The Association of Ghana Industries (AGI) has affirmed its support for the International Monetary Fund programme to help bring stability to the economy.

According to the association, it has been following, with keen interest, developments on the Domestic Debt Exchange Programme as a key condition for the IMF intervention. Due to this, it indicated that it appreciates the urgent need for the IMF intervention to help bring stability to the economy.

“We also acknowledge that this programme will allow Ghana to gradually reduce its debt-to-GDP metrics toward sustainable levels, and AGI therefore affirms its support to the IMF programme. We however wish to draw attention to the DDE component as presently designed.”

Association of Ghana Industries

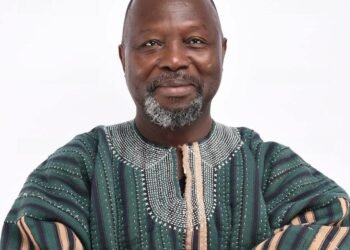

Contained in a statement signed by its Chief Executive Officer, Seth Twum Akwaboah, the AGI stated that engagements with its members, especially those in the Insurance and Banking sectors show they’re willingness to commit to the DDE programme to move the process forward. However, AGI expressed some key challenges that need to be addressed for the DDEP to yield the expected impact.

It indicated that the current state of the programme will impact the liquidity and solvency position of financial institutions. Additionally, the association noted that it will also limit its ability to support the real sector of the economy, and this requires maximum attention.

Commenting on liquidity, the AGI stated that it envisages liquidity constraints the banks will face under the DDEP and its impact on business access to finance. It revealed that it is important to ensure that in the wake of potential challenges, the productive sectors of the economy are not denied access to much needed funds to increase their production.

“In view of this, we welcome Government’s intention to establish the Ghana Financial Stability Fund (GFSF) to provide liquidity support.”

Association of Ghana Industries

On the issue of solvency, the AGI highlighted that the current structure of the DDE Programme will not only impact liquidity and profitability of the financial institutions but more importantly, its solvency as a result of huge impairment losses on their balance sheet.

These economic losses, it emphasized, will potentially erode the capital of our financial institutions and affect their going concern status.

Impact of debt exchange programme on industries

Regarding access to finance, the AGI revealed that industrialisation remains the most important engine of economic growth and there is a need to grow local industries to reduce the over-dependency on foreign exchange for imports.

It expressed belief that as the financial sector goes through this turmoil, access to funds particularly for the productive sectors would be affected.

“This will worsen the perennial difficulties encountered by the business community in accessing finance for their operations. The AGI is therefore urging government and all stakeholders to consider this challenge as an opportunity to support the productive sector of Ghana to produce more of our essential goods and limit reliance on importation to ease pressure on the local currency.”

Association of Ghana Industries

Under the current circumstance, AGI indicated that fiscal prudence is crucial to restoring confidence in the economy and therefore a review of government’s expenditure is necessary. It underscored that the budget deficit projection in the 2023 budget statement ought to be reviewed significantly to align with the 5% provision in the Fiscal Responsibility Act.

“We are confident that an IMF Programme will help instill fiscal prudence that will not warrant the setting aside of the Act. An increase in budget deficit from 7.4% (as of September, 2022) to 7.7% of GDP as contained in the 2023 budget does not inspire confidence among the business community.”

Association of Ghana Industries

Furthermore, the AGI called on government and all relevant stakeholders to see this crisis as an opportunity to introduce reforms that would enhance the development of agriculture and industry on a long-term basis. It further expressed that it would link it with other productive sectors such as the mining and construction sectors to bolster sustainable growth of our economy.

“We would like to see government’s excessive borrowing from the banks, which tends to crowd out the private sector, become a thing of the past.”

Association of Ghana Industries

READ ALSO: You Don’t Have To Be A Lawyer To Perform- Minority Leader