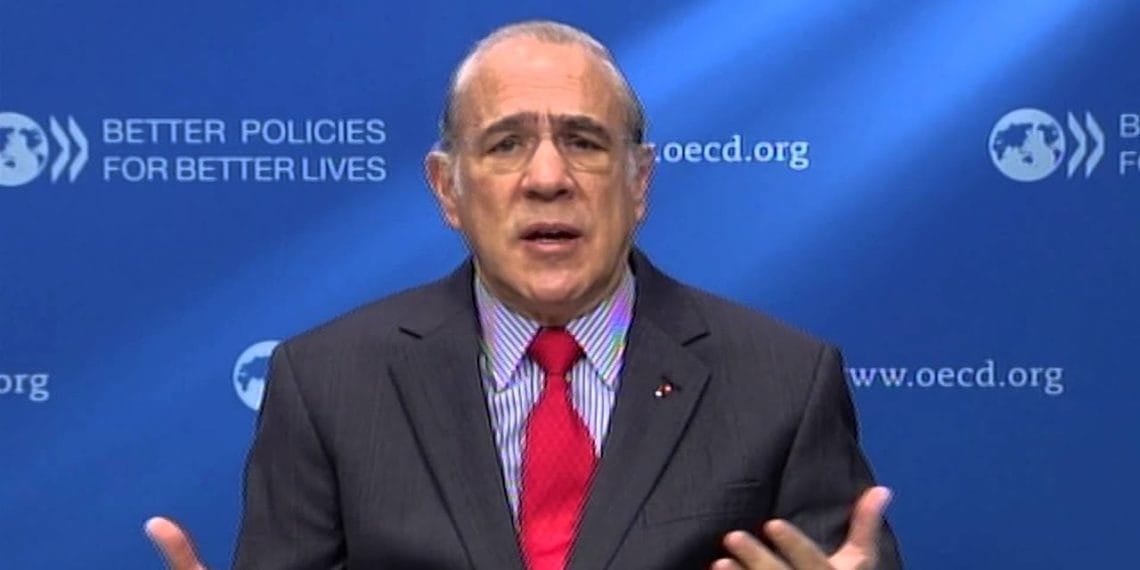

The Secretary-General of the Organization for Economic Co-operation and Development (OECD), Ángel Gurría, has intimated;that the Biden administration’s global minimum tax rate proposals are a “once in a lifetime” chance to end tax abuse.

The OECD head, who is coordinating international negotiations on Biden’s proposal,;also revealed a deal was within striking distance and could;be signed this summer after “decades of limited progress”.

His comments follow the Biden administration’s push for a global minimum tax rate. This, officials say, is to end a “30-year race to the bottom”, in which countries have slashed corporate tax rates;in an effort to attract multinational businesses.

Addressing reporters, Gurría acknowledged that the proposal could ensure a “complete overhaul of the international tax system”.

“It is a once in a lifetime opportunity to achieve a complete overhaul of the international tax system,;to both provide more tax certainty for businesses, as well as ensure everyone pays their fair share of taxes.

“The new US impetus is just what was;needed;to get this negotiation over the line by mid-2021.”

The OECD Chief also posited that a global minimum tax rate offers an escape route;from years of deadlock on international tax reform.

He warned;that failure to conclude the agreement, which is being;debated at talks between 135 countries, would risk the world slipping into a renewed era of economic conflict over trade.

“Today, we are at a crossroads, push forward with greater effort on tax cooperation, or face the risk of countries taking unilateral measures. This would not only result in increased tax uncertainty but could provoke a tax-driven trade war – the last thing a world economy ravaged by the Covid pandemic needs.”

‘New era for a better regulation of globalization’

Ángel Gurría’s comments come at the end of his 15 years in charge of the OECD. He will stand down at the end of May, to be replaced;by;Australia’s former finance minister, Mathias Cormann.

“As I approach the end of my term as secretary-general, it is my lasting hope;that we learn from the previous crisis to build forward better.

“Concluding a global tax deal in 2021 would be the culmination of many years of hard work;and would mark a new era for a better regulation of globalization.”

The Biden administration announced plans earlier this month for sweeping reforms to the global tax system. The proposals included a provision to limit the ability of multinational firms to obtain profits in low-tax jurisdictions and to agree a worldwide minimum tax rate.

Biden’s administration has also proposed a $1.8tn American Families plan, which will be funded by;a number of tax increases for large companies and wealthy individuals.

Under the Biden proposals, big technology companies and large corporations would be forced to pay taxes to national governments based on the sales they generate in each country, irrespective of where they are based.

Officials say American firms currently pay roughly 13 percent on offshore earnings. As a result, the US has suggested raising the global minimum tax rate to 21 percent. Experts have, however, noted that this is higher than in several jurisdictions including Ireland, Hungary and the Caribbean and could be a stumbling block.

Read more: Expert warns against the use of mined lands for farming