Former Deputy Minister of Information, Mr. Felix Kwakye Ofosu, commenting on the continuous depreciation of the cedi has sarcastically remarked that the Vice President’s economic logic is ‘shrewd’. He stated that the Vice President thinks the current exchange rate of US$ 1:GH₵ 13.75 is better than the exchange rate of US$ 1.00: GH₵ 4.00 in 2016.

He noted that the Vice President’s claim that the incumbent government has a better economic record than the previous NDC Mahama-led administration is laughable, indicating that the country is grossly indebted to external creditors.

Furthermore, the former Deputy Information Minister mockingly stated that regardless of the current economic challenges the country is grappling with, the Vice President would still argue that the country is better off owing GHS610 billion and not being able to pay its debt than owing GHS120 billion and be able to service your debt regularly. “Insane logic!” he reiterated.

“The Ghana cedi now exchanges at GHS 13.75 to a dollar. This terrible depreciation is occurring at a time when we are not under external pressure to service the debt. He [the President] is the very worst to have managed the Ghanaian economy and has proven himself a complete charlatan. Throw him out!!”

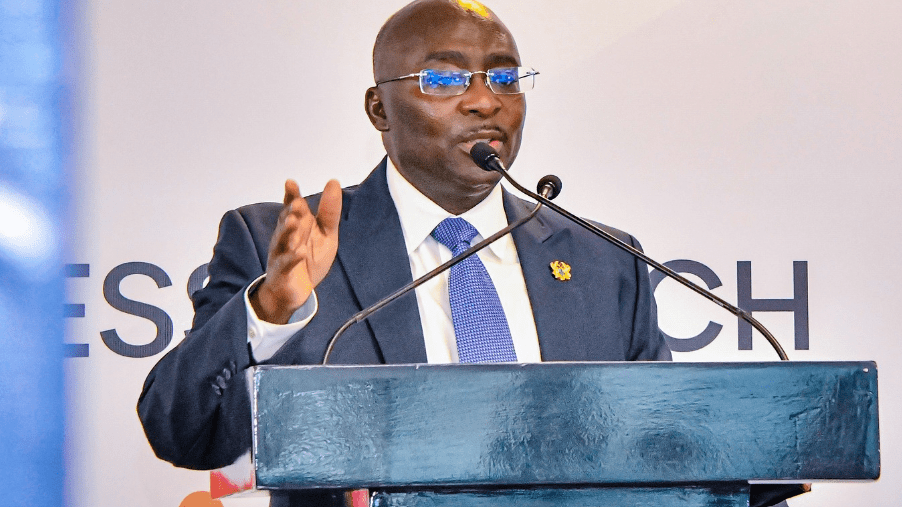

Mr. Felix Kwakye Ofosu

Moreover, Banking Consultant, Dr. Richmond Atuahene, noted that the standard of living and economic conditions of Ghanaians have not improved over the last seven years since the inception of the Akufo-Addo-led government.

He indicated that Ghana’s debt structure is extremely appalling to the point where the country is currently imploring its European creditors to grant the country a default on its debt payment.

He emphasized that Ghana’s economy is nothing to write home about. “If you check the World Bank level of poverty, it has increased from 21% and it’s going to 34% in 2025” he added.

Cedi To Depreciate Further

Dr. Atuahene indicated that the Domestic Debt Exchange Program (DDEP) will not aid the Cedi’s appreciation against the dollar, indicating that the Ghana Cedi may depreciate further against the dollar between this month, March and June to at least GH₵ 15.00.

Furthermore, the Bank Consultant argued that the current inflation rate of 23.2% recorded by the country is not the best, indicating that the government should not consider it as an achievement for which it will praise itself.

He argued that Ivory Coast and Togo which are Ghana’s closest neighbors have better inflation rates of 3.6% and 6.7% respectively.

He noted that the country’s demand for foreign goods like drugs, spare parts, poultry feed and meat among others make it impossible for the cedi to appreciate as the country is constantly importing these goods while export is low.

“The only consolation [that comes with the DDEP] is that we are not paying the foreign bonds and debts, they have postponed it. If they were paying it today, the cedi would have gone to about GH₵ 18.00 or GH₵ 20.00 because we are not producing and exporting enough to support the currency”.

Dr. Richmond Atuahene

Dr. Atuahene also suggested that the country should diversify its source of revenue by diversifying agriculture, indicating that Ghana’s reliance on cocoa alone for export is not a viable economic practice.

He noted that investing in the other aspects of agriculture will ensure import substitution which will decrease the importation of goods such as yellow corn, rice, and poultry, which the country can produce.

He also stated that the country has a stifling taxation system that charges businesses more than they can afford, arguing that for a country as small as Ghana, twenty-seven tax handles are enough to run any business to the ground.

Furthermore, he cited Ghana’s taxation system as the reason for which Multinational Corporations (MNCs) are moving their businesses out of the country.

He also indicated that the government’s decision to undertake the DDEP, which effectively pronounced the country bankrupt, made the country unattractive for direct foreign investment.

Conclusively, while the incumbent government continues to assure Ghanaians of economic recovery in a short time, the energy sector crisis which is affecting the operation of businesses coupled with the increasing inflation rates states otherwise.

READ ALSO: Pipeline Crisis Sparks South Sudan Security Fears