viewed by many industry analysts as a “lost opportunity” to capture a larger share of the lithium value chain, which includes the production of battery-grade chemicals.

The lack of transparency regarding when the current and previous ministers were informed of this viability assessment has fueled accusations of “shakara” or deceptive negotiation tactics.

Fiscal Terms and the 5% Royalty Ceiling

The fiscal regime has become a flashpoint for stakeholders who argue that the 5% royalty rate is “inimical to the national interest.”

While the government maintains that the 5% rate aligns with the Minerals and Mining Act, 2006 (Act 703), the opposition insists that lithium, as a strategic green mineral, justifies a higher negotiated rate.

Traditional leaders in the catchment areas have also voiced their rejection of the 5% offer, demanding better terms for the affected communities.

Experts point out that while the Minerals Income Investment Fund (MIIF) was expected to hold a significant interest and the community was promised a 1% package, the revised terms seem to dilute these benefits, prioritizing “short-term political expediency” over long-term economic sovereignty.

Institutional Scrutiny and the Road Ahead

There is a growing concern that Parliament may be bypassed in its duty to “scrutinize this transaction” due to the “deadline which has been laid before Parliament,” where a certain number of days could trigger automatic passage.

Hon. Jinapor has called for a pause to allow for thorough interrogation, insisting that the “catchment area was supposed to have 1%” and that the “retention of the value chain” must be guaranteed.

The consensus among civil society is that the Ewoyaa project should not just be about exporting raw spodumene; rather, it must include “adaptive clauses” and “performance covenants” that protect the Republic if market conditions or technological pivots occur.

“At the end of the day, our country first,” Hon. Jinapor remarked, signaling that support for the deal is contingent on it being structured to maximize Ghana’s mineral wealth.

READ ALSO: Chairman Wontumi’s Legal Woes Deepen as AG Indict Him in a ¢24m EximBank Loan Loss