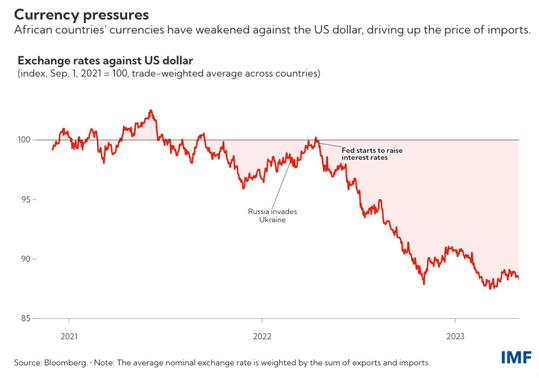

The majority of Sub-Saharan African currencies, as shown by the Chart of the Week have lost value relative to the US dollar, which has fueled inflationary pressures on the region as import costs have risen sharply.

This, coupled with a slowdown in GDP, leaves policymakers with difficult choices as they balance keeping inflation in check with a still-fragile recovery.

As the Chart of the Week shows, the average depreciation for the region since January 2022 is about 8 percent. The extent varies by country, however. Ghana’s cedi and Sierra Leone’s leone depreciated by more than 4.5 percent.

The depreciations across the region were mostly driven by external factors. Lower risk appetite in global markets and interest rate hikes in the United States pushed investors away from the region towards safer and higher paying US treasury bonds.

Foreign exchange earnings took a hit in many countries as demand for the region’s exports dropped because of the economic slowdown in major economies. At the same time, high oil and food prices, partly due to Russia’s war in Ukraine, pushed up import costs in 2022.

Large budget deficits have compounded the effects of these external shocks by increasing the demand for foreign exchange. About half of the countries in the region had deficits exceeding 5 percent of gross domestic product in 2022, putting pressure on their exchange rates.

IMF Discloses The Consequences And Solutions Of Weaker Currency

According to IMF reports, as currencies weaken against the US dollar local prices of imported goods, as much of what people buy, including essential items like food will rise.

“More than two-thirds of imports are priced in US dollars for most countries in the region. A 1 percentage point increase in the rate of depreciation against the US dollar leads, on average, to an increase in inflation of 0.22 percentage points within the first year in the region. There is also evidence that inflationary pressures do not come down quickly when local currencies strengthen against the US dollar.”

IMF Report

By providing importers with foreign currency from their reserves, many central banks in the region have attempted to support their currencies. However, with with reserve buffers running low in many countries, there is little room to continue intervening in foreign exchange markets.

Countries, as stated by reports, have also applied administrative measures such as foreign exchange rationing or banning foreign currency transactions. These measures can be highly distortive and create opportunities for corruption.

Given that the external shocks are expected to persist, countries where exchange rates are not pegged (fixed) to a currency have little choice but to let the exchange rate adjust and tighten monetary policy to fight inflation.

Countries with pegged exchange rates will need to adjust monetary policy in line with the country of the peg. In both country groups, fiscal consolidation can help to rein in external imbalances and limit the increase in debt related to currency depreciation. Structural reforms can help to boost growth.

Read also: World Bank Says The Greatest Option For African Oil And Gas Economies Is Asset Diversification