As the government prepares to present the 2025 Budget Statement, the Ghana Union of Traders’ Associations (GUTA) has outlined key expectations aimed at easing the burden on businesses and fostering a more competitive market environment.

The Association is advocating for tax cuts, currency stability, and reduced business costs, expressing cautious optimism about potential reforms.

GUTA has welcomed assurances from the new administration regarding plans to streamline the tax system by reducing taxes, duties, and levies, which have long hindered trade and business growth.

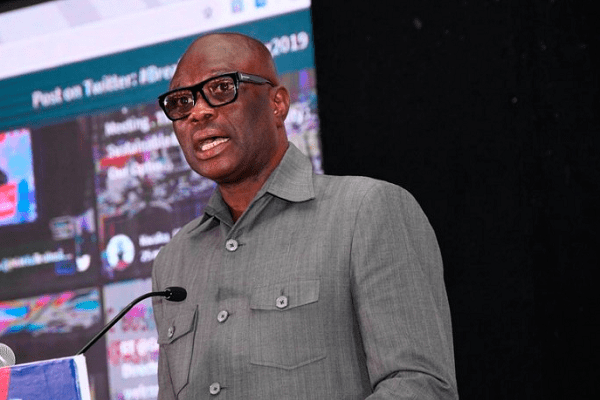

“The assurance to ease the business climate through tax reforms is a step in the right direction. Our expectations are clear, and we believe this budget is an opportunity to address long-standing challenges traders face.”

Tax Reforms and Elimination of “Nuisance Taxes”

A major demand from GUTA is the elimination of what it terms “nuisance taxes”, which the Association believes have become redundant and only serve to increase business costs. According to GUTA, cutting such taxes will relieve traders, promote expansion, and make Ghana’s business climate more attractive.

A key area of focus is the restructuring of the Value Added Tax (VAT) to ensure uniformity across sectors and reduce the compliance burden on businesses. “A reformed VAT system will ease compliance burdens and make operations more predictable for businesses,” Dr. Obeng noted.

GUTA has argued that the complex VAT system discourages compliance and increases operational costs, especially for small and medium-sized enterprises (SMEs). A simplified and affordable VAT structure, they believe, will boost tax revenue while enhancing business sustainability.

Ensuring Exchange Rate Stability for Importers

One of the most pressing concerns for traders is the volatility of the Ghana cedi, which directly affects import costs and business planning. GUTA has, therefore, proposed a shift in how the Bank of Ghana determines the dollar exchange rate used for import duty calculations.

Currently, the exchange rate is adjusted weekly or biweekly, creating uncertainty for traders who must frequently revise pricing and budgets. Instead, GUTA is calling for a fixed exchange rate system, where adjustments are made quarterly or bi-annually to provide stability. “Frequent changes in the dollar rate destabilise business planning. Pegging it quarterly will bring much-needed stability,” the Association emphasized.

If implemented, this measure could help stabilize import duties and reduce price volatility, particularly for essential goods.

GUTA has also proposed the introduction of an unconditional tax amnesty program to encourage more businesses to regularize their tax obligations without fear of excessive penalties.

The Association believes that such a program would not only expand the tax net but also provide relief to struggling businesses. “This is not just about revenue mobilization—it’s about giving businesses breathing space to recover and grow,” Dr. Obeng explained.

GUTA has further emphasized that, alongside tax amnesty measures, the government should adopt effective education, monitoring, and enforcement strategies to ensure fair and transparent application of tax laws.

Fixed Duty System for Spare Parts and Other Imports

A long-standing issue for traders has been the unpredictability of import duties, particularly in the spare parts sector. GUTA is advocating for a fixed duty system, a proposal that aligns with the governing party’s manifesto.

The Association believes this system could eventually be expanded to cover all imported commodities, ensuring greater predictability in pricing and shielding businesses from arbitrary duty fluctuations.

Beyond tax and trade policies, GUTA is urging the government to prioritize economic stability by tackling issues such as inflation, high interest rates, and exchange rate fluctuations. These factors, the Association argues, have made business planning unpredictable and deterred investment. “A stable economic environment is crucial for business predictability and growth,” Dr. Obeng stressed.

In addition to revenue-raising measures, GUTA is also calling for the government to reassess its expenditure priorities to eliminate waste and mismanagement of public funds. “We pay taxes to see meaningful development. Value for money should be a guiding principle in public spending,” Dr. Obeng asserted.

For traders across Ghana, the upcoming budget presents a critical opportunity for reform, one that could determine the future of commerce and entrepreneurship in the country.

READ ALSO: Stock Market Update: Ghana Bourse Sees Four Gainers, One Loser