The Ghana Union of Traders Association (GUTA) is urging the government to swiftly address the decline in the value of the cedi against major currencies, particularly the dollar.

According to GUTA, this currency depreciation is significantly impacting businesses, especially those in the trading sector.

GUTA has labeled the current situation as a crisis, highlighting that the falling value of the cedi, along with rising freight costs from Asia, is making business operations increasingly difficult and expensive.

It emphasized that urgent action is needed to stabilize the currency and alleviate the financial strain on businesses.

GUTA emphasized that the weakening of the cedi has triggered inflationary pressures, causing prices of goods to soar and posing serious challenges for businesses to stay profitable. It stated that the cedi’s depreciation “has increased unpredictability or forecast of businesses.”

“The inflationary pressures resulting from the depreciating cedi have pushed the cost of goods through the roof, making it increasingly difficult for businesses to stay afloat.

“The purchasing power of the consuming public has also been affected, thereby reducing the turnover of businesses.”

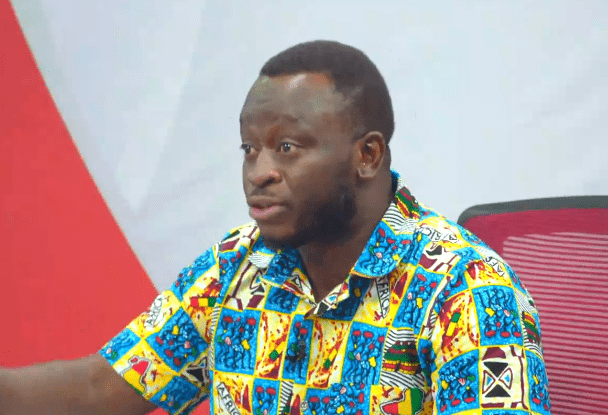

GUTA

Additionally, GUTA highlighted that these economic circumstances have made servicing bank loans exceptionally challenging.

This situation has made it challenging for traders to repay goods acquired from international suppliers, contributing to increased business indebtedness.

The Union also highlighted the escalating freight charges and customs duties at the port, which are denominated in dollars. According to GUTA, these factors are significantly impeding trade and commerce, resulting in substantial hardships for both businesses and consumers.

“GUTA expresses its readiness to collaborate with the government and other stakeholders on this issue,” it added in a statement dated May 14, 2024.

Analysis of Cedi Depreciation Trends

Dr. Abudu Abdul-Ganiyu, Technical Advisor to the Minister for Finance, was recently quizzed about why the cedi was depreciating, he said “We have to look at the data and year-to-date depreciation.”

According to him, the year-to-date depreciation is around 12% whereas in the same period last year, it was around 27%.

“So that certainly tells that even though there has been depreciation it has been slower compared to what the depreciation was same period last year.”

Dr. Abudu Abdul-Ganiyu

Regarding the causes, he said, “If you look at the US dollar on the international market, if you compare that to the pound sterling, compare that to the euro, and all the other major trading currencies, the US dollar has actually strengthened.”

“Whilst we are concerned about measures that we have to put in place to ensure the strength of our local currency, we should also know that the US Treasury and managers of the US economy are equally putting measures in place to ensure that their currency becomes stronger.”

Dr. Abudu Abdul-Ganiyu

Dr. Abdul-Ganiyu highlighted that in recent months, Ghana’s economy underwent a significant event. For instance, in February, approximately GHC 5.8 billion worth of maturing coupons from the domestic debt exchange program were paid out. This influx of funds into the system is expected to increase liquidity in the cedi.

“We’ve also made payments to contractors for a lot of IPCs [Interim Payment Certificates] that were pending over a period. So significant payments have been made to contractors. If you speak to contractors across the country I can assure you that they are extremely happy about those payments that have been made to them.”

Dr. Abudu Abdul-Ganiyu

The government and the Bank of Ghana should intervene promptly to address the cedi’s depreciation trend and stabilize the currency for economic stability and business sustainability.