The President of the Ghana Union Traders Association (GUTA), Dr Joseph Obeng, has disclosed that the yet to be established Ghana Traders Bank will not be solely owned by traders.

According to him, it’s a universal bank like we have the “Agricultural Development Bank”. He explained that the concept of the Agric Development Bank is to “support farmers” although it doesn’t mean other people “cannot save” through Agric Development Bank.

“So, it is in the same light… The concept is designed for the benefit of the trading community but it does not mean it’s going to be owned by the traders alone. It’s going to be a universal bank which is going to have [people] who are going to manage these funds. Of course, we are expecting that government also brings its input… so that what government will give to the mainstream banks, a portion will also be given to us”.

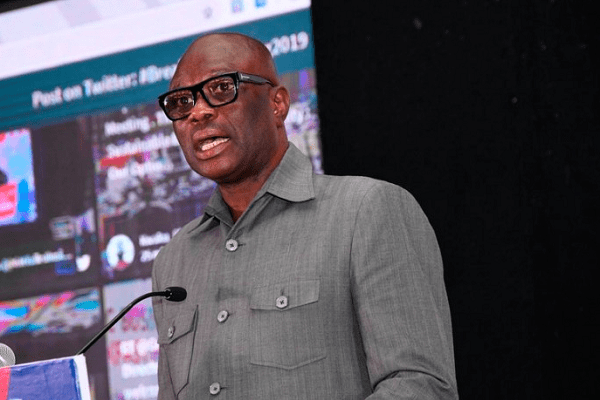

Dr Joseph Obeng

Speaking to the Vaultz News, Dr Obeng noted that the Association has been paying the “Exim fund” through the Exim bank by taking all the charges for “importation and give it to exporter”. Following this, he explained that the onus lies on government to also give traders “fair share” because they cannot always be paying for other areas of the economy.

“We have to also capitalize so that we can also migrate from trading to captains of industries. Because we lack the resources to do that, that’s why the traders still remain in their shops, still selling… But the natural progression of trading is for you to start with the small trading activities and then you go into wholesale importation and then… you transform yourself into manufacturing…”

Dr Joseph Obeng

Group specific banks will engineer competition

On his part, the Director of the Institute of Statistical, Social and Economic Research at the University of Ghana, Professor Quartey, revealed that he is “in for” traders having their own bank since banks have been set up for group specific sectors such as cocoa farmers, who have “ADB for agriculture” and “NIB for industries”. As such if services or traders want their own which will address their “specific needs” as well as “engineer competition” then it is in the right direction.

“What I will add is that they have to ensure they meet all the regulatory requirements and also they run it like a business with all the key management [and] very competent personnel in place”.

Professor Quartey

Touching on how affordable the loans will be for the traders, Professor Quartey explained that one issue with banking is the issue of “domestic information” and due to this the banks will not know everything about the customer. However, he noted that if the bank is dealing with a customer, a client based that it knows very well, then the “risk premium” that it will charge as part of the lending rate will be minimized.

“So, in my opinion, traders have a bank and they themselves know the nature of the business and everything, it will minimize the risk of default and that will also reduce the lending rate”.

Professor Quartey

Commenting on how accessible the Traders Bank will be, Prof Quartey indicated that “it depends” on a number of factors. He expressed that if it is not something that will be “centralized in Accra” but will be in the regions, then it will be “more accessible”.

“But if it’s going to be one big bank in the capital cities, then it won’t be very much accessible to all traders. But I think in all, once it is a bank with traders in mind [and] in focus, they will tailor their products that will meet their clients’ demand. So, they will be more accessible unlike some of the formal banking system where they find it difficult to approach the banks, they don’t have the confidence to even walk into a bank. This one, I believe, will be tailor made and closer to the people”.

Professor Quartey

Read Also: Vodacom to Augment Market Position with Two Major Acquisitions