President of the Ghana Union Traders Association (GUTA), Dr Joseph Obeng, has condemned what he described as the ‘Rambo style’ operation by the Ghana Revenue Authority (GRA) in invading businesses of traders in the Ashanti region.

According to him, the GRA cannot assign any cogent reason for the harassment of traders in the Ashanti region apart from its usual “flimsy” explanation that Ashanti region contributes only about 12% tax to the national revenue.

He revealed that GRA equally predicates its operation on the claim that it does not understand why goods in Ashanti region are cheaper than in Greater Accra region.

To this, Dr Obeng explained that GRA failed to recognize that the purchasing power and demand for goods and services in Accra are higher than any part of the country.

Furthermore, Dr Obeng noted that the 12% tax contribution from Ashanti commensurate with the business activities in the region as most of the corporate entities with branches in Ashanti and other regions pay their taxes in Accra, as well as payment of duties.

“With regard to the VAT invigilation, we detest the ‘Rambo’ style manner of infiltration and invasion of our privacy in our business premises by the GRA. What needs to be made clear is that the VAT system which is a consumption tax should be restructured to bring fairness, parity, simplicity and affordability to ensure effective compliance as the only way forward to compel both the trader and the consumer to abide by the policy.”

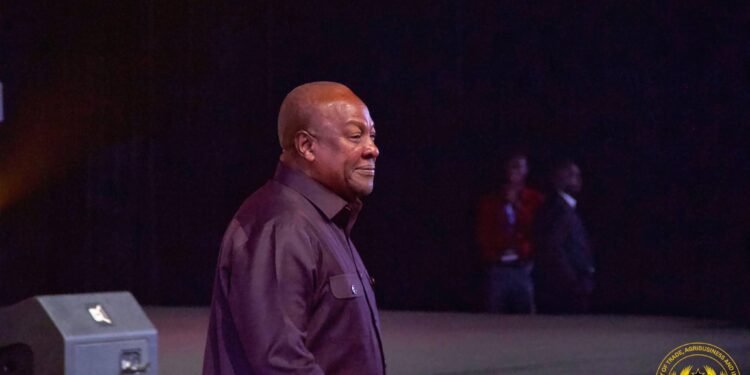

Dr Joseph Obeng

Payment of VAT by traders

Addressing the media today, September 20, 2023, Dr Obeng emphasized that the existing structure when it comes to VAT payment is now in three forms which is not uniform.

He elaborated that there are traders who charge the standard rate system of about 22%, those who charge the flat rate system of 4% and those who are made not to charge the VAT at all due to the threshold limit.

“All these group of traders are operating in the same vicinity. In this circumstance, the consumer uses his or her discretion and he or she is not under any obligation… As if that is not enough, GRA also goes further to frustrate members of the business community, especially traders, by sending what they call invigilators to sit in our shops and monitor our sales as if we are in a police station, which perceives business operators as criminals…”

Dr Joseph Obeng

Dr Obeng emphasized that GUTA members have no problem if GRA does its due diligence at the port and collects the legitimate tax due it before the cargos are released. However, he stated that the association will no longer tolerate acts of intercepting cargos of traders after leaving the port.

“… If anything at all, the externalities of COVID-19 pandemic and geopolitics have affected the business community more and we can no longer entertain any abuse from the Authority [and] from any quarter in carrying out our legitimate businesses.”

Dr Joseph Obeng

Meanwhile, Dr Obeng cautioned the GRA that the business community constitutes the economy, and that without them there will be no economy. However, he noted that with or without GRA, businesses will continue to exist.

“Therefore, they must see the need to work with us as partners in national development but not to behave in this manner in their quest to meeting the revenue target set for them. In any case, all the revenue targets set for GRA have been met continuously for four years – it means that the trading community are not doing badly…”

Dr Joseph Obeng

READ ALSO: Economist Demands Cessation Of Government’s Recurring Debt Exchange Programme