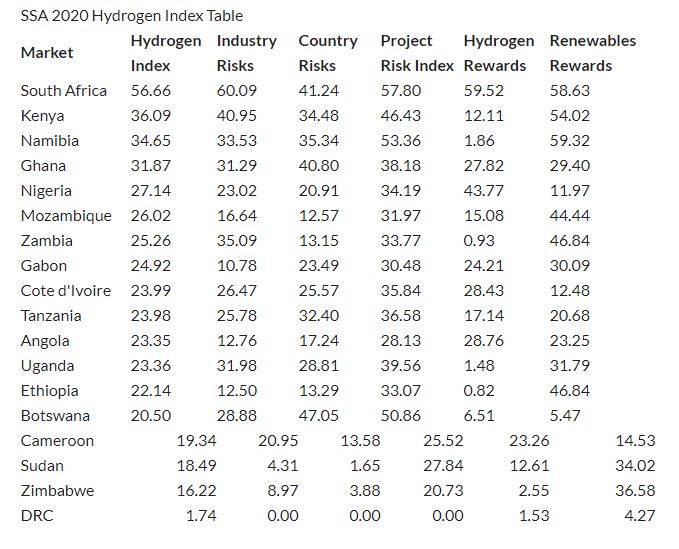

Fitch Solutions country risk and industry research, an affiliate of Fitch Ratings Inc. has ranked Ghana among the top performers (4th position) in its green hydrogen suitability index with a score of 31.87.

According to Fitch Solutions, Ghana is a regional hotspot for green hydrogen development not only in SSA but also a regional leader within the ECOWAS sub-region. The research firm contends that this is particularly important given Ghana’s green hydrogen market reaching a state of electricity overcapacity that has resulted in the delay of planned non-hydropower renewables projects.

Should this development continue, this will reopen opportunities for renewable power investors as green hydrogen production is viewed as a capacity growth enabler. One such investor is Swiss firm, NEK, which has indicated that it intends to install green hydrogen production factories near its planned wind power sites provided they receive government approval. However, production capacity will most likely remain minimal at first, with Ghana’s ranking in the region dropping from fourth to seventh within the 10-year forecasted period.

Within the ECOWAS region, Nigeria ranks next to Ghana and the fifth in SSA. Based on the rankings, Nigeria will rise to 18 spots in the global rankings. In 2020, Nigeria’s suitability for green hydrogen production stood at 90th globally, and is forecasted to increase to 72nd globally and 2nd in the region.

Based on the rankings for the green hydrogen suitability index in SSA, South Africa ranked first with an index of 56.66 while Democratic Republic of Congo scored the lowest with an index of 1.74. Again, Fitch solutions forecasted that South Africa will remain its top spot in the SSA region over a ten year forecast from 2020 to 2030.

South Africa’s market suitability for green hydrogen production will climb up in the global rankings from its current ranking of 42nd in 2020 to 37th in 2025, before dropping again slightly to 40th in 2030. Key factors in this regard are South Africa being the region’s most industrialized economy while also having the largest installed non-hydroelectric renewables capacity base in SSA.

From 2021 to 2030, South Africa’s renewables capacity will grow by an annual average rate of 7.2 percent, increasing from 6.7GW to 11.2GW. In contrast, the market with the second largest renewables capacity base in 2030 will be Kenya with just under 2.0GW.

Kenya, another market that stands out for potential green hydrogen development and ranks second in SSA with an index of 36.09 maintains the top spot in the East African region. This is due to the country’s geothermal potential along the East Africa Rift Valley, while it is also expected that Kenya will have the second-largest installed renewables capacity base in SSA from 2020 to 2030.

Fitch solutions forecast that geothermal electricity will account for an annual average of over 50 percent of Kenya’s total electricity generation, and over 80 percent of non-hydropower renewables generation over the next decade. This indicates a strong base of non-intermittent renewables supply from which to develop green hydrogen.

READ ALSO: Ghana’s LNG imports to rise to 1.2bcm- Fitch Solutions