Ghana’s energy sector has long been plagued by inefficiencies, financial woes, and governance challenges, with the Electricity Company of Ghana (ECG) at the center of its struggles.

Years of poor leadership, procurement abuses, and weak revenue collection systems have left ECG in dire straits, forcing it to depend heavily on subsidies from the national budget.

This dependency has contributed significantly to Ghana’s mounting fiscal challenges. With the election of President John Mahama and a new administration, hopes are high for reforms that could breathe new life into ECG and the broader energy sector.

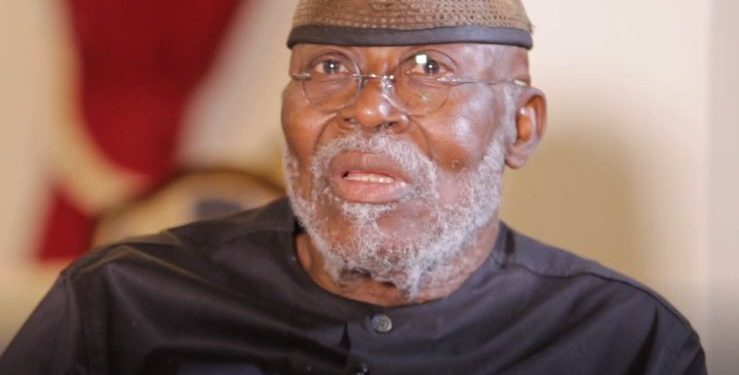

In an interview with Vaultz News, Kodzo Yaotse, Policy Lead on Petroleum and Conventional Energy at the Africa Centre for Energy Policy (ACEP), highlighted key areas requiring immediate attention and structural change to revitalize the sector.

As President Mahama begins his term, one of his first challenges will be appointing the right leadership for the energy sector.

“Leadership appointments will be critical to signaling whether there’s a new direction for the energy sector.

“Investors and stakeholders alike are waiting to see what policies will be introduced in the first and second quarters of next year.”

Kodzo Yaotse, Policy Lead on Petroleum and Conventional Energy at ACEP

Beyond leadership appointments, the new administration must address ECG’s debt crisis, streamline revenue collection, and foster transparency in its operations.

At the heart of ECG’s challenges lies its inability to collect sufficient revenue. The company’s revenue collection efficiency stands at a dismal 43%, creating a massive funding gap across Ghana’s power value chain.

“Any attempt at fixing the energy sector problems starts from there.

“How do we ensure that the utility company is able to collect enough revenue so that you’re able to pay back through the entire value chain to provide reliable power?”

Kodzo Yaotse, Policy Lead on Petroleum and Conventional Energy at ACEP

This inefficiency has had a ripple effect. Independent Power Producers (IPPs), who generate electricity for the national grid, have repeatedly threatened to shut down operations due to unpaid debts.

One such case involved Sunon Asogli Power, which temporarily suspended its operations earlier this year over ECG’s inability to meet its financial obligations. These disruptions not only risk plunging the nation into darkness but also discourage private investment in the sector.

The governance structure of ECG has been another major stumbling block. The company is often run with a political mindset rather than a commercial one, limiting its operational effectiveness.

Yaotse criticized the lack of accountability and the excessive influence of political appointees, saying, “ECG has simply become ungovernable because the people managing the entity show that they are not responsible to the regulator but to the appointee authority, the President.”

This has led to public disagreements between ECG and PURC, undermining public confidence in both entities.

Calls for Private Sector Participation

One solution that has been widely discussed is the involvement of the private sector in managing ECG. Advocates of this approach, including ACEP, argue that private sector participation could bring much-needed financial discipline and operational efficiency to the company.

This idea is not new. During Mahama’s previous administration, the government initiated a concession process to introduce private sector participation.

However, this process was concluded by the subsequent administration in a manner that was criticized for its lack of transparency, leading to widespread controversy.

As Yaotse pointed out, any renewed attempt to bring in private sector management must be done transparently to regain public trust and attract credible investors.

“We are not asking ECG to be sold because ECG remains a strategic national asset for the energy security of the country.

“What we are asking for is the management and operations of the company to be given to a private entity so that even the regulator can now properly regulate the entity.”

Kodzo Yaotse, Policy Lead on Petroleum and Conventional Energy at ACEP

Under a private management model, the Public Utilities Regulatory Commission (PURC) could enforce its regulatory powers more effectively, ensuring accountability and the necessary investments to sustain ECG’s operations.

This approach, however, would require significant capital injections and careful oversight to avoid the pitfalls of the past.

Renewable Energy Goals: Lofty Commitments, Little Action

Beyond addressing ECG’s inefficiencies, Ghana’s energy sector faces another critical challenge: the slow adoption of renewable energy.

Despite setting ambitious targets in 2010 to achieve 10% renewable energy penetration by 2020, the country has only reached about 2%.

“All the manifestos we’ve seen have made commitments to expanding renewable energy. But the strategies to achieve these goals remain vague. We’ve had to shift our renewable energy timeline to 2030.”

Kodzo Yaotse, Policy Lead on Petroleum and Conventional Energy at ACEP

While renewable energy featured prominently in the manifestos of coming governments, the lack of actionable strategies has hindered progress.

Yaotse lamented, “What is missing from those discussions are the strategies that they are going to use to accelerate that penetration… It is difficult to really tell.”

While the challenges are significant, Ghana’s energy sector is not without hope. However, success will depend on the government’s ability to prioritize long-term solutions over short-term fixes.

The stakes are high. If Mahama’s administration can successfully reform ECG and the broader energy sector, it could set Ghana on a path toward sustainable economic growth.

Failure to act, however, would deepen the country’s fiscal woes and further erode public trust in its institutions.

As the nation waits for concrete action, one thing is clear: the coming months will be pivotal in determining the future of Ghana’s energy sector.

For now, stakeholders and citizens alike will be watching closely to see whether this new government can deliver the change it has promised.

READ ALSO: MTN Ghana Gains as GSE Market Capitalization Hits GHS 109.1 Billion