Dr. Theo Acheampong, an Energy Economist and Political Risk Analyst, has suggested that the government’s take from petroleum agreements signed over the past decade under the concession and hybrid regimes should have generated between 51-60 per cent of oil revenues.

The state of affairs regarding the performance of Ghana’s oil business over the past decade could be attributed to a number of issues including the government’s (in this case, the Ghana Revenue Authority’s) inability to assess the credibility of the cost element in offshore operations provided by International Oil Companies, Dr. Acheampong said.

For the purposes of assessing the efficiency of the country’s fiscal regime over the period, Dr Acheampong said, modelling Ghana government’s take for four petroleum agreements signed over the past decade including: contract 1 (Tullow: Jubilee WCTP&DWT Unitised); Contract2 (Eni: Offshore Cape Three Points); Contract 3: (AGM: South Deepwater Tano); Contract 4: (Exxon: Deepwater Cape Three Points, which recently relinquished the block), showed that Ghana should have accrued more than 50% of oil revenues.

The sad reality is that, following a thorough analysis by the Public Interest Accountability Committee (PIAC), a total of $31.2 billion oil revenues has been generated from the country’s oil fields, of which amount, only $6.55 billion has accrued to Ghana from 2011-2020, representing only about 19-20% of oil revenues.

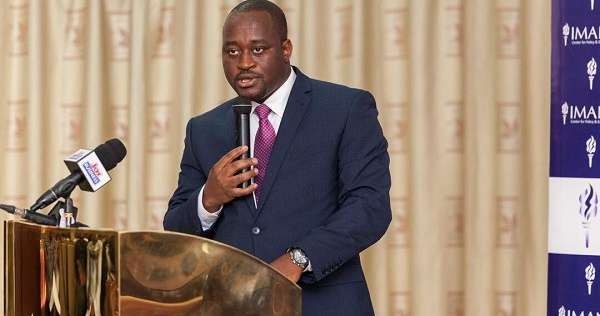

He made these remarks during a virtual meeting hosted by the Ghana Environmental Advocacy Group, titled: “Ghana’s Extractives Fiscal Regime- Why the Hybrid System & No Earmarked Funds for Local Communities? Any Remedies?”

“It [The modelling] was just to then see, over the course of 15-20 years from the time that we signed those first contracts, that you will say may be, we shortchanged ourselves, have we learnt our mistakes and are we collecting better for the state in terms of the different instruments.”

Dr Acheampong

Assessment of Fiscal Regime

Based on the modelling, the average effective tax rate (AETR) which is basically the government take, is a combination of three oil revenue streams (the royalties, income taxes and the windfall tax/Additional Oil Entitlement (AOE)) which was used for the assessment of the fiscal regime.

“We did not include GNPC’s carried and participating interest because that distorts the picture a little bit. So, we were looking purely at the concession system and these three instruments in Ghana’s concession system,” said Dr. Acheampong.

“If you model that through these different fields, what you actually see is that on average we should be collecting around 51% of the total take. Now, here is the catch, with the 51% that we should be collecting, only one of the instruments is in government’s control (that is the royalty bit). Corporate income tax and AOE or the windfall tax are subject to whatever cost deductions that the companies make.

“So, whereas this modelling is telling us that we should be collecting on average about 51% and when you include GNPC’s entitlement into it, it pushes that to about 60%, what we have done in the last 10 years is actually collecting around 19-20% of the revenues coming in. And predominantly, it is because of the corporate income tax issues and then the AOE issues. As we speak currently, the AOE instruments have been triggered and this is still a subject of debate between GRA and other entities in the government.”

Dr. Theo Acheampong

Comparison to Other Regional Fiscal Regimes

Compared to other regional fiscal regimes, theoretically, Ghana’s fiscal regime in AETR levels are less than the IMF benchmark range of between 65%-85%. However, the inclusion of the State carried and participating interest (state take) into the mix pushes the AETR into the 65%-75% range as confirmed in other studies, he said.

More so, within the wider African market, the following are Average Effective Tax Rates at $50/bbl and 10% discount rate: Senegal (Concession: 53%, Production Sharing: 59%), Congo Republic (Production Sharing: 87%), Niger (concession: 80%), Algeria (Concession: 124%). Overall, the general Ghana government take is within reasonable bounds.

While the foregoing proves that this is the case, regardless of the fiscal regime in place, the biggest challenge that could prevent countries from realizing their expected government take stems from the cost element of the oil exploration and development by the International Oil Companies (IOCs), Dr. Acheampong said.

“Interestingly, what the government should be taking on paper or in theory is not that different from what others are meant to be collecting. But the practical reality is that for you to collect Corporate Income Tax or AOE, you need to be able to vet cost and all those things.

“So to the extent that somebody is hiding cost and padding cost, etc., this theoretical 65-75% then becomes a bit of a mirage in that regard… and that has nothing to do with whether you have a production sharing contract or a concession system.”

Dr Acheampong

Given the abysmal performance of the country’s oil and gas sector, many experts have suggested that Ghana deserves better and have therefore called for a review of the fiscal regime for a Production Sharing Agreement, which is considered simpler and has many advantages compared to the hybrid system in order to ensure Ghana benefits hugely from its oil resources.

READ ALSO: Economist Lauds BoG for Laying Strong Foundation for Macroeconomic Stability