Banks’ profitability measure, the growth in interest income declined to 9.5 per cent on a year-on-year basis compared to 22.0 percent in February 2020.

The Banking Sector Development report shows that the slow growth in interest income underpins the relatively low growth in credits. Also, net fees and commissions increased by 13.7 percent simultaneously, albeit slower than in February 2020.

Meanwhile, interest income and banks’ net fees and commissions followed the same trajectory within the review period. Morever, slower growth in credits, trade-financing and other off-balance sheet transactions declined growth of fees and commissions.

Following this, net interest income growth declined from 25.9 percent in February 2020 to 10.9 percent in February 2021. This is notwithstanding the dip in growth in interest expenses from the contraction in borrowings.

Also, the shortfall in these revenue sources of banks, ultimately impacted on the profits-after-tax of banks. Profit-after-tax of banks declined from 38.8% to 5.9%, reflecting vulnerabilities to bank’s credit default risks and low revenues.

Furthermore, the banking sector continues to bear the brunt of the Covid-19 impact. This is on the basis of declining revenues and increasing loan loss provisions. Also, while operational costs were fairly controlled, declining by 0.3 percent compared with a growth of 18.6 percent in February 2020, loan loss provisions grew the more.

Accordingly, total loan loss provisions increased by 62.2 percent in February 2021, compared to 6.5 percent in February 2020. This is due to rising non-performing loans (NPLs) attributed partly to the COVID-induced repayment challenges and bank-specific loan recovery challenges.

Other profitability indicators

Moreover, banks’ interest margin which reflects the difference between interest incomes generated by banks and the amount of interest paid to surplus lenders (savers) trended downwards marginally by 0.2 percentage points between the reviewed periods. This again reflects lower interest rates between the periods.

Gross yield declined marginally from 3.1 percent to 2.8 percent. So did banks’ interest payable, declining to 0.9 percent from 1.0 percent between February 2020 and February 2021. Interest margin to total assets also declined marginally from 1.4 percent to 1.3 percent over the period.

However, banks’ interest margin to gross income ratio increased to 56.6% from 55.2%, reflecting slower growth in gross income.

The ratio of gross income to total assets marginally declined to 2.3 percent from 2.6 percent. This implies that for each asset in use, the gross income generated in February became less as compared to 2020. The banking sector’s profitability ratio also declined to 22.8 percent in February 2021 from 23.3 percent the previous year.

To corroborate, examining banks’ return on assets (ROA) and return on equity (ROE) indicators, the report shows that overall profitability declined, although still positive. Return on Equity (ROE) declined from 25.1% to 22.1%, while Return on Assets (ROA) slumped from 4.9% to 4.4% over the period.

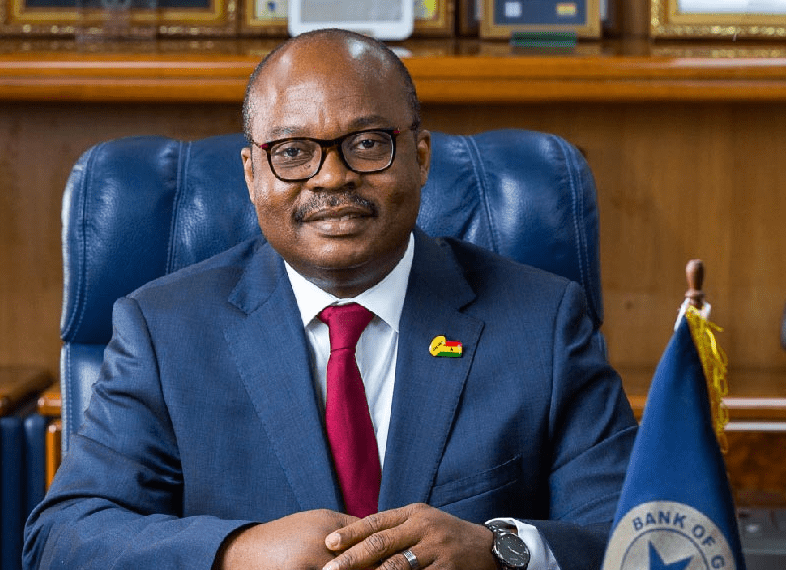

These notwithstanding, as the pandemic lingers, low credit demand and supply conditions, as well as credit default risks, remain the hurdle to cross. The Bank of Ghana (BoG) indicates that continuous monitoring of the sector to promote risk management will cushion the sector from the impact of the pandemic.

READ MORE: US to share 60 million doses of AstraZeneca COVID vaccine with the world