Hon. Kofi Arko Nokoe, MP for Evalue Ajomoro Gwira and VALCO board member, has championed a transformative vision for the Volta Aluminium Company Limited (VALCO), asserting that the state-owned enterprise requires strategic investment rather than privatization.

At a time when the board is evaluating the future of the smelter, Hon. Nokoe emphasized that the “passion of the CEO and the people” constitutes a powerful foundation for a national industrial resurgence.

He argued that the existing “master plan” for the company is a robust blueprint that the nation must support to ensure long-term sovereignty over its natural resources.

By positioning VALCO as a “standee” for Ghanaian industrial excellence, he suggests that telling the company’s story accurately will attract the necessary capital to modernize its infrastructure without surrendering ownership to private entities who might prioritize profit over national development.

“The story of VALCO is a positive one, and all it needs is support and investment. If the story is told well, investors will step in to help link it from start to finish, from mining to the final product. We must support this as a nation because the benefit of VALCO stands out and cannot be compromised.”

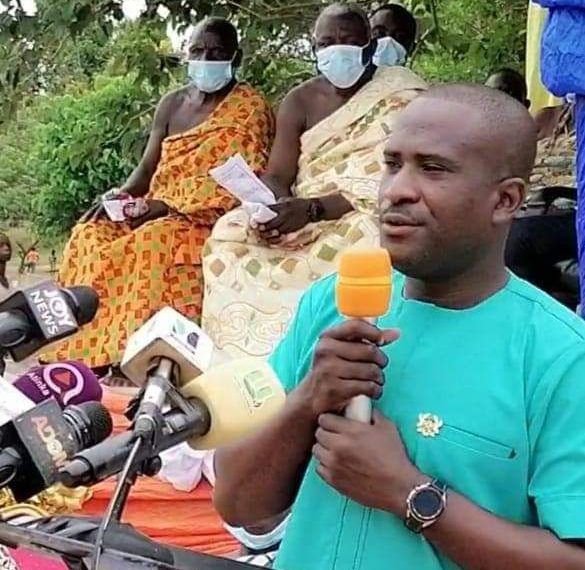

Hon. Kofi Arko Nokoe

Expanding on this industrial roadmap, the legislator highlights the staggering economic disparity between exporting raw materials and producing finished goods.

Currently, a tonne of bauxite sells for a mere $40 to $50, whereas processed aluminium commands a market value exceeding $5,000 per tonne.

To bridge this gap, Nokoe advocates for a “start-to-finish” integration that links bauxite mining directly to a domestic refinery and then to the VALCO smelting lines.

This “mutual fixing” of aging machinery is essential to unlocking a massive employment engine capable of generating 6,000 direct jobs and approximately 10,000 indirect roles in sectors like metal recycling and scrap management.

Given that aluminium is a critical component in aircraft manufacturing and the global transition to renewable energy, he maintains that the metal “sells by itself,” making the “chase after aluminium” a strategic race that Ghana cannot afford to lose through shortsighted divestment.

The Economic Imperative of the Integrated Master Plan

The push for a “master plan” that includes a domestic refinery is a direct challenge to the historical extractive model that has seen Ghana export raw wealth for decades.

By processing bauxite into alumina locally before it reaches the VALCO potlines, the country eliminates the heavy costs of importing refined raw materials.

This synergy is expected to contribute significantly to the GDP, with some estimates suggesting a 1% boost through expanded aluminium-based industries. Furthermore, the global “chase after aluminium” is intensifying due to its role in the green economy.

As a metal used in everything from EV battery casings to solar panel frames, VALCO’s output represents a strategic commodity that ensures Ghana remains a key player in the 21st-century industrial landscape.

Safeguarding National Interests and Social Stability

The negative impacts of selling VALCO to private interests often involve the risk of job rationalization and the loss of national control over a “strategic standing” asset.

Privatization frequently prioritizes short-term shareholder dividends over long-term national development goals, such as youth employment and industrial skill acquisition.

Hon. Nokoe’s stance suggests that the 16,000 potential direct and indirect jobs are a “benefit that stands out,” providing a social safety net that private entities might not guarantee.

By retaining a strong state interest and focusing on “mutual fixing” of machinery, the government can ensure that the wealth generated from Ghana’s bauxite remains a domestic catalyst for infrastructure and community development rather than being siphoned off as offshore profit.

The Strategic Value of Aluminum in Global Markets

Aluminium is no longer just a commodity; it is a critical mineral for the future of aerospace and sustainable technology. The market’s resilience means that VALCO does not need a buyer to be rescued; it needs a partner to be empowered.

The transition from a “loss-making” perception to a profitable reality hinges on the government’s ability to tell the VALCO story effectively to the right kind of strategic investors—those who seek to build rather than just own.

With the right support, VALCO can move from its current limited capacity to a full-scale operation that powers the nation’s industrial “reset,” proving that state-owned enterprises can indeed thrive when managed with vision and the right technical reforms.

READ ALSO : Vice President Backs Judiciary Reforms to Improve Access to Justice