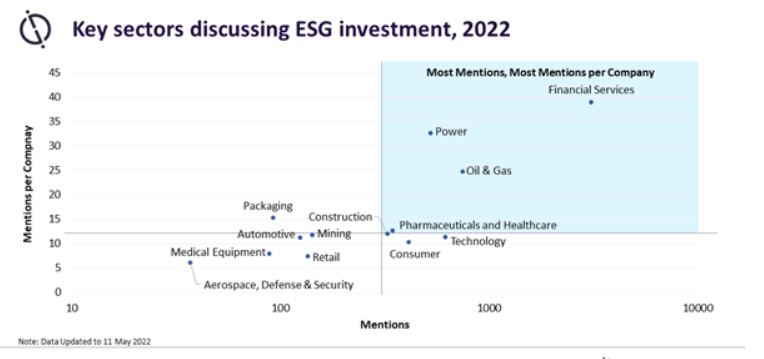

Analysing the frequency of investment discussions in company’s filings, GlobalData has found that companies within the financial services, power, oil & gas, and pharma sectors are centering discussions on ESG investment opportunities more frequently in 2022, than other industries.

The leading data and analytics company names Credit Suisse, NatWest Group, Enel SpA, Exxon Mobil, and Novartis AG among the companies that mentioned ESG-related keywords the most within investment discussions.

Rinaldo Pereira, Business Fundamentals Analyst at GlobalData, said:

“Financial services companies mentioned ‘Climate’ the most in 2022 ESG filings, with discussions largely focusing on which investments can help prevent climate change and which partnerships could help their clientele address low-carbon initiatives. How to reduce the impact of loans, investment offerings and insurance products on the climate were also points of discussion.”

Rinaldo Pereira

These findings also support findings of GlobalData’s report, ‘ESG (Environmental, Social, and Governance) Strategy Survey 2021’, which noted that these industries ranked highly against other sectors in questions.

The areas considered center around the impact ESG would have on their business, the role ESG would play in their investment decisions, and whether they would increase investment to meet ESG goals.

The findings show that for instance, 91 per cent of power ESG executives expected that their companies would increase investment in ESG in the next five years (followed by 88% for oil & gas, and 82% for pharma).

Luke Gowland, Thematic Analyst at GlobalData, said:

“Financial services, power, oil & gas, and pharma are some of the highest exposed to ESG in terms of their business models and regulation, so it is good that they’re aware of the issue and talking about the importance of ESG.

“However, caution must be taken. I’d take everything these companies say about ESG in their filings with a pinch of salt, they may be using their filings as an opportunity to greenwash investors and the public, for example.”

Luke Gowland

Other Areas Companies are Focusing

GlobalData’s Company Filings database also identified ‘Employees’, ‘Governance’, and ‘Customers’ as other keywords linked to ESG investment.

“It is interesting to see companies talking about employee investment, especially in terms of increasing diversity, training and digital capabilities. The digitalization trends of 2020 and 2021 seem to have spurred focus on the digital capabilities of employees in 2022.”

Rinaldo Pereira

Discussions in the financial services and oil & gas sectors included the ‘governance’ portion of ESG, with companies highlighting the importance of transparent corporate governance.

“With ESG becoming increasingly important for customers and investors alike, transparent corporate governance, ethics, and credibility were key topics of interest for companies discussing ESG investment. Furthermore, ‘suppliers’ appeared as a key word in investment discussions in ESG filings, highlighting that companies use an ESG lens before supplier-related investment.”

Rinaldo Pereira

All companies are now under pressure to reduce their scope 3 emissions, and disclosure of these figures is increasingly being required by the major reporting frameworks (TCFD, CDP, SASB etc), Gowland said.

Therefore, considering this view, companies are choosing to buy from or partner with companies that can demonstrate a commitment to ESG— although price will always be a big influencer, he added.

READ ALSO: SSA: Tight Vehicle Supplies to Squeeze Sales Growth in 2022