In a bid to address long-standing hurdles hindering economic growth, trade, and financial inclusion across the African continent, the Pan-African Payment and Settlement System (PAPSS) emerges as a groundbreaking initiative, backed by the African Export-Import Bank (Afreximbank) and the African Union.

Historically, cross-border payments within Africa have been fraught with inefficiencies, high costs, and long processing times. These challenges have impeded the flow of capital, stifled trade opportunities, and marginalized smaller businesses and individuals.

Recognizing the urgent need for a solution, Afreximbank and the African Union spearheaded the creation of PAPSS, with a multifaceted approach aimed at streamlining cross-border transactions.

The system is designed to address several critical issues. First, it seeks to reduce the costs associated with traditional cross-border transactions by eliminating multiple intermediaries, currency conversions, and fees.

Also, it aims to enhance the speed and efficiency of fund transfers, ensuring near-instant transactions between originators and beneficiaries.

Additionally, PAPSS seeks to foster financial inclusion by providing a secure platform for small and medium-sized enterprises (SMEs) and individuals to engage in commerce without facing complex payment procedures.

Lastly, it promotes transparency and oversight, empowering governments and central banks with better visibility into cross-border trade activities, ultimately bolstering revenue generation and economic growth.

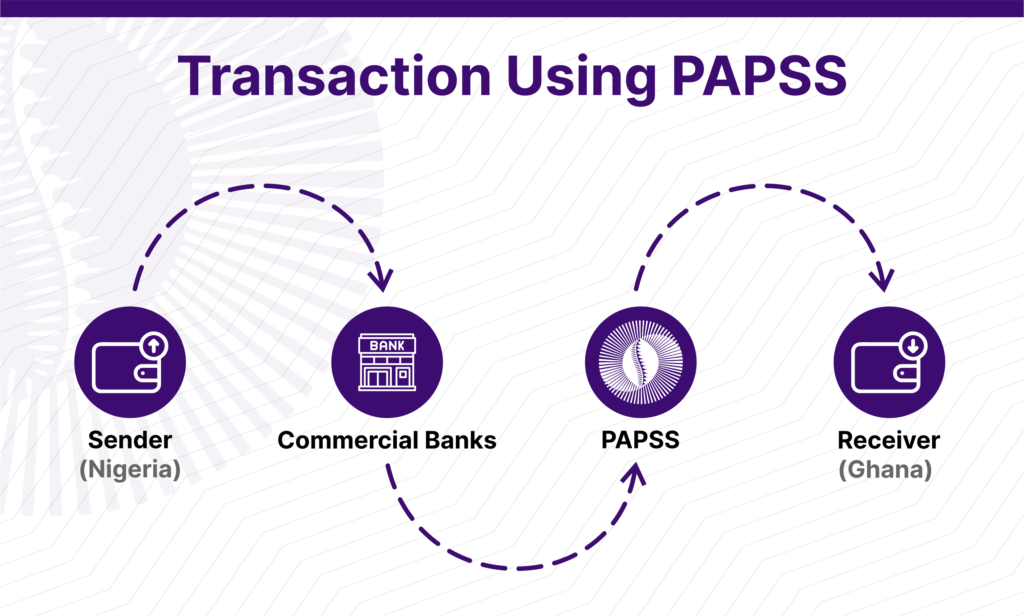

PAPSS operates through a streamlined process. An originator initiates a payment instruction in their local currency, which is then subjected to necessary validation checks by the system. Subsequently, PAPSS forwards the payment instructions to the beneficiary’s bank or payment service provider, facilitating the clearance of funds in the beneficiary’s local currency.

By simplifying payment processes and providing operational efficiencies, PAPSS opens up vast economic opportunities for stakeholders. Encouraging intra-African trade through secure and swift payments, the system fosters confidence among businesses engaging in cross-border transactions.

Moreover, by bridging gaps between African markets, PAPSS contributes to enhanced financial integration, facilitating seamless movement of money and investments across the continent.

Challenges and Opportunities for PAPSS Adoption

Although the concept of PAPSS is an excellent initiative, it seems more work needs to be done to achieve its goal.

According to the latest findings from the Future of Trade Report, approximately half of the businesses operating in Africa are currently unaware of the existence of the Pan African Payment and Settlement System (PAPSS).

Despite its potential to revolutionize intra-African trade by simplifying payment processes, reducing costs, and improving efficiency, the widespread adoption of PAPSS across the continent faces several challenges that need to be addressed.

“A significant hurdle lies in the diverse regulatory landscapes, financial infrastructures, and oversight systems across African nations. Central banks need to find ways to reconcile these differences to ensure PAPSS functions smoothly.”

Future of Trade Report

Additionally, the report highlighted the challenge of establishing a system for settling transactions and determining exchange rates for currencies with fluctuating values. This aspect is crucial for facilitating smooth cross-border transactions.

To address this challenge, the report emphasized the importance of comprehensive campaigns aimed at educating businesses about PAPSS and its advantages. Such efforts could play a significant role in accelerating the adoption of the system.

“Africa’s business leaders aware of PAPSS are strongly positive about its ability to boost intra-African trade,” the report stated.

Moreover, an overwhelming 98% of business leaders recognize the potential of PAPSS to have a positive influence on intra-African trade.

Furthermore, the survey unveiled that 98% of business leaders throughout Africa advocate for their central banks to hasten participation in the PAPSS network. This robust backing underscores the business community’s confidence in PAPSS and their eagerness to see its widespread implementation.

As such, while PAPSS holds immense potential for transforming intra-African trade, addressing regulatory, infrastructural, and awareness challenges is paramount for its successful implementation.

READ ALSO: Projecting Ghana Tourism Via Movies