The Centre for Environmental Management and Sustainable Energy (CEMSE) has renewed calls for comprehensive and sustained reforms in Ghana’s energy sector, warning that without structural changes, the country risks re-accumulating debt even as efforts continue to clear existing arrears.

Executive Director of CEMSE, Benjamin Nsiah, said clearing legacy debt, though necessary, is not a permanent solution to the sector’s long-standing financial problems. According to him, Ghana has experienced repeated cycles where debts are settled only for new obligations to accumulate over time.

“It’s one thing paying legacy debt, and another thing re-accumulating these debts in the future. “There are times when we clear these debts, yet in the future we build them up again.”

Mr. Benjamin Nsiah, the Executive Director of the Centre for Environmental Management and Sustainable Energy

He argued that the focus of policy discussions must now shift from short-term debt clearance to reforms that address the structural drivers of the energy sector’s financial distress.

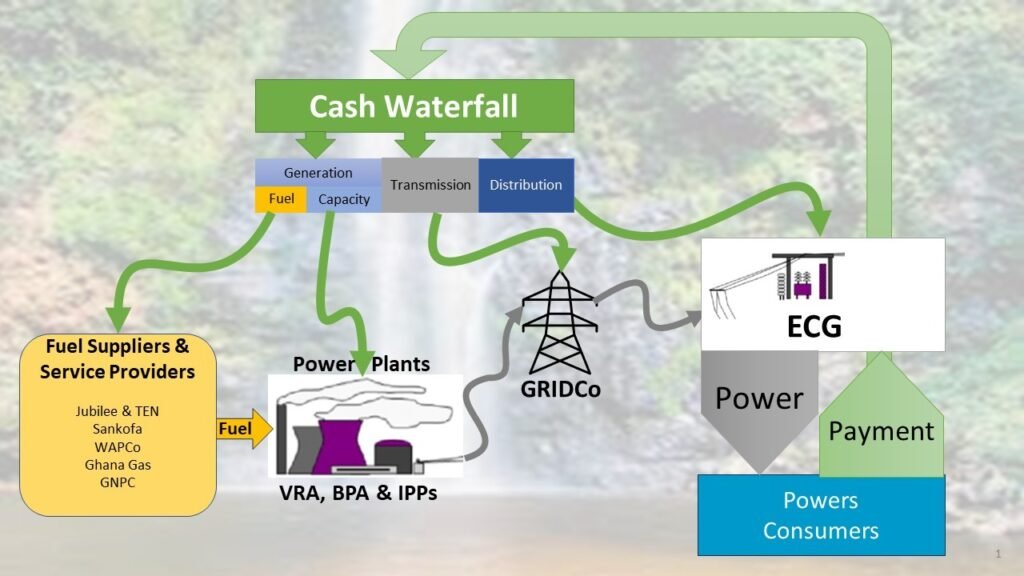

The call comes amid reports that government still owes Independent Power Producers (IPPs) approximately US$1.1 billion, highlighting the depth of the financial challenges confronting the sector.

While recent payments have reduced portions of outstanding liabilities, analysts say the sector remains vulnerable to fresh debt build-up if underlying inefficiencies are not addressed.

Structural Reforms as the Way Forward

Mr. Nsiah stressed that preventing the recurrence of energy sector liabilities requires deliberate and sustained implementation of structural reforms.

He pointed to recommendations contained in the World Bank’s Energy Sector Recovery Programme as a useful framework for achieving long-term stability.

Central to these recommendations, he explained, is the need for competitive and transparent contracting in power generation and gas supply.

According to him, poorly negotiated Power Purchase Agreements (PPAs) and gas offtaker contracts have historically inflated costs and placed undue financial pressure on the sector.

“If we are able to implement these recommendations effectively in terms of signing good PPAs, good gas offtaker contracts that offer value for money and are not overpriced it will make a significant difference.”

Mr. Benjamin Nsiah, the Executive Director of the Centre for Environmental Management and Sustainable Energy

Beyond contractual reforms, CEMSE is also urging government and regulators to intensify efforts to reduce technical and commercial losses in the power distribution system.

Ghana’s current system losses are estimated at about 27 percent, significantly above the 21 percent benchmark set by the Public Utilities Regulatory Commission (PURC).

According to Mr. Nsiah, high losses translate directly into lost revenue, worsening the sector’s cash flow challenges and increasing reliance on government support.

Reducing losses, he said, would improve the financial position of power utilities and limit the need for repeated bailouts, which often divert public funds from other critical sectors such as health, education and infrastructure.

Settling Arrears and Removing Subsidies

CEMSE also called for a clear and credible plan to settle outstanding government arrears owed to players within the energy value chain, particularly IPPs.

The group believes that predictable payment arrangements are essential to restoring investor confidence and ensuring reliable power supply.

In addition, Mr. Nsiah urged government to gradually remove energy subsidies that distort pricing and mask the true cost of electricity production.

While acknowledging the social sensitivity of subsidy removal, he argued that targeted support for vulnerable consumers would be more sustainable than blanket subsidies that weaken the sector’s finances.

“These measures will go a long way to sustain the sector and position it for development, growth, expansion, and long-term sustainability.”

Mr. Benjamin Nsiah, the Executive Director of the Centre for Environmental Management and Sustainable Energy

Energy sector analysts warn that failure to implement meaningful reforms could undermine Ghana’s energy security and discourage future investment. Persistent payment delays to IPPs have in the past led to threats of plant shutdowns, raising concerns about supply disruptions.

CEMSE’s call comes at a time when government is under pressure to balance fiscal consolidation with the need to maintain stable and affordable electricity supply.

Call for Policy Consistency

Mr. Nsiah emphasised that reform efforts must be consistent and insulated from political cycles to achieve lasting impact. He noted that piecemeal interventions and short-term fixes have contributed to the sector’s recurring problems over the years.

According to him, aligning policy implementation with established recovery programmes and regulatory benchmarks will be critical to breaking the cycle of debt accumulation.

As government continues negotiations with IPPs and development partners, CEMSE says the priority should be building a financially sustainable energy sector that can support economic growth without becoming a perpetual drain on public finances.

The group believes that with disciplined contracting, reduced losses, and transparent pricing, Ghana’s energy sector can move beyond crisis management towards long-term stability and resilience.

READ ALSO: Mahama’s Ministerial Cuts Save Ghana Millions in Costs – Presidential Spokesperson