In recent days, speculation has arisen regarding the alleged takeover of Tema Oil Refinery (TOR) by Sentuo Oil Refinery Ltd., a Chinese-owned private oil refinery.

However, TOR has swiftly moved to dispel these rumors, asserting that no talks of acquisition have taken place. In a statement released on Wednesday, April 10, 2024, TOR categorically denied the allegations, emphasizing that there have been no discussions regarding the sale of the refinery.

Furthermore, TOR clarified that no ceremony has been organized to mark any purported acquisition by Sentuo Oil Refinery.

Meanwhile, TOR reaffirmed its dedication to its objectives, particularly the restoration and resumption of operations within its processing plants and equipment. Despite external speculation, TOR emphasized its commitment to achieving these goals independently, without any indication of a purchase or acquisition by Sentuo Oil Refinery.

The statement emphasized TOR’s autonomous stance and refuted claims suggesting otherwise. It emphasised the refinery’s ongoing efforts to enhance its terminal business and reiterated its commitment to operational autonomy.

TOR emphasized its unwavering commitment to due diligence processes and regulatory compliance. The refinery highlighted its rigorous adherence to legal and regulatory obligations before engaging in any commercial endeavors. TOR assured stakeholders that it operates with integrity and transparency, ensuring that all actions are conducted within the framework of established regulations.

By reaffirming its adherence to due diligence and regulatory standards, TOR sought to reassure stakeholders of its commitment to ethical business practices and compliance with legal requirements.

Current Collaboration with Sentuo: A Clear Business Relationship

Moreover, TOR provided clarity on its existing collaboration with Sentuo Oil Refinery, particularly in the realm of crude oil storage. The statement outlined the nature of the partnership, wherein Sentuo pays TOR for the storage of crude oil in the refinery’s storage tanks.

TOR elucidated the logistics involved, including the subsequent transfer of crude oil back to Sentuo for refining operations.

By explaining the specifics of its collaboration with Sentuo, TOR aimed to dispel misconceptions and provide transparency regarding its business relationships.

TOR reiterated its commitment to maintaining strong relationships with stakeholders and fostering transparency. The refinery assured stakeholders that any significant developments or adjustments would be communicated openly and clearly. TOR emphasized the importance of transparency in its operations, highlighting its dedication to keeping stakeholders informed and engaged.

Through its commitment to transparency and open communication, TOR sought to reinforce trust and confidence among its stakeholders.

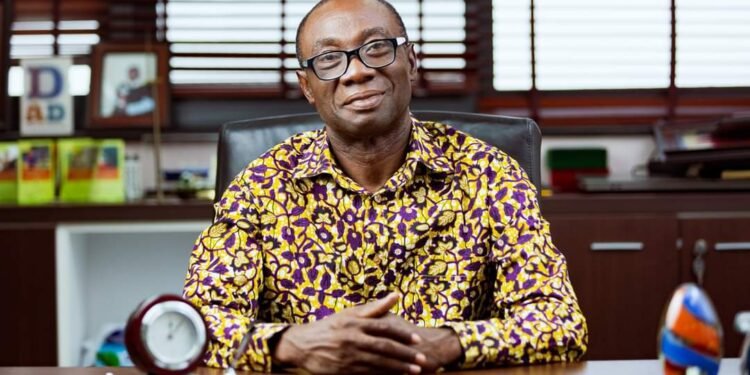

It can be recalled that the Executive Director of the Alliance for Social Equity and Public Accountability (ASEPA), Mensah Thompson, accused the Ghanaian government of intentionally sabotaging the operations of the Tema Oil Refinery (TOR) to pave the way for its sale to Sentuo Oil Refinery Limited.

Mr Thompson alleged that this move is aimed at granting Sentuo Oil Refinery Limited a monopoly in the market, allowing it to dictate prices without the inconvenience of competing with TOR for market share. He argued that if TOR were perceived to be functioning effectively, the public would resist its sale to Sentuo.

Mr Thompson’s comment came after a whistle-blower alert received from a TOR insider revealed to ASEPA that a meeting was ongoing between the Managements of TOR and Sentuo Oil Refinery on the sale of TOR.

Mr Thompson, moreover, highlighted the government’s pattern of deliberate mismanagement and neglect of state-owned enterprises when they have plans to sell them. “Look at how a valuable entity like Ghana Airways went down and was sold. We have a lot of private Airways in Ghana that are profitable. Now, Ghanaians are paying exorbitant fees for air travel because we no longer have a national airline,” he lamented.

READ ALSO: Strategic Imperative of SEC’s Deadline for Listed Companies’ 2023 Financial Reports

Top of Form