A latest report by the Bank of Ghana (BoG) has indicated that fraud cases in the banking sector increased from 2,175 to 2,295 2019, representing a marginal increase of 5.4 per cent.

According to the report, Rural and Community Banks reported 55 per cent of the total cases, and commercial banks and savings and loans institutions reported 23 per cent and 22 per cent of the cases respectively.

In total, eighty-three (83) institutions reported cases in 2019, as compared to seventy-two institutions (72) in 2018.

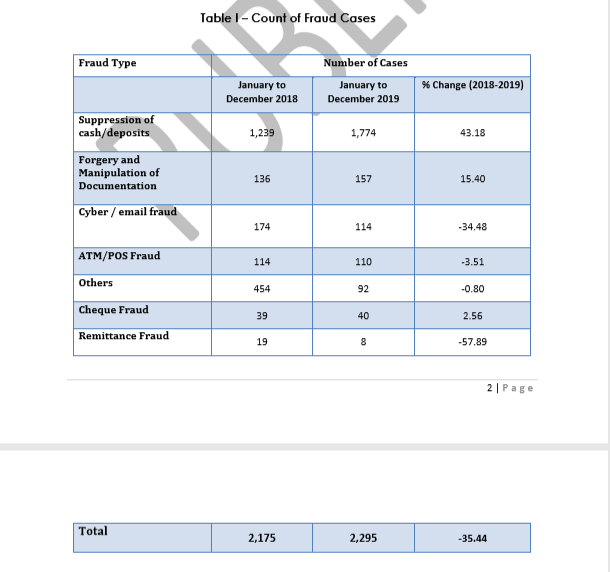

The various fraud types that contributed to the total number of fraud incidences reported to the BoG can be seen as illustrated in the table and graph below:

The total value of the fraud cases amounted to GH115.5 million, out of which, GH82 million was detected and recovered, while GH33.4 million was loss.

The marginal increase in the number of fraud cases according to the central bank could partly be attributed to the improved efforts by the Financial Stability Department to identify, monitor and to ensure compliance with reporting of fraud cases in the industry.

As part of efforts to give more details, the report said the various forms of advanced technologies adopted by financial institutions made the banking sector more susceptible to various risks such as phishing, identity theft, card skimming, vishing, email fraud and more sophisticated types of cyber-crime.

“Similar to the year 2018, in 2019, suppression of cash and deposits accounted for the largest portion of the total number of fraud cases reported to the Bank of Ghana,” the report said.

Cyber Fraud

During the year under review Cyber fraud cases decreased by 34.48 per cent from 174 cases in 2018 to 114 cases in 2019. However, despite the decrease in 2019, cyber fraud accounted for the highest value of attempted fraud amounting to GH¢ 50.54 million (with actual loss of GH¢14.31 million).

The report stressed that about 94 per cent of the fraud cases reported as suppression of cash and deposits were perpetrated by staff (either contract or permanent) of the financial institutions.

“The alarming rate of involvement of bank staff in the perpetration of fraud in the banking sector, calls for significant reforms in the engagement, remuneration and disengagement processes of employees and contractual staff of financial institutions”, the report noted.

In all, the total loss value reported is made up of GH¢10.35million with a remaining balance of GH¢23 million.