Dr. Yusif Sulemana, an Energy expert and a Senior Oil Production Specialist at Petroleum Development of Oman, has called on the Ghana National Petroleum Corporation (GNPC), to build internal structures and avoid the persistent haemorrhaging of the national oil company (NOC).

This, he said, is to ensure that the NOC achieves the revised target of becoming a stand-alone operator as well as achieve world-class operatorship in the coming years.

With the previous target set in 2012, the GNPC stated that: “The overarching strategic goal of GNPC is to become a stand-alone operator by 2019 and a world-class operator by 2027”.

Having delayed achieving the stand-alone operatorship goal in 2019, albeit, two years later, the NOC again reset this goal, targeting 2036 (next 15 years from 2021). This also indirectly means that this would shift the corporation’s 2027 deadline for its world-class operatorship ambition further.

In 2021, the then CEO of GNPC, K.K. Sarpong, stated that, “We have to build the capacity of GNPC to become an operator. If we do that, 15 years from now, we should mature and stand-alone.” This, he said in line with the recent efforts to acquire additional stakes in oil blocks operated by Aker Energy and AGM Petroleum.

“Two things are required for every corporation/entity to be a stand-alone operator as far as this upstream business is concerned: 1) You need the State of the art technology to be able to champion that. 2) You need capital or the required investment to be able to do that… Between these two, I will rate capital or investment as key. That should be an ultimate goal for every NOC, but until now it is a mirage and if we keep on with what we are doing, it is going to continue to be a mirage.

“I think we have to prioritize our investments and invest in areas that can create value. And the only thing that can create value for the corporation is to invest in our exploration and production drives; We acquire fields that are profitable… and will bring us value for money. If we do that it is going to gravitate us into a stand-alone operatorship.”

Dr Sulemana

Section 2 subsection 2b of the PNDC Law 64 (1983), which is one of the key objectives of the GNPC stipulates that, GNPC is to “ensure that Ghana obtains the greatest possible benefits from the development of its petroleum resources.” Meanwhile, some have asserted that the corporation has woefully failed in this mandate as it appears to be spending massively on corporate social responsibility (CSR).

The Petroleum expert further noted that: “The other one that I think is key is to build internal structures and avoid wastage. Even with the meagre stake or money that we are getting from the co-operations and partnerships with players such as Tullow and ENI, if we are not able to manage that well, then it means that we are not going anywhere.

“So, I think we should be deliberate in our spending, and we should channel the spending to where it is needed. We should avoid spending in areas that will not bring value to the corporation. For instance, championing CSR is a very beautiful idea but championing CSR should not be to the detriment of the core business of the NOC- that cannot guarantee any corporation independent operatorship.”

Dr Sulemana

Doing Business As Usual Will Delay Target

Doing business-as-usual— which simply could not see the NOC achieve its previous target— may as well, unintentionally replicate another delay of the target. Moreover, this strategic ambition by the NOC is also fenced around a 2026 deadline which would require that GNPC does not continue receiving petroleum receipts from the Petroleum Holding Fund (PHF). GNPC’s finances are likely to be further constrained by the dictates of the PRMA Act 815 (as amended).

Section 7(3) of the PRMA states that “for a period not exceeding fifteen years after the commencement of the PRMA, the cash or the equivalent in barrels of oil ceded to GNPC shall not be more than 55% of the net cash flow from the carried and participating interests (CAPI) after deducting the equity financing cost and be reviewed every three years by Parliament”.

Following the above, “This makes 2026 the earliest date for reviewing the upper limit for funding the national oil company,” adding that, “ there could be limited or moderate government support to GNPC or none at all,” according to PIAC’s ten-year assessment report.

The report on the ten-year assessment of petroleum revenue and management and use, stated that transfers to GNPC over the past ten years since the implementation of the PRMA has allocated US$2 billion to GNPC, being the Corporation’s equity financing cost (Level A receipts) and a percentage of the net cash flow from CAPI (Level B receipts), as provided for in Section 7(2) of Act 815 as amended.

Accordingly, GNPC’s total equity financing costs (Level A receipts) amounted to US$1.14 billion over the period, representing 55% of the total GNPC allocations. Level B receipts for other expenditures such as staffing and other operational costs amounted to US$921 million or 45% of total allocations.

