Dr. Joseph Obeng, the President of the Ghana Union of Traders (GUTA), has petitioned government to widen the country’s tax net for more businesses to boost revenue generation as the Finance Minister prepares to read the mid-year budget on Thursday, July 23.

In an interview, Dr. Obeng said in light of the impact of the pandemic, cost of operation has gone up and as such an intervention from the government by offering a much easier route of credit access will facilitate the fruitful comeback of businesses.

“This time it is very difficult to get credit from some of our foreign suppliers because of the obvious. They are also very handicap, they are not able to meet their own financial requirements. And any fund that government is bringing in the form of a stimulus package shouldn’t just be disbursed to people, but rather it should be used to setup a parallel fund or alternative bank for us, to source affordable credit. That by itself will compel the main stream banks to reduce their interest rate, otherwise, we’ll just be dancing around the problem”.

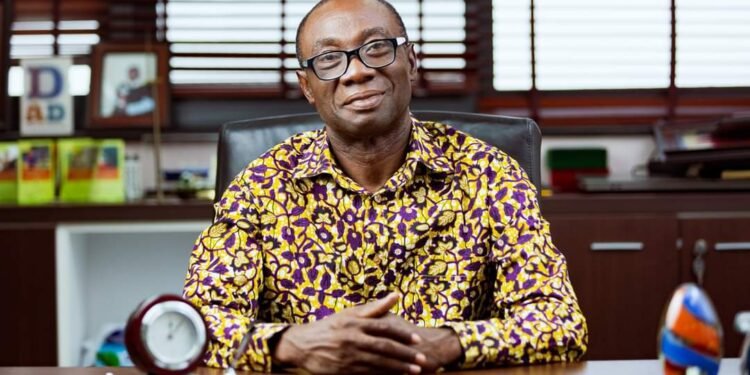

Dr. Joseph Obeng

Consumer spending has been altered as a result of the pandemic which has egregiously affected nations globally and closure of borders has exacerbated the plight of members of the Ghana Union of Traders Association, as the witnessed a decline in revenue.

The situation snowballed downhill as they also experienced a shortage of products and reduced importation caused by a slowdown in production from major import destinations such as China.

According to GUTA CEO, it has become imperative for government to lower the tax burden on a few businesses captured by the Ghana Revenue Authority, as a colossal number of businesses operate in the informal sector.

“We also appeal to government to expand the tax net. The tax net as a structure now is not open, it is just being recycled among the few people who have already been captured by the tax system and so every time government needs money it just comes to increase the taxes and it doesn’t help“.

“We need government to re-look at this and simplify the system especially for the informal sector where a great majority of us are not captured into the tax net. The tax stamp policy should therefore be enhanced and then broadened so that it can capture all aspects of trading in every geographical area”.

GUTA demands better tracking system

On July, 13, the president of the Ghana Union of Traders Association (GUTA), has stated that the lack of data to track business activities online has become a smart avenue to dodge tax payment.

Dr. Joseph Obeng in an interviews that the country’s revenue targets can be exceeded this year if the tax net is spread out to include all transactions in the e-commerce sector.

“E-commerce is coming strongly to overtake most of the physical trading that we do,” he said. Government has not looked on that side especially when many businesses are migrating there due to the coronavirus pandemic and a huge volume of goods being traded there”.

“A whole lot of people are dodging tax payments through this system. Government must sit with stakeholders to find ways to register all patrons of e-commerce even if it means setting up a server to track revenues”.

Businesses are turning to online platforms for various transactions. However, the Coronavirus pandemic, though disrupting business activity, has created a huge demand for e-commerce which today accounts for 80 per cent of business activity in the SME sector.

Unfortunately, there is not any data tracking system by the GRA to tax business activities online.