Ghana’s Liquefied Natural Gas (LNG) project is classified as wielding the potential to reduce the threat of energy poverty in the coming years, according to the Africa Energy Chamber (AEC).

In its Africa Energy Outlook 2022, the AEC said the project is considered as a promising gas-to-power project likely to “provide strong foundation for resilient, low-emission power infrastructure” for Ghana.

While dirtier fuels such as coal and oil are being blacklisted across much of the advanced world, natural gas presents a cleaner alternative for countries, especially on the continent. After the COP26 meeting at Glasgow, Africa’s commitment to making progress in switching to cleaner fuels would become more pronounced.

With the Tema LNG Terminal facility completed and now pending commissioning, this will increase the country’s chances of finding ready-market for the supply of LNG to neighbours in the region.

As recent reports suggest, Ecow-Gas, an affiliate of the Tema Liquefied Natural Gas Terminal Company (TLTC), has been awarded contracts to build LNG storage and regasification facilities in Sierra Leone, Liberia and recently, Burkina Faso. By sourcing fuel from the Tema LNG facility, Ecow-Gas aims to introduce a reliable supply of LNG to these three countries.

Adding the Tema LNG project to Ghana’s energy mix presents an important element in Ghana’s energy security and provides relatively cleaner fuel for power generation and industrialization.

Tema LNG Project Supply Capacity

According to AEC, “the construction of the terminal gives Ghana independency over its own energy supply making it less reliant on the West African Gas Pipeline.”

Expectations are that demand for LNG in the West African region will nearly double in the next decade as countries start to invest in further gas-to-power generation amid the transition from dirtier fuels.

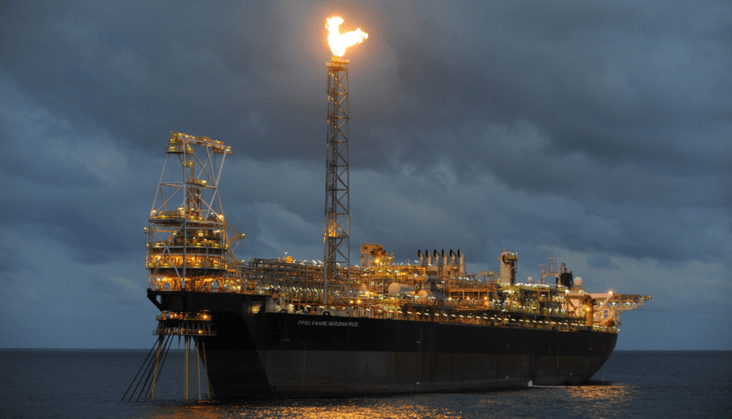

The operation of the Tema LNG project includes a re-gasified LNG delivered from a Floating Regasification Unit permanently offshore which will be sent to the Volta River Authority (VRA) in Kpone across the harbor via a subsea pipeline and then through an existing 6.5km onshore pipeline.

The Tema LNG Terminal Company expects first gas by the second half of 2021 according to the Ghana National Petroleum Corporation (GNPC). The GNPC has a supply contract with Royal Dutch Shell and will pay a tolling fee to TLTC.

The Tema LNG project will have a capacity of 230 mmscfd. By sticking to the 2021 Energy Supply Plan, Tema LNG is to supply 125 mmscfd in the second half of 2021, bringing total gas supply to 510 mmscfd. This will mean an excess of total gas supply considering total gas demand for 2021 stays around 339.5 mmscfd.

CSOs Raise challenges facing the Project

However, CSOs and experts have raised critical reservations about the Tema LNG project indicating it was poorly formulated. They contend that no sales agreement has been cited where GNPC with any independent power producers (IPPs) either in the country or within the sub-region to purchase the gas.

This raises serious risks due to the take-or-pay obligations associated with the contract and once the terminal is commissioned, GNPC will be expected to pay capacity charges, whether there is a buyer or not. This may compound the energy sector debt challenges that have been accumulated over the years, and which would have to be borne by tax payers.

Interestingly, “the price of landed LNG is still largely unknown to officials at the Ministry of Energy, IPPs and the Volta River Authority, although there is speculation that it is pegged to the price of Brent crude.” Dr Ishmael Ackah, an energy economist has said.

Besides, price of LNG on the global market has skyrocketed in the past few months, and should this upsurge continue, this will open up other possible risks to the project.

He added that “the project is primarily aiming to sell to Tema-based industries, but they currently use residual fuel oil (RFO), which is at least 35% cheaper than LNG. The price of supplied LNG will need to come down to push adoption in this market.”

These among other issues require urgent action by stakeholders, especially, GNPC so as to maximize the potential benefits likely to be harnessed from the project.

READ ALSO: Ecow-Gas Wins Contract to Build LNG Facilities in Burkina Faso