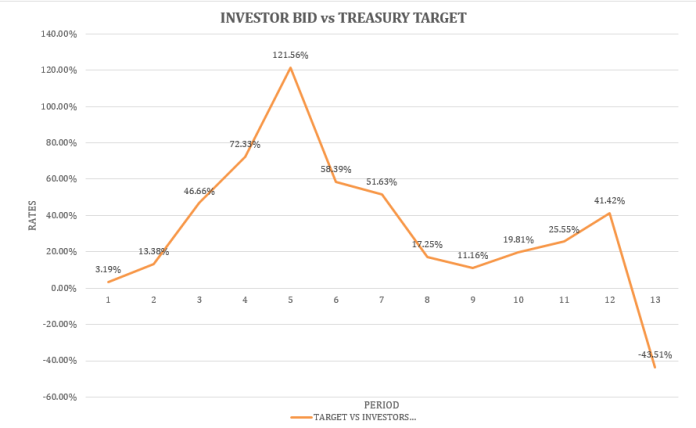

Treasury faced a setback as demand for Treasury bills (T-bills) dropped by 43 percent, marking the market’s first under-subscription in 17 consecutive weeks.

This decline contrasted with the strong investor interest seen in the first quarter of 2024, particularly from banks seeking safety at the shorter end of the market.

The shift in demand dynamics was attributed to a recent policy adjustment by the Bank of Ghana (BoG), implementing a three-layered Cash Reserve Requirement (CRR) for banks.

Analysts suggested that approximately GH¢16.2 billion ($1.2 billion) could flow from banks to the BoG due to the new CRR policy, potentially tightening cedi liquidity and leading to a short-term appreciation of the currency.

Consequently, banks appeared to prioritize bolstering reserves to comply with the new requirements rather than investing in T-bills.

The research arm of Databank noted, “Investors’ demand for T-bills fell below the treasury’s target in last week’s money market auction, as banks with loan-to-deposit ratios below 55 percent prepared to increase cash reserves to the respective required levels.”

Similarly, analysts at Apakan Securities pointed out, “We believe the three-level CRR adjustment by the Central Bank last week triggered the pullback in demand conditions as banks mull over the policy action.”

Looking ahead, analysts anticipate a continuation of this trend, but at a slower pace, in the upcoming auction scheduled for April 5, 2024. The Treasury aims to raise GH¢2.81 billion through this auction to refinance maturing obligations valued at GH¢2.58 billion.

In March 2024, the Treasury successfully raised a total of GH¢19.9 billion through T-bill issuance, which was 17 percent lower than the previous month. These funds were utilized for budgetary support and the refinancing of maturing bills valued at approximately GH¢14.47 billion.

Although under-subscription occurred, borrowing costs experienced a slight dip. Yields on T-bills continued their downward trend, albeit at a slower pace. The 91-day bill dipped by 25 basis points (bps) to 25.75 percent, while the 182-day and 364-day bills also saw decreases of 25 bps each to settle at 28.25 percent and 28.85 percent respectively.

For context, yields maintained a downward trajectory in March 2024, with the 91-day, 182-day, and 364-day bills closing at 26 percent (down 128 bps), 28.5 percent (down 125 bps), and 29.1 percent (down 120 bps) respectively.

While the under-subscription of the Treasury bill auction indicates a potential challenge in the short term, the continued decline in yields suggests cautious optimism in the market.

The recent policy adjustments by the central bank come amid an ongoing battle with inflation. Analysts predict a slower pace of yield decline in the coming months due to the CRR adjustment and a potential slowdown in the disinflation process.

Investor Sentiment To Be Monitored

The next auction on April 5 will be closely watched to gauge investor sentiment and assess the full impact of the apex bank’s tightening measures on the nation’s short-term financing efforts.

“We expect the CRR adjustment to drain GHS liquidity in the market and soften demand for T-bills. However, we still foresee yields on T-bills declining this week, albeit at a slower pace.”

Apakan Securities

On the secondary market, analysts also perceive a net-offered position on the market this week as the CRR amendment takes effect.

Last week, the holiday-shortened trading period and subdued investor sentiment towards bonds weighed heavily on trading activity, causing trading volume to shrink to the third lowest level this year.

Total traded volume tumbled to GH¢355 million last week from GH¢564 million the previous week. Market activity hovered around the medium to long-term papers.

The new bonds dominated market activity, accounting for approximately 99 percent of the total traded volume. Feb-2037 (CPN: 9.85 percent) and Feb-2036 (CPN: 9.7 percent) were the most actively traded papers, settling at 14.63 percent and 13.54 percent, respectively.

READ ALSO: NHIA Involved In A Duplicitous GH₵ 2.67 Billion Digitization Scandal