The flaring of unwanted natural gas produced during oil recovery is causing many oil producing countries financial losses of up to US$82 billion a year, according to GlobalData.

Despite the numerous technological solutions available for use to avoid gas flaring, many countries persist with the activity- including developed countries such as the US and Russia. Aside lost revenue, this is also an environmental issue, as gas flaring is a major contributor to CO2 emissions.

According to the report, ‘Gas Flaring- Thematic research’, countries could make up to US$82 billion, if they utilized the gas instead of flare it.

Anna Belova, Senior Oil and Gas Analyst at GlobalData, remarked: “It would do many countries, especially in Europe and Asia… a lot of good if oil and gas operators found the strategy to sell this gas rather than lose it- not only for the money but for meeting their CO2 targets too.”

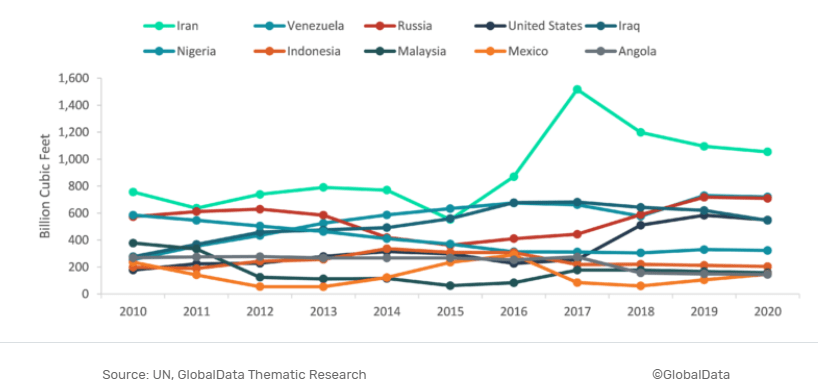

Countries with the largest gas flaring volumes, accounting for over 87 per cent of all flared gas in 2020 were 12, namely: Angola, Algeria, Indonesia, Iran, Iraq, Libya, Nigeria, Malaysia, Mexico, Russia, the US and Venezuela.

Belova further pointed out, “the top 12 gas-flaring countries flared almost 13 billion cubic feet of gas per day (bcfd). To put that into context, that amount of gas could easily keep the whole of Japan well-supplied for a year. All of that power has simply gone to waste.”

Low domestic prices, inaccessible markets cause of gas flaring

According to the report, many countries flare gas than consider its salability. This is due to lack of access to these markets, combined with the small volumes of gas produced at individual oil sites.

However, low domestic gas prices complicates the situation in most of the top flaring countries. The value of flared gas, when priced at domestic prices in Russia or the US for example, is often less than a quarter of what the gas could command on Europe or Asia markets.

“Reducing global gas flaring will require a multi-prong approach. [This is] due to unique regional drivers that prioritize flaring over monetization of gas. Small-scale modular technologies, aimed at converting gas into liquids or chemicals. [This] represents a logical choice for remote and distributed flaring sites.

“Alternatively, multiple sites by different operators can be combined with large-scale midstream and downstream components– provided enough flaring density. This approach was pioneered by Saudi Aramco. [It] has now been applied in Texas, with LNG-based monetization of gas, and Russia, with natural gas used as feedstock for petrochemicals.”

Anna Belova

Belova added: “Given that technological solutions exist at multiple scales, regulatory and investor pressures are needed to drive investments.” Supporting this is the need for environmental, social and governance (ESG) commitments by operators to end routine flaring of gas globally.

READ ALSO: Grow Electricity Access by 3% annually to Reach 2025 Target— Nana Amoasi VII