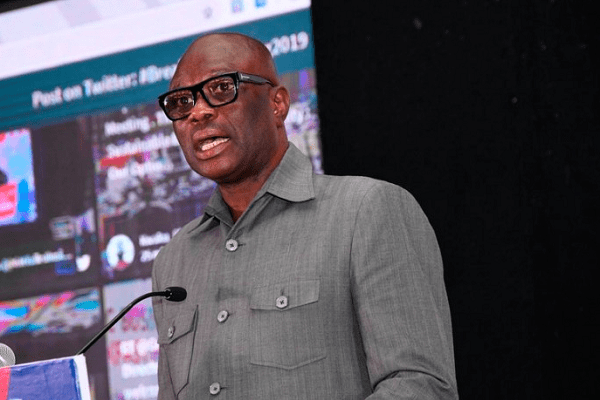

President of Ghana Traders Union Association, Dr. Joseph Obeng, has called on government not to consider a proposed fifty percent reduction on the benchmark value on imports.

According to him, the benchmark serves as a stabilizer in the import valuation system. As such, reducing the value will only compound the plight of Ghanaian businesses.

He made this revelation at meeting with the Ghana International Trade Commission to cross-examine the illicit dumping of substandard goods by foreign retailers onto the Ghanaian market.

The meeting is to develop a review of framework that guides the benchmark value for imported goods into the country.

The GUTA President’s comment follows an allegation that, the Association of Ghana Industries, is lobbying government to reduce the benchmark values.

“It will be callous for any group to call for the reversal of fifty percent reduction of the benchmark value which has held in resuscitating businesses in no small measure. Already, due to the above stated factors, prices of goods and services are escalating in the market and any attempt to reverse the policy will result in unbearable hardships to the general public.

“We are stating all these undeniable facts because, it has come to our notice that AGI is seriously lobbying the government to consider the fifty percent reduction of the benchmark value which serves as a stabilizer and has brought sanity into the import valuation system of the country”.

Reduction of benchmark value

Additionally, Dr. Obeng posited that, the scrapping of the 50% reduction in benchmark value will overburden Ghanaian businesses.

He further called out the AGI for suggesting a reduction in benchmark values against importers.

“Here, I must say, AGI is not being fair to the importers and the general trading community because they have all the opportunities. Government has supported industries more than anything else. Industries are paying zero percent duty; the worse percentage they will pay is 2.5% only. About 70% of duties that are being paid for raw materials and other products in manufacturing industries have been zero rated and the highest is 2.5%. They also benefited from the benchmark reduction.

“We are being surcharged and we pay and non-refundable VAT of 17.5%, now 18.5% at the port; we don’t get the refund again. Importers do not get a refund; manufacturers again are made to get the refund. It’s refundable to industries. What else could the government have done for manufacturing entities against the importers who are being surcharged with only 50% of the reduction of values for it to be a problem for manufacturing companies? It’s not fair”.

Surcharging Ghanaian businesses

Touching on the issue of surcharging businesses, Dr. Obeng insisted that the move will not augur well for them. He maintains the view that, these businesses can only outsource about 10% of import requirements from local manufacturers.

“We recognize the fact that some industries have some problems but they should not benchmark their problems on the CIF values. They should benchmark their problems on the FOB prices. So, if they compare their prices on their fellow competitors globally, then they know that they are not competitive. Because they know that they cannot compete with them.

“Mostly, their products are over 30% higher and so, we cannot source mostly from them. Because some few companies are producing some few items that cannot even sustain the market; the government should surcharge the good people of Ghana even in the wake of the pandemic where prices have gone up astronomically? This is not acceptable.

The GUTA president further cautioned government not reverse “this good policy of the benchmark value”. According to him, this will not augur well “for the unity of members of Ghanaian business community”.

Read Also: Happiness deteriorates in Ghana