Ghanaians are set to experience a decline in fuel prices following the latest Chamber of Oil Marketing Companies (COMAC) Petroleum Pricing Outlook, which projects a reduction in ex-pump prices for petrol, diesel, and liquefied petroleum gas (LPG).

The pricing update for the March 16th – 31st window highlights the impact of declining crude oil prices, global market adjustments, and the marginal stability of the Ghanaian cedi against the U.S. dollar.

The report examined the implications of these developments for Ghana’s economy, consumers, and fuel market dynamics.

“Crude oil prices declined by 4.16%, from $75.49 per barrel in early March to $71.94 per barrel by mid-March.

“This drop is attributed to concerns about a global economic slowdown, U.S. trade policies, and an expected increase in oil supply from OPEC+ and Russia.”

COMAC Petroleum Pricing Outlook

COMAC noted that global oil production has rose by 240,000 barrels per day (bpd) in February, largely due to increased output from Kazakhstan, Iran, and Venezuela.

The rise in oil supply and lower demand growth forecasts have led to a downward trend in global oil prices, translating into a reduction in refined petroleum product costs.

As a result, “international product prices for petrol, diesel, and LPG dropped by 9.22%, 6.37%, and 9.00%, respectively.”

Price Adjustments at Ghana Pumps

Ghanaians can expect lower fuel prices in the second half of March. The report outlines the following ex-pump price projections:

| Product | Price as of March 1 (GHS/Lt) | Price as of March 16 (GHS/Lt) | Percentage Change |

| Petrol | 14.90 | 14.25 | -4.5% |

| Diesel | 15.20 | 14.63 | -3.8% |

| LPG | 17.35 | 16.68 | -3.9% |

These reductions offer some relief to consumers, particularly transport operators, households, and businesses reliant on LPG for cooking.

However, fluctuations in the Ghanaian cedi against the U.S. dollar may affect price stability in the coming months. The exchange rate moved from GHS 15.5793/USD on March 1 to GHS 15.6118/USD on March 10, reflecting a marginal depreciation of 0.20%.

Lower fuel prices are expected to ease inflationary pressures, as transportation costs significantly influence overall price levels in Ghana.

Reduced diesel and petrol costs will likely result in lower transport fares, benefiting both businesses and consumers.

Manufacturers, logistics firms, and transport operators stand to benefit from decreased fuel costs, leading to reduced operational expenses. This can translate into lower prices for goods and services, boosting economic activity.

Although lower fuel prices provide relief to consumers, they may impact government revenue, as petroleum taxes constitute a significant portion of state income.

The COMAC report highlighted various levies and taxes, such as “the Energy Debt Recovery Levy, Road Fund Levy, and Special Petroleum Tax,” which contribute to national revenue.

These levies, accounting for 21% of fuel costs, fund government programs and infrastructure but also increase the financial burden on consumers.

