The Chamber of Bulk Oil Distributors (CBOD) has projected a marginal decline in fuel prices despite recent global crude oil volatility, in its latest market outlook covering the first pricing window from April 1 to April 15, 2025.

The report highlighted complex international and domestic dynamics that are shaping pump prices, inflation risks, and energy affordability in the short term.

“Pump prices are projected to range above GHS13/Ltr. However, this projection is highly dependent on the performance of the cedi.”

Chamber of Bulk Oil Distributors (CBOD)

CBOD reiterated the importance of government’s continued support through FX auctions and broader macroeconomic reforms.

The report added that foreign reserve accumulation and debt management strategies will play a pivotal role.

Meanwhile, analysts warn that global crude price forecasts remain volatile due to policy shifts in major economies.

On the supply side, the EIA forecasts that U.S. crude oil production will rise steadily to 13.59 million barrels per day (b/d) in 2025 and 13.73 million b/d in 2026, a development that could ease global price pressures.

According to CBOD, global crude oil prices rose by an average of 1.38% in the first quarter of 2025 compared to the previous quarter, peaking in February with Brent crude hitting $83 per barrel.

This uptick, the report noted, was largely influenced by the aggressive economic policies and protectionist measures under the new Trump administration in the United States.

“The rise in crude prices during the quarter can be attributed to a sharp decline in global stock levels, particularly in the U.S.

“Moreover, available data shows that OECD industry inventories of crude and refined products fell to their lowest levels for this time of the year since 2022.”

Chamber of Bulk Oil Distributors (CBOD)

CBOD also referenced an analysis by CITAC Africa, which linked the spike in crude prices to “trade-war-provoking rhetoric and actions” of the U.S. administration.

The imposition of sanctions on Iranian oil shipments to China and new tariffs on imports from Canada, Mexico, and China have disrupted supply chains and fueled market uncertainty.

However, despite these price pressures, CBOD believes that rising inflation concerns, especially in China, and broader demand anxieties are tempering crude prices.

The report indicated, “It is expected that global crude prices will remain subdued in the second quarter of the year,” projecting further geopolitical tensions between the U.S. and its trade partners to impact oil demand.

Fuel Price Trends in Ghana

Domestically, the report points to a stable Ghanaian cedi as a key factor preventing more aggressive increases in local pump prices.

“The stability of the cedi has been largely attributed to the interventions of the Bank of Ghana (BoG) in the FX market.”

Chamber of Bulk Oil Distributors (CBOD)

In 2024, the cedi depreciated by 19.2% against the U.S. dollar, contributing to a surge in local fuel costs. However, proactive FX auctions to Bulk Import, Distribution and Export Companies (BIDECs) have helped stabilize the currency this year.

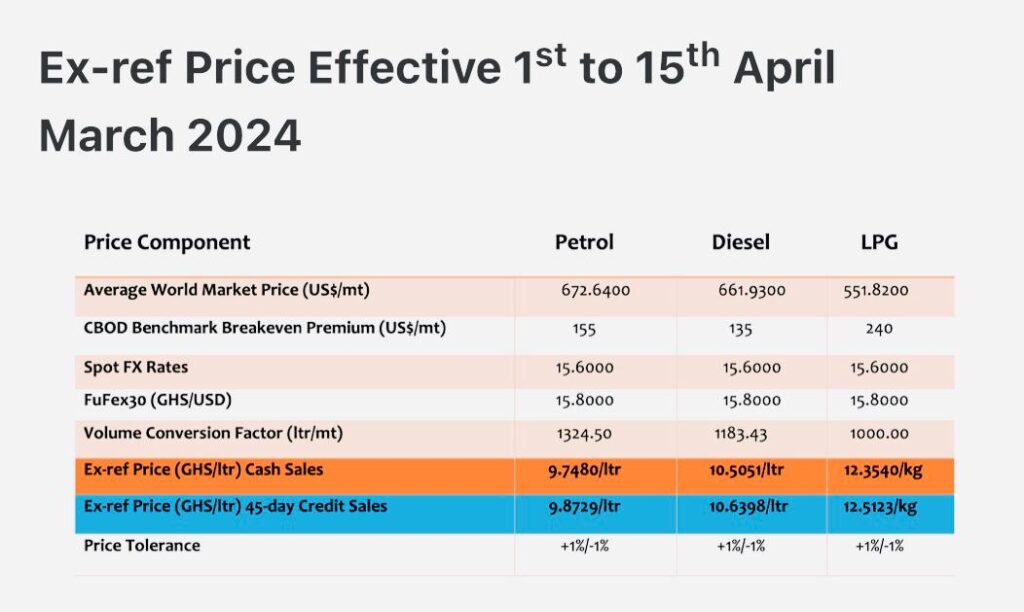

Compared to the last quarter of 2024, the first quarter of 2025 saw average pump prices for petrol and diesel rise by 7% and 3%, respectively, while Liquefied Petroleum Gas (LPG) prices declined by 3%. But in the latest pricing window, petrol and diesel prices both saw notable declines.

“Pump prices of petrol fell by 3.26% compared to a reduction of 0.67% in the previous window.

“Pump prices of diesel declined by 2.02% after rising slightly by about 0.09% in the previous window.”

Chamber of Bulk Oil Distributors (CBOD)

Year-on-year, petrol prices remain 13.80% higher, and diesel is up by 8.5%. Diesel prices have dropped by 1.25% since the beginning of 2025, reflecting marginal relief for consumers.

Despite this potential relief, CBOD cautioned that tariff impositions and supply disruptions may continue to inject uncertainty into oil markets.

“The potential for trade wars and supply chain disruptions, as well as the outright inflation-fueling effects of new tariffs, gave rise to a bearish economic outlook.”

Chamber of Bulk Oil Distributors (CBOD)

As Ghana navigates these external shocks, the local fuel market remains delicately balanced. The synergy between global oil price trends, the performance of the Ghanaian cedi, and government policy interventions will be crucial in determining the affordability and stability of petroleum products in the coming months.

For now, consumers can take modest comfort in the expected decline in prices, but continued vigilance is required as global developments evolve.

READ ALSO: Ghana, Czech Republic Deepen Ties with President Petr Pavel’s Visit