In a move to protect the Muslim community from fraud and financial exploitation, GCB Bank PLC has officially launched the Hajj Account, a specialized savings product designed to help Ghanaians prepare for the sacred pilgrimage to Mecca.

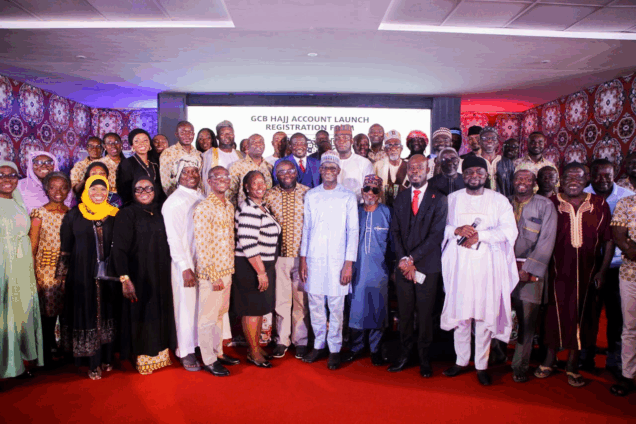

The account was introduced on Friday, September 5, at a colorful ceremony at the National Mosque in Accra, marking a new era of faith-based banking solutions in Ghana.

The initiative is aimed at addressing the longstanding challenges faced by Muslims who wish to embark on Hajj but fall victim to dishonest agents and poor savings mechanisms.

The Executive Head of Retail Banking at GCB, Mr. Sina Kamagate, highlighted the driving motivation behind the Hajj Account. Recalling a personal incident in 2009, he narrated how the funds he entrusted to an agent for his grandmother’s pilgrimage were misused.

“Only to receive the sad story that, for whatever reasons, that journey was never going to be possible because apparently he had used the money to solve his own problems.”

Mr. Sina Kamagate

Such cases, he explained, are not isolated, as many prospective pilgrims have been swindled by fraudulent middlemen posing as legitimate Hajj facilitators. The new account is therefore designed to cut out impersonators, giving Muslims the assurance that their savings will directly support their Hajj journey.

How the Hajj Account Works

The account is easy to open with just GH₵50, alongside a Ghana Card, utility bill, and passport photo. Alhaji Gomda of GCB explained that the Hajj Account operates strictly as a savings product, with features tailored to promote discipline. Withdrawals will be restricted, no debit cards will be issued, and customers will receive regular updates on their deposits.

“When it is time for your journey, we would firstly help you by transferring that money to the Hajj account in the name of your designated Hajj agent,” Mr. Kamagate explained. Importantly, the account is not tied to any particular year—pilgrims can save at their own pace until they are ready.

To maintain compliance with Islamic financial principles, the Hajj Account will not attract interest. Instead, GCB Bank has partnered with Hollard Insurance to provide a comprehensive insurance package.

Hajia Elikem, a representative from Hollard, meanwhile, outlined the benefits

“We came in to provide some insurance benefits or cover, which makes sure that you are secure while you are out of Ghana. Should anything happen to any member who travels to Hajj, in terms of death, disability or critical illness, there’s a lump sum benefit that will be paid to the person or the family.”

Hajia Elikem

Additionally, the package includes travel insurance covering lost luggage, hospitalization, and accidents, ensuring pilgrims can travel with peace of mind.

A Welcome Initiative from the Muslim Community

The Head of Corporate Affairs for the Ghana Hajj Taskforce, Alhaji A.B.A. Fuseini, praised the initiative as timely and necessary.

“I think it is a very important intervention in the sense that it gives you time, for those who may take a bit more time to gather the resources, to be able to make savings. And then it introduces certainty. Once you begin saving and you are closer to the attainment of your target, you know that the Hajj is very close.”

Alhaji A.B.A. Fuseini

He emphasized that the partnership between GCB and the Hajj Board would eliminate impersonators, thereby restoring confidence in the pilgrimage process.

Beyond the launch of the Hajj Account, GCB Bank has also set up Ghana’s first-ever Islamic Banking Unit, a milestone that reflects its dedication to inclusive financial services. According to Mr. Kamagate, the unit will develop more products tailored to Muslims who prefer faith-based financial solutions.

“This is the first time in the history of banking in Ghana where a bank has set up an Islamic banking unit. We are working to start offering Islamic banking solutions to our Muslim communities who don’t fancy secular banking.”

Mr. Sina Kamagate

For decades, Ghanaian Muslims have dreamt of a reliable system to save towards their pilgrimage without fear of fraud. With the launch of the Hajj Account, GCB Bank has taken a bold step in bridging the gap between faith and finance, ensuring that pilgrims’ dreams of performing Hajj are protected from fraudulent practices.

“You no longer have to save money with any personalities. Just open a Hajj account with us, build up your savings, and we will take care of the rest. This product is created to solve multiple challenges we have observed over the years when it comes to the Hajj process.”

Mr. Sina Kamagate

READ ALSO: Analysts Predict Tough September as Cedi Faces Liquidity Crunch