Russia is poised to increase its energy exports to China in 2025 as part of its strategy to sustain its ongoing conflict with Ukraine, according to Wu Dahui, deputy dean of Tsinghua University’s Russian Institute.

Wu Dahui, a prominent expert on Russian studies, emphasized the protracted nature of the Russia-Ukraine war, stating that 2025 is unlikely to witness a peace agreement.

Instead, he predicts a pattern of “alternating between conflict and negotiation” will become the norm. With economic sanctions tightening and access to Western markets increasingly restricted, Russia is left with few alternatives but to deepen economic ties with China, he said.

“China’s role as a critical partner for Russia will only grow as the global geopolitical environment remains tense,” Wu explained, noting that energy exports will serve as a cornerstone of this relationship.

Bilateral trade value between the two nations is expected to rise, with both sides exploring mechanisms to circumvent sanctions and streamline payment processes.

In 2024, trade between Russia and China reached $222.78 billion, a 2.1% year-on-year increase, according to China’s customs. However, sanctions targeting Gazprombank—the primary institution facilitating payments for Russian oil and gas—introduced new challenges.

Washington’s sanctions, implemented in November, aimed to curtail Russia’s energy revenue by restricting financial transactions. This forced private trading companies to seek alternative payment channels, with many turning to cash-based transactions in Chinese yuan.

Despite these challenges, independent Chinese refiners, key end-users of Russian crude, reported no significant disruption. “Our suppliers are willing to accept yuan payments directly, and the sanctions haven’t affected our crude procurements,” said one refining source.

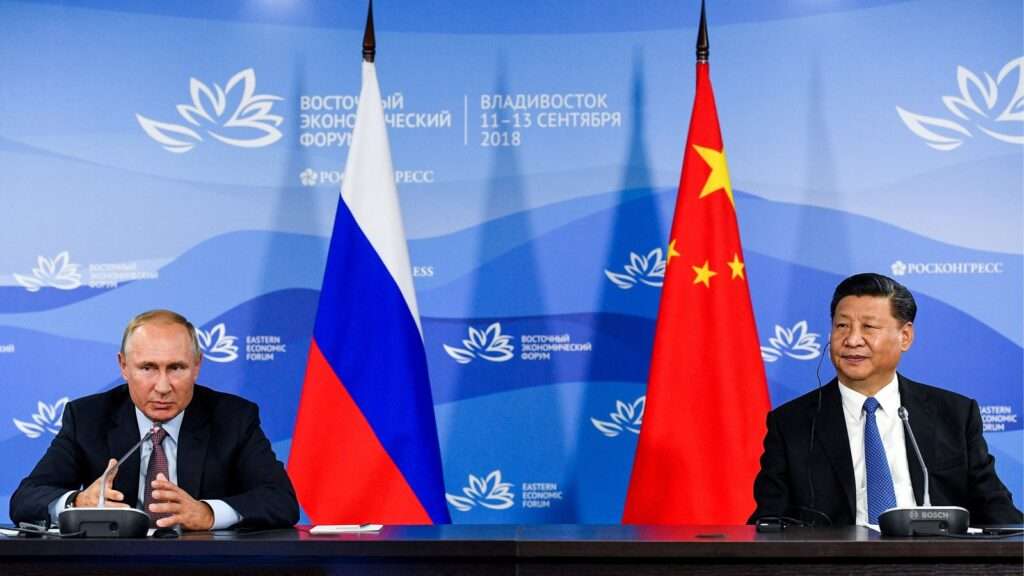

Strategic Bilateral Relations

The Russian Institute at Tsinghua University, a premier institution established to foster cooperation between Beijing and Moscow, has been instrumental in analyzing the strategic needs of the two nations.

“Trump’s approach to resolving the conflict fundamentally differs from Putin’s objectives, particularly regarding NATO, sanctions, and territorial claims, making it too complex to achieve any actual peace agreement in the short term.”

Wu Dahui, deputy dean of Tsinghua University’s Russian Institute

This geopolitical impasse has solidified China’s position as Russia’s primary trade partner. At the 15th Russia’s Calling forum held in Moscow on December 5, Putin reaffirmed Russia’s commitment to strengthening ties with China, describing the relationship as a crucial long-term economic partnership.

Russia’s natural gas exports to China are expected to increase significantly in 2025, with an additional 8 billion cubic meters (Bcm) projected, bringing total annual exports to 38 Bcm.

This expansion will position Russia as China’s largest natural gas supplier, surpassing Turkmenistan’s 33 Bcm/year supply. The increase is facilitated by the China-Russia eastern route gas pipeline, which was commissioned on December 2, 2024, and is expected to reach full capacity in 2025.

Russia has cemented its position as China’s top crude oil supplier, accounting for 19.8% of the market share in the first 10 months of 2024.

During this period, China imported 2.17 million barrels per day (b/d) of Russian crude, representing a 2.2% year-on-year increase, even as China’s total crude oil imports declined by 3.4%.

State-run Rosneft has established term deals with CNPC to supply approximately 800,000 b/d of crude, including 200,000 b/d via Kazakhstan through the Atasu-Alashankou pipeline and 600,000 b/d of ESPO Blend via the Skovorodino-Mohe pipeline.

As Russia navigates the geopolitical challenges of sustaining its war efforts, its reliance on energy exports to China is set to grow.

The expansion of natural gas pipelines, robust crude oil trade, and the adaptability of payment mechanisms will ensure that bilateral trade between Russia and China remains strong.

For China, the geographical proximity and pipeline infrastructure make Russian energy supplies nearly exclusive, offering a strategic advantage over other suppliers reliant on seaborne shipments.

The deepening energy partnership between Russia and China not only underscores their mutual economic interdependence but also highlights the evolving dynamics of global energy trade in the face of geopolitical tensions.