GNPC’s Financial Strength in Decline

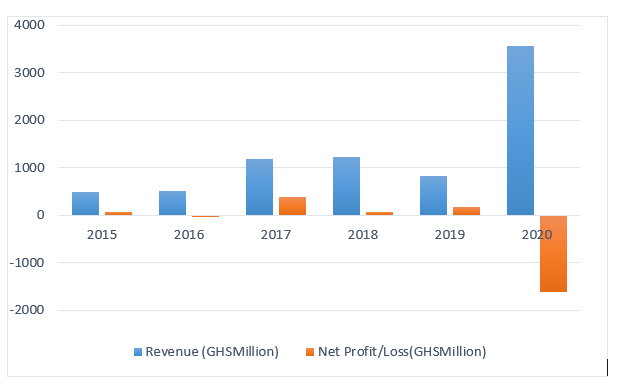

GNPC’s financial performance, in recent times is skewed towards a decline. Between 2018 and 2020, the company made an average net loss (see figure above) compared to an average net profit of GHS136.94 million between 2015 and 2017. In 2020 alone, the company made a net loss amount of (GHS1618.82 million).

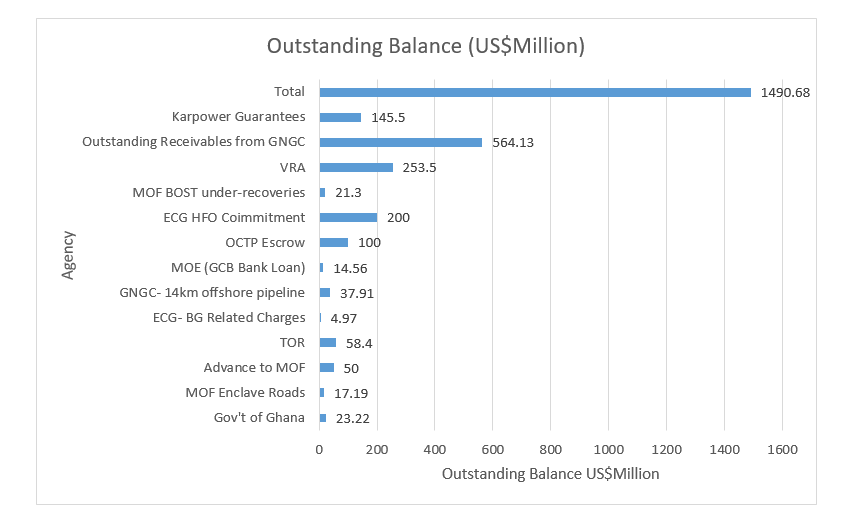

One problem that could be traced as a reason for the corporation’s below par performance is its persistent use of quasi-fiscal expenditures which have been highlighted invariably by the independent watch dog for the country’s upstream operations, the Public Interest Accountability Committee (PIAC).

According to the PIAC’s assessment report, the NOC has been used to make payments and guarantees for state agencies as well as national and local infrastructure projects. For instance, between 2015 and 2020, GNPC provided US$17.19 million and GHS25.90 million to fund various enclave roads in the Western Region under the purview of the Ministry of Finance.

Another example is the fact that, the Corporation provided payment of US$200 million of guarantees in respect of heavy fuel oil (HFO) supply commitments from Litasco, a trading firm, to the Electricity Company of Ghana (ECG).

Another area for which GNPC has often been criticized is the Corporation’s overhead costs, particularly, staff costs. GNPC’s staff costs have increased by 11.59% annually (CAGR) from US$7.66 million in 2011 to US$22.94 million in 2020. Accordingly, the Corporation’s staff strength has increased over the ten years, increasing from 207 to 530.

Staff costs in the period 2011-2016 averaged US$10.30 million while averaging US$20.72 million from 2017-2020. “Staff costs saw a significant spike, especially after 2018, where they have consistently been over US$20 million,” according to the PIAC assessment report, further explaining that, “A likely reason for the astronomical increase in payroll costs is the Corporation’s staff increment over the years”.

That said, it is very clear that, the corporation’s quest to become a world-class operator is the way to go, but if drastic measures are not taken to get the corporation towards focusing on its core mandate and avoid the bleeding of the corporation’s resources through other non-core activities this could be another mirage.

Besides, investments into the oil and gas sector is becoming constrained and thus, requires that the NOC’s resources are used judiciously to achieve the required results.

READ ALSO: Ghana’s Current Account Deficit to Widen to 3.6% in 2022