The Bank of Ghana (BoG) has reiterated its commitment to clamping down on illegal lending platforms that exploit borrowers, threatening them with public humiliation and violating their privacy.

This stern warning comes at a time when the use of unauthorized lending apps has become increasingly prevalent, leading to a rise in unethical practices that have, in some tragic cases, driven loan defaulters to commit suicide.

In recent years, the proliferation of illegal lending apps has posed a significant threat to the financial stability and personal security of many Ghanaians. These platforms often target vulnerable individuals in need of quick cash, offering loans with minimal requirements. However, the terms and conditions associated with these loans are often predatory, with exorbitant interest rates and unrealistic repayment timelines.

What is even more alarming is the practice employed by these unauthorized apps to enforce repayment. Borrowers who fail to meet the repayment deadlines are subjected to threats, with the lenders threatening to publish their photos and confidential data online. This form of intimidation not only violates privacy laws but also subjects borrowers to severe emotional distress, with some feeling so overwhelmed that they resort to taking their own lives.

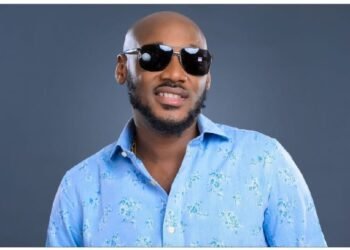

Speaking at the MTN Ghana Mobile Money @15 Fintech Stakeholders’ Forum, Mr Kwame Oppong, the Director of Fintech at the Bank of Ghana, emphasized that the central bank will not tolerate any unauthorized products or services that pose a risk to the integrity of the financial sector. He underscored the importance of maintaining a stable financial environment, noting that any product or service introduced into the market should not destabilize the economy or jeopardize the livelihoods of individuals and businesses.

“Nothing should be introduced in this country that causes instability in the financial sector and somehow puts the integrity of the economy at risk. Secondly, nothing should come into the country that somehow jeopardizes the livelihoods of individuals and businesses.”

Mr Kwame Oppong

Addressing the Exploitative Practices of Illegal Lending Apps

Mr Oppong condemned the unethical practices of illegal lending apps, particularly their use of threats and intimidation to coerce borrowers into repaying loans. He expressed disbelief that such tactics could be considered a viable business model, especially when they lead to severe consequences like suicide.

“Those illegal lending apps who threaten borrowers by putting their pictures online, just because people need something little to get by? By the time they realize, their pictures are extracted and shared across their contact list. How is this a way of making a living by putting people on suicide watch by threatening to announce to the world that they owe you?”

Mr Kwame Oppong

In response to these growing concerns, Mr Oppong advised the public to exercise caution when engaging in financial transactions online. He assured the public that the Bank of Ghana is actively working with relevant security agencies to identify and apprehend those behind these illegal lending platforms. He highlighted a recent collaborative effort between the BoG, the Economic and Organized Crime Office (EOCO), and other security agencies that resulted in a raid where over 200 individuals, including some foreigners, were apprehended.

MTN Ghana’s Commitment to Financial Safety

At the same event, Shaibu Haruna, the Chief Executive of Mobile Money Limited, reaffirmed MTN’s commitment to safeguarding the financial well-being of its customers. He acknowledged the challenges posed by mobile money fraud and emphasized MTN’s ongoing efforts to implement advanced safety tools and enhance customer education on fraud prevention. Haruna emphasized that building trust among customers is essential for the continued growth and success of mobile money services in Ghana.

The MTN Mobile Money @15 Fintech Stakeholders’ Forum, held under the theme “Building Trust and Cooperation Among Stakeholders: How to Maximize the Impact of Emerging Technologies for the Promotion of Financial Inclusion,” served as a platform for stakeholders in the financial technology sector to discuss the impact of emerging technologies on the financial sector. The forum also provided an opportunity to deliberate on ways to strengthen regulatory frameworks to build trust among users and stakeholders.

The event brought together key players in the fintech space, including regulators, financial institutions, and technology providers, to explore collaborative approaches to promoting financial inclusion while ensuring the stability and security of the financial system.

READ ALSO: Ghana’s Rising Debt Has Direct Ramifications on Ghana’s Capital Market- Analyst