Africa stands at a pivotal crossroads in its pursuit of becoming a major player in the global liquefied natural gas (LNG) market.

With vast untapped gas reserves in countries like Mozambique, Tanzania, Senegal, and Mauritania, the continent holds the potential to transform its energy landscape and contribute significantly to global energy security.

However, as revealed in the State of African Energy Outlook Report 2025, financing, security issues, regulatory bottlenecks, and under-investment pose significant hurdles to realizing this potential.

Similar challenges that have plagued the continent’s oil sector are evident in its gas projects, with the report stating, “The impact of it becomes much more visible in the next decade, where almost 20% of the potential gas supply in 2040 risks remaining stranded.”

According to the report, one of the critical reasons behind these stranded resources is the lack of a robust domestic or regional gas market to absorb the output. This shortfall underscores the urgent need for African nations to strengthen intra-regional energy markets while also exploring opportunities for global exports.

“Sub-Saharan Africa also faces challenges on the electricity access, and that is where gas to power can play an important role in not only increasing the electricity access to a wider population but also help commercialize some of this gas.”

State of African Energy Outlook Report 2025

The report emphasized the importance of developing domestic markets alongside export opportunities. For instance, pipeline projects such as the West African Gas Pipeline (WAGP) and the proposed Trans-Saharan Gas Pipeline are being explored as critical infrastructure for exporting gas to neighboring African countries and even Europe.

However, these pipelines are capital-intensive and require seamless inter-governmental collaboration, presenting additional challenges to financing and execution. A lack of coordinated policies and regional cooperation has historically hindered the timely realization of such projects.

Large-Scale LNG Projects in Africa

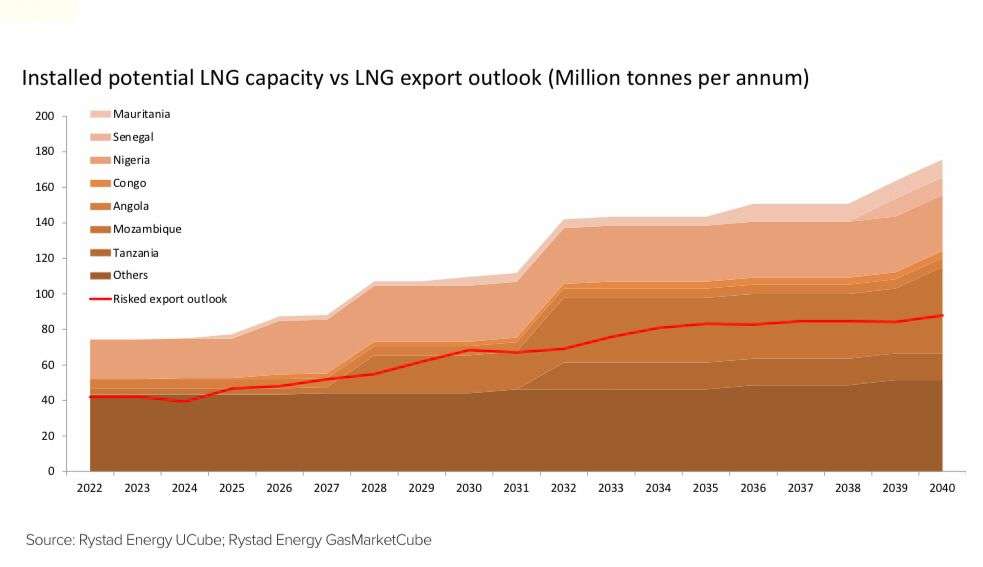

Africa’s LNG industry is poised for significant growth. The State of African Energy Outlook Report 2025 estimated that “Africa’s gas resources could support an LNG export capacity of up to 175 million tonnes by 2040, a sharp increase from the current exports of about 40 million tonnes.”

This projection highlights Africa’s potential to quadruple its LNG output in less than two decades. Yet, this ambitious target depends on overcoming several obstacles.

The report tempered its optimism, projecting “LNG exports to reach around 85 million tonnes by 2040 if low-risk projects proceed successfully.”

Mozambique, with its substantial reserves, emerges as a critical growth driver. The country has the potential to contribute nearly 50 million tonnes of LNG capacity. However, serious security concerns in Mozambique’s Cabo Delgado province have already disrupted the development of its first onshore LNG project.

Security challenges have forced a shift in focus toward smaller-scale offshore floating LNG (FLNG) projects, such as the Coral North development. While these offshore projects are less vulnerable to insurgent attacks, they lack the scale and economic impact of larger onshore projects.

In West Africa, Senegal and Mauritania have shown promise with joint LNG developments such as the Greater Tortue Ahmeyim (GTA) project.

However, progress has been hampered by major setbacks, including the withdrawal of BP, a leading operator in the region. BP’s exit raises concerns about delays in development timelines and casts uncertainty over the viability of other projects in the region.

Despite these challenges, there remains cautious optimism. The region’s gas reserves are extensive enough to support significant LNG export growth if stakeholders address regulatory uncertainties and attract stable financing.

The report stressed that regulatory reforms and investor-friendly policies are critical to unlocking Africa’s LNG potential. Transparent legal frameworks, consistent tax regimes, and guarantees for project security are among the measures that could help draw the necessary capital.

Africa’s LNG potential represents an opportunity to reshape its energy future and strengthen its position in global energy markets. However, realizing this potential will require overcoming significant hurdles, including financing constraints, security risks, and regulatory inefficiencies.

READ ALSO: GOGO Condemns Facebook’s Unjust Ban of CDD-Ghana Director, Demands Justice