President of the Ghana Union of Traders Association (GUTA), Dr Joseph Obeng, has disclosed that the projected establishment of the Ghana Traders Bank is to help minimize lending rates to traders in the country.

According to him, universal banks over time have offered steep lending rates which has made it almost impossible for traders to borrow to expand their businesses. Dr Obeng explained that the difference between the Traders bank and the national development bank proposed by government is to ensure that the needs of traders are addressed.

“They price us very high for the interest; the lending rates being far away from the policy rates. This is the reason why we are craving for our own bank where we will minimize the lending rates to the barest possible, to suit the trading community. In this case, we are going to tailor make the services to the needs of the trading community”.

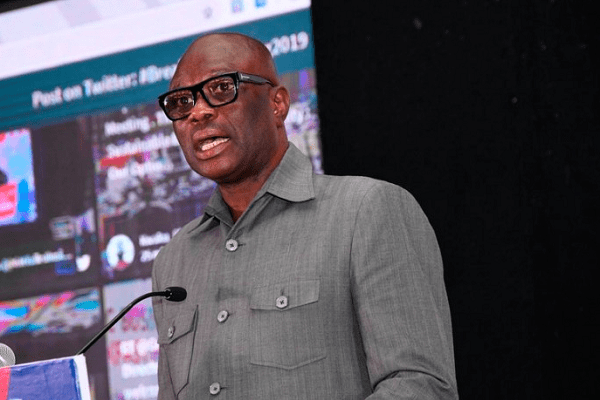

Dr Joseph Obeng

Speaking to the Vaultz News, Dr Obeng revealed that if government sets up the Traders Bank as a one purpose bank in the direction of business community for them to source their “credit at affordable rate”, then it is in the right order. He disclosed that from the explanation given to the Association, funds from the development bank is going to be “earmarked” for the mainstream bank for disbursement to traders.

The GUTA President emphasized that what this means is that the “status quo” remains and banks are going to behave the same way they were behaving. Dr Obeng noted that, once government makes the national development bank a one purpose bank designed to factor in the needs of the business community with regards to access to “affordable credit”, then it will be in line with what they intend doing with the Traders’ Bank.

“But the explanation given to us [with] regards to the National Development Bank is that they are going to create the fund for the disbursement for the mainstream banks for onward disbursement to the trading community which has been the norm”.

Dr Joseph Obeng

Addressing lending rates challenges

High cost of borrowing has been a bane to businesses as the current average lending rate stands at 20.5%. Commenting on how GUTA intends to ensure traders borrow at a lower rate than the banking sector average, Dr Obeng indicated that if they are able to “prune down” the cost that the banks price for traders to the “barest minimum”, then they would succeed in transferring the benefit to the trader who is coming for the loan from the Ghana Traders’ Bank.

“We are not expecting that if the policy rate is 13.5%, we will put a cap of about 5%. We intend to put not more than 5% as the cap which will lower the interest rate to appreciable level. So, if the policy rate goes down to 10, we are not going beyond a cap of maybe 5%. So, it means we can go between 3% to 5% after the policy rate which will be quite affordable for the customer compared to the mainstream bank”.

Dr Joseph Obeng

Dr Obeng revealed that the “policy rate” is there to “guide us” even though banks “price the rate”. Based on the fact that banks insist there are defaulting customers who do not pay their loans, the GUTA President admitted that there are some lapses in the operations of banks which endears them to look for ways to recoup their monies by piling such debt on the otherwise “innocent customer” who is paying his loans.

To resolve the challenge, Dr Obeng posited that the onus lies on the bank to consider all the things such as operational inefficiencies, corruptions at the bank, leading to “astronomical cost”, which is then spread to “anybody to pay”.

“… The onus lies on them to do the necessary due diligence to make sure that they’re not giving their monies for bad customers for them to default. Sometimes, the customer defaults because [they’re] in connivance with some of the bank officials… So, the bank officials will give this to their cronies knowing that the money will not be paid. Then they put all these together and then price the lending rate high for the unassuming, otherwise innocent customer who duly pays…”

Dr Joseph Obeng

Read Also: France returns 26 treasures stolen in colonial-era back to Benin