Nigeria’s gross domestic product (GDP) has been projected to make a total recovery equivalent to its 2019 level of GDP only by 2023.

The country is expected to make a slow recovery as a result of the structural weakness in their systems and the poor policymaking strategies implemented by governments over the years which is predicted to continue and drag on growth.

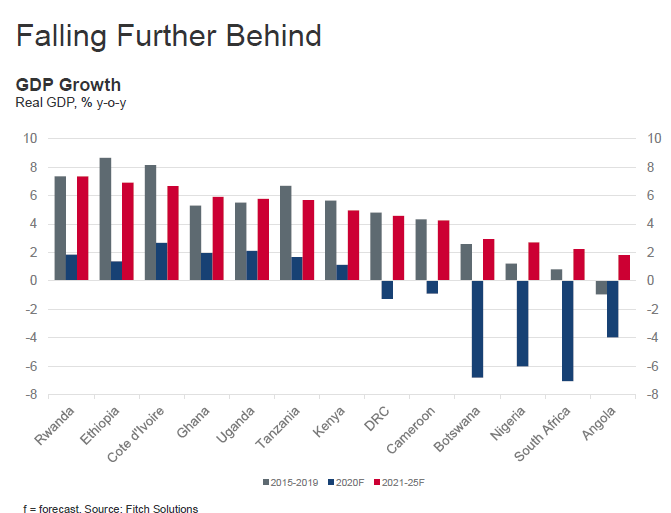

As the novel coronavirus has taken a toll on economies globally and emerging economies as well as sub-Saharan Africa taking a harder hit from the crisis, Nigeria is seen and projected to be one of sub-Saharan Africa’s worst performing economies this year.

This was revealed by John Ashbourne, a global emerging market economist, during a webinar held on Tuesday 11th August, 2020 organised by Fitch Solutions. According to him, productivity per head in Nigeria will continue to fall.

“We estimate that Nigeria will only recover its 2019 level of GDP in 2023. Output per head will probably continue to fall, as it has done since 2016.”

Nigeria’s GDP in 2019 stood at 2.27 percent which is equivalent to approximately $446,543 billion and rated as one of the best GDP growth rates for the country.

However, activity is projected to strengthen in 2021 as growth is projected to be weak and take a slow pace.

“Activity will strengthen in 2021, but growth will probably remain slow. In real terms, output will not return to the level seen in 2019 until 2023. We expect that headline growth will remain weak over the coming years, with the country falling behind regional peers.”

Meanwhile, the decline and the projection of a further decline in GDP is based on the fall in private consumption spending. According to the research, the rate at which people purchased and consumed plummeted into the negatives, that is around -4.2 percent, due to some factors.

“We expect that output will fall by 6.0 percent in 2020. This will be mostly due to a sharp fall in private consumption spending due to lockdown rules, tighter fiscal policy and declining oil income.”

On the other hand, the report revealed that the naira will weaken further. According to the survey, the continuous decline in reserves will prompt another devaluation of the country’s currency.

“Given the low prices and bearish sentiment towards EM currencies, pressure on the Naira will continue to mount. We expect that the currency will weaken to NGN475/USD at the end of the year and NGN510/USD next year.”

The report went on to disclose that the Naira will depreciate as a result of the failure of Nigerian policymakers to relax the foreign exchange (FX) rates.

“The depreciation will come in a series of steps, as in recent years. Policymakers are very unlikely to fully liberalize the FX regime.”