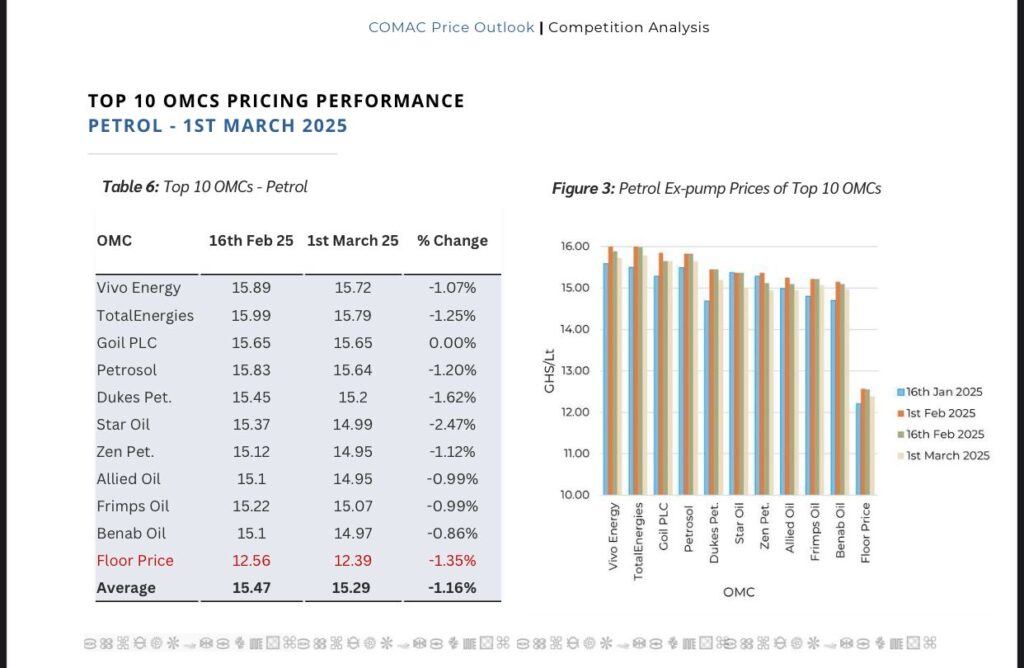

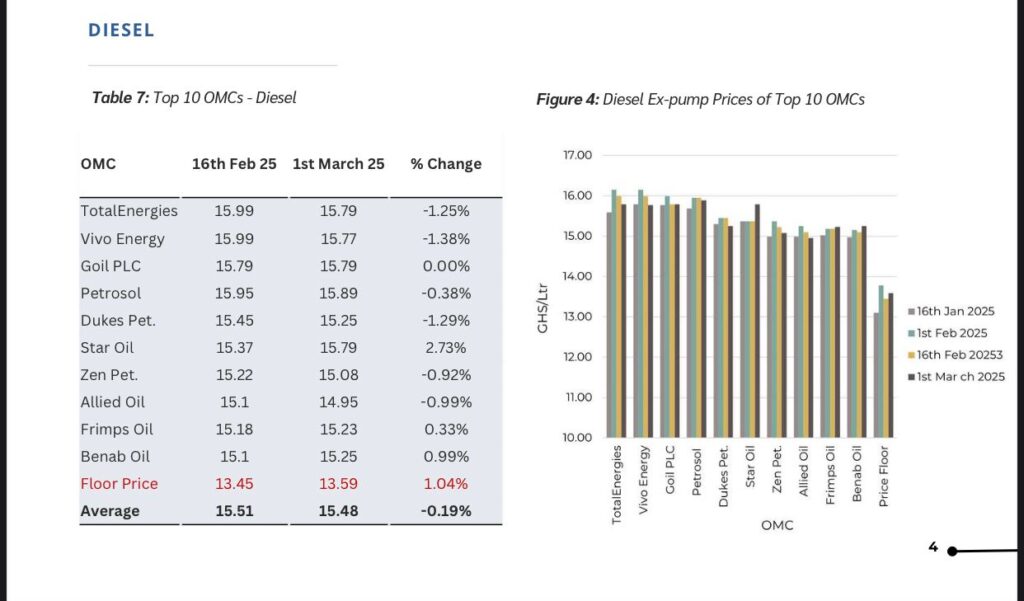

Competitive Pricing Among Oil Marketing Companies (OMCs)

The price changes also impact the competitive landscape among Ghana’s leading OMCs. The report ranked Star Oil, Goil PLC, and Vivo Energy as the top three players, with Star Oil commanding the highest market share in petrol and diesel sales.

Competitive pricing among OMCs will determine the extent to which consumers benefit from the projected reductions in ex-pump prices.

For LPG, prices ranged from DA Oil’s 19.91 GHS/Kg (highest) to Trinity Oil’s 14.48 GHS/Kg (lowest).

Market competition is expected to intensify as OMCs adjust prices based on international market trends and government policies.

Outlook for the Coming Months

While COMAC forecasts continued price stability, factors such as: “OPEC+ production adjustments, global economic trends, and currency exchange fluctuations” could alter price dynamics in the coming months.

In its final remarks, COMAC urged government’s intervention to ensure that fuel price declines translate into real economic benefits for consumers and businesses.

The next pricing window, set for April 1st, 2025, will provide further clarity on market trends and potential adjustments.

The March 2025 Petroleum Pricing Outlook from COMAC offers a positive development for Ghanaian consumers, as fuel prices drop due to declining global crude prices and a relatively stable cedi.

However, continued vigilance is necessary, as future market fluctuations, exchange rate movements, and fiscal policies could impact fuel pricing trends.

As stakeholders—from consumers to businesses and policymakers—monitor these trends, maintaining a balanced energy policy and ensuring economic stability will be key to sustaining long-term benefits from lower fuel costs.

READ ALSO: Seth Terkper Warns of Potential Debt Default by 2028