As Ghana prepares to wind down its engagement with the International Monetary Fund (IMF) by 2026, President John Dramani Mahama has pledged that his administration will sustain the momentum of fiscal discipline, ensuring that prudent economic management becomes a long-term national policy rather than a short-term intervention.

Speaking at the 9th Ghana CEO Summit on Monday, May 26, 2025, under the theme “Transforming Business and Governance for a Sustainable Futuristic Economy,” Mahama emphasized the importance of responsible fiscal practices, particularly as Ghana transitions out of the IMF’s Extended Credit Facility (ECF) programme.

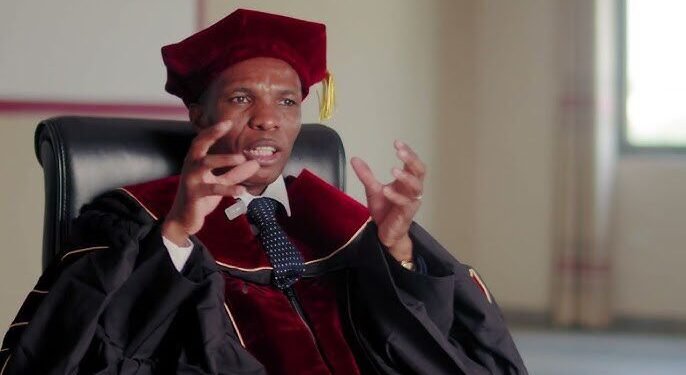

“Completing the IMF programme with discipline, we will continue the discipline in government expenditure and borrowing and work to achieve all targets under the extended credit facility programme with the IMF.”

John Dramani Mahama

Key Milestones on the IMF Journey

Ghana entered into a $3 billion IMF programme in 2023 after facing a severe economic crisis marked by unsustainable debt, high inflation, and a depreciating currency. The programme was designed to restore macroeconomic stability, rebuild investor confidence, and ensure sustainable debt levels.

Mahama revealed that the government is targeting the completion of the fourth review of the IMF programme by June 2025. This review will be critical to unlocking additional funding and assessing the progress made in structural reforms and fiscal consolidation.

Following this milestone, Mahama noted that Ghana plans to engage the IMF under its Policy Support Instrument (PSI)—a non-financial arrangement that supports countries committed to strong economic policies but not in need of financial assistance. This would signify a return to independent economic management with IMF oversight but without borrowing.

Continuity Beyond the IMF

Mahama’s remarks signal a desire to shift Ghana from dependence on external financial rescue programmes to a path of sustainable self-governance. He stressed that fiscal discipline should not be seen as a condition imposed by external lenders but as a national imperative for long-term development.

“Afterwards, we will participate in Article IV consultations and adopt the Policy Support Instrument framework, signalling Ghana’s return to responsible, non-borrowing engagement with the Fund.”

John Dramani Mahama

This approach echoes calls by local economists and international development partners for Ghana to institutionalize macroeconomic discipline through legislation and independent fiscal oversight bodies to avoid the boom-and-bust cycles that have characterized the economy for decades.

Private Sector Confidence and Stakeholder Optimism

The CEO Summit, attended by key figures in Ghana’s business and financial sectors, provided a timely platform for Mahama to address the private sector, which has been severely affected by the recent economic downturn. Many CEOs and entrepreneurs in attendance welcomed the emphasis on fiscal responsibility, noting that macroeconomic stability is a prerequisite for business confidence and investment.

“Ghana’s private sector needs predictability in inflation, exchange rates, and interest rates to make long-term investment decisions. Fiscal discipline from the government is a key pillar,” said one participant from the financial services sector.

John Mahama’s call for continuity in prudent spending and borrowing practices resonates with the aspirations of both domestic and international stakeholders, reinforcing the notion that fiscal discipline is not a destination but a journey—one that must continue even after the IMF steps aside.

READ ALSO: Private Consumption to Fuel 3.2% of Ghana’s GDP Growth in 2025