A PwC review of Africa’s oil and gas industry has hinted that the fall out of the pandemic on the industry is expected to prolong deep into the future.

According to the review, the onset of the global COVID-19 pandemic has significantly impacted on Africa’s oil and gas industry, wearing off hard-won gains over the years.

The global demand slump triggered by the COVID-19 shock has forced massive production cuts with 2020 production forecasted to fall by 19% for Africa’s top five oil producing countries.

The lower projected price and global liquidity challenges for international oil companies (IOCs) has led to a significant decline in industry investment and delays in project development. Still, Governments have had to divert budgetary expenditures towards healthcare delivery and welfare as suggested by the UN Framework for COVID-19 responses. And this has further placed governments’ fiscal stance under pressure.

On the net, the fall out of the pandemic has greatly increased the fiscal and economic distress in African oil and gas producing countries. Recall that, as the COVID-19 pandemic spread like wildfire across the globe in early 2020, countries swiftly responded with national lockdowns and restrictions which ultimately led to a major collapse in demand for oil and related products.

Africa’s Oil and Gas Industry Grounded due to Travel Restrictions

The resultant effect of these necessary actions further resulted in an unprecedented level of market disruption. At an estimated peak demand reduction of 25 mmbbl/d, the impact of the pandemic has dwarfed global demand estimated to be at 7-9 mmbbl/d, which is approximately equal to the entire Africa production.

The level of volatility in oil and gas market was so deep that it led to oil futures contracts entering negative zone (For example; West Texas Intermediate oil future contracts for May 2020)

This meant that, “contracts dropped to US$37/bbl, effectively meaning sellers had to pay their buyers as a result of shortfalls on global storage and ability to accept contract delivery.”

Although the price has since inched up to above US$43/bbl, the stability of the price level still remains questionable as projections of future market indicate weakening fundamentals. With indications of a second wave of the pandemic-related lockdowns beginning, the price again fell below US$40/bbl.

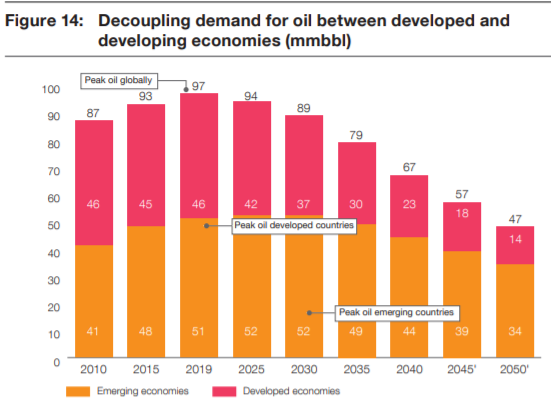

Indeed, in this new normal environment, where market behaviours have been impacted upon, especially in terms of virtual working and travel restrictions, we are likely to see permanent lower future demand, the report hints.

The report also highlights that, “the permanent and sudden long term market shift has also impacted significantly on international oil and gas companies with announcement of huge losses, disinvestments, downscaling and lay-offs in a bid to remain sustainable and relevant.”

As a consequence, many IOCs in Africa have written off some of their assets this year based on anticipated oil prices and assets they believe would not be favourable.

Chevron, BP, Shell, Total, Equinor, ExxonMobil and Eni have all announced asset write-downs, estimating US$87 billion of reserves that are now considered uneconomical for production.