Nigeria, Africa’s largest crude oil producer, has reached a milestone in its energy sector as a consortium of local companies, Renaissance, successfully acquired Shell’s onshore oil and gas assets in a $1.3 billion deal.

This groundbreaking move has garnered widespread support from the African Energy Chamber (AEC), which views it as a transformative step toward empowering local firms and solidifying Nigeria’s standing as a premier investment destination in Africa’s oil and gas industry.

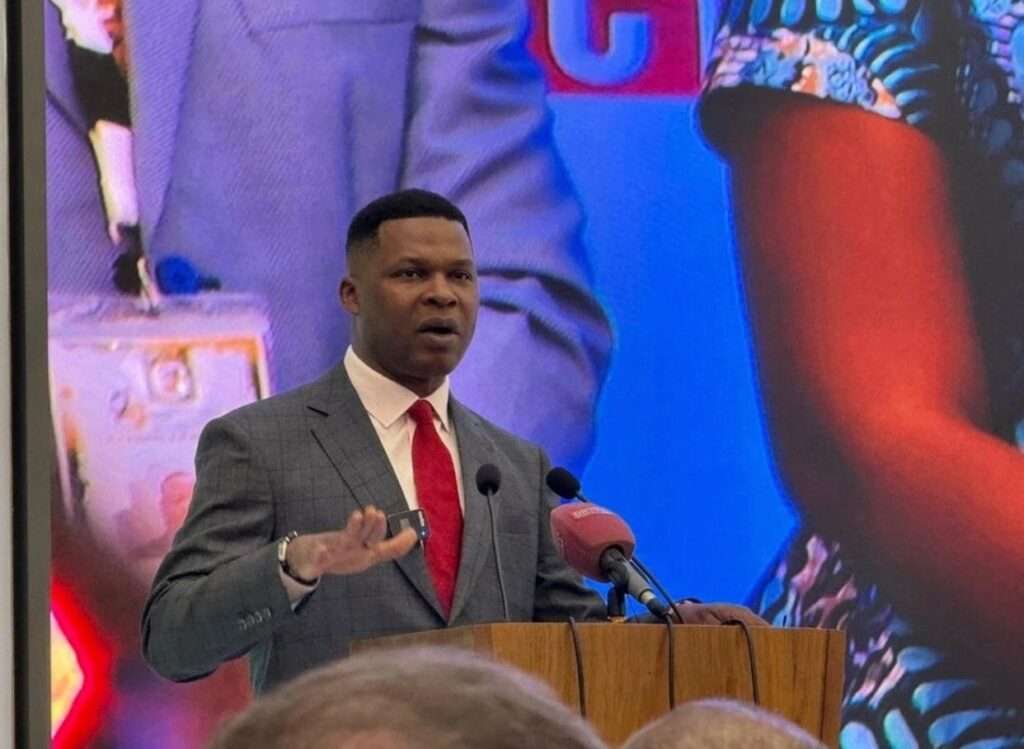

NJ Ayuk, Executive Chairman of the AEC, expressed his enthusiasm for the deal, stating, “The Chamber is wholeheartedly supportive of the Nigerian government’s commitment to supporting local companies operating in the oil and gas sector.”

The acquisition underscores Nigeria’s confidence in its indigenous companies and reflects its strategic focus on strengthening local participation in the hydrocarbons sector.

Renaissance, the consortium spearheading the acquisition, is a partnership of leading Nigerian energy companies, including ND Wester Ltd., Aradel Holdings Plc, Petrolin Group, FIRS Exploration and Petroleum Development Co., and Waltersmith Group.

These companies are known for their expertise in managing diverse oil and gas assets while prioritizing socioeconomic impact.

With this acquisition, Renaissance is poised to play a pivotal role in Nigeria’s energy market, aligning with the government’s goal to increase local participation in the sector.

The deal also reflects a broader vision of ensuring that the benefits of Nigeria’s vast hydrocarbon resources translate into economic growth and development for its citizens.

“Nigeria is continuing its focus on becoming a leading force in the global energy market.

“This approval is poised to steadily improve the positive impact the industry will have on domestic companies operating in the country.”

NJ Ayuk, Executive Chairman of the AEC

The approval of the Shell-Renaissance deal highlights the Nigerian government’s determination to create an enabling environment for local companies to thrive.

Implications for Nigeria’s Energy Sector

The $1.3 billion deal is not only a testament to the capabilities of Nigerian companies but also a major step forward in achieving the government’s $10 billion investment target for the oil and gas sector.

Transferring ownership of Shell’s onshore assets to local firms, Nigeria is ensuring that wealth generated from its natural resources remains within the country, driving job creation and infrastructure development.

Beyond its impact on the oil and gas industry, the Shell-Renaissance deal is expected to have far-reaching socioeconomic benefits.

Indigenous companies like those in the Renaissance consortium are well-positioned to prioritize community development, environmental sustainability, and job creation.

NJ Ayuk highlighted this aspect, stating, “We look very much forward to seeing what Renaissance has in store, not just for Nigeria’s energy sector, but for the broader growth of socioeconomic development in the West African region.”

The Renaissance consortium’s acquisition also signals a shift in Nigeria’s energy strategy, with an increased focus on utilizing local expertise to explore and develop untapped resources.

This aligns with the government’s broader objective of enhancing production capacity and achieving energy security.

As Nigeria continues to implement policies that support local empowerment and attract investment, the future of its energy sector looks promising.

Deals like the Shell-Renaissance acquisition serve as a blueprint for other African nations seeking to balance foreign investment with local participation.

With its rich natural resources, strategic policy reforms, and commitment to local capacity building, Nigeria is well on its way to solidifying its position as a leading force in the global energy market.

The African Energy Chamber’s endorsement of the Shell-Renaissance deal further underscores the significance of this achievement, paving the way for a brighter, more inclusive future for Nigeria’s energy sector.

The $1.3 billion acquisition is more than just a business transaction; it is a testament to Nigeria’s vision of empowering its local companies, fostering sustainable development, and positioning itself as a competitive player in the global oil and gas industry.

READ ALSO: Mozambique Turmoil Sparks Action on Cross-Border Trade