The Official Liquidator (OL) has gazetted eight (8) additional failed Fund Management Companies (FMCs) whose licences were revoked by the Securities and Exchange Commission (SEC) as the second batch of beneficiaries of the government’s bailout package.

Upon completion of the gazetting process, these corporate organisations will cease to exist, having been duly wounded up by the OL.

The 8 gazetted companies include UniSecurities Gh Ltd, QFS Securities Ltd, Ultimate Trust Fund Ltd, SGL Royal Kapital Ltd, Corporate Hills Investment Ltd, Heritage Securities Ltd, EM Capital Partners Ltd and Cambridge Capital Advisors Ltd.

The Registrar-General and OL, Mrs Jemima Oware, made these comments at the ‘Time with the commissioner‘ series held in Accra and intimates that all the winding up directives for the companies have been gazetted and notices for any remaining claims as proof of debts will be published in newspapers by the end of the week.

Mrs. Jemima Oware however revealed that “for UniSecurities, even after the order had been granted and I had actually gazetted the order, I received an appeal from its lawyers against the order,” the lawyers requested to set a date for their documents to be looked at and agreed upon at the Appeal court halting the process.

“But I have already gazetted the order and so unless I get another application bringing an injunction to restrain me from continuing, I can’t stop,” Mrs. Oware remarked.

Mrs. Oware disclosed that she is going ahead with the creditors’ meeting for the eight defunct companies to be held virtually on 25th and 26th November 2020.

Currently, two (2) other companies from Kumasi namely Global Investments Ltd and Goldstreet Fund Management Ltd are undergoing winding up and gazetting. When the gazetting process is complete, an official notice will be sent to creditors to submit proof of claims “and this will then be followed by the notice for the first creditor meetings and class meetings to be held,” she mentioned.

Recounting the challenges encountered during the liquidation process, Mrs. Oware said the court processes involved were very cumbersome and bureaucratic. Also, some companies had incorrect contact details making it difficult to locate them.

The Registrar General further applauded the government’s efforts in authorising the partial bailout of GH¢50,000 for all remaining customers of the revoked FMCs, pending the outcome of the liquidation petitions.

Finally, she went on assuring that her outfit would expedite the process to bring the much-needed relief to those affected, however, the bailout package being rolled out by the government was not compulsory, as claimants had the choice to accept to be part or to decline.

“The OL is very determined to ensure that all investors and creditors receive their funds once we receive the winding up order”.

Bailout structure

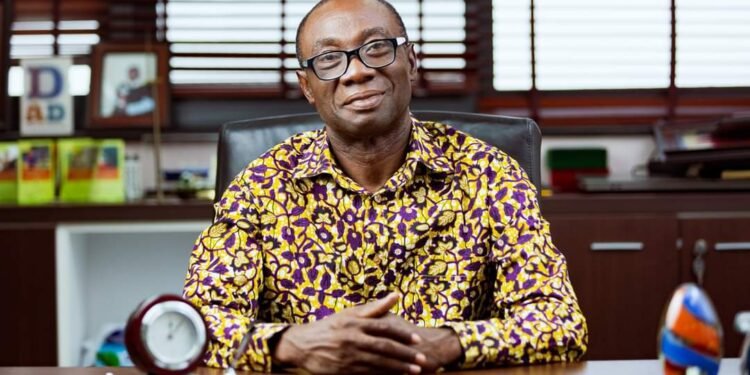

Throwing more light on the bailout structure, the Director-General of SEC, Rev. Daniel Ogbamey-Tetteh, elucidated that the bailout package is to be offered to investors of the FMCs through a Special Purpose Vehicle (SPV), which should be capitalised by the government in the form of short and long-term bonds.

“Investors (claimants) who choose to participate in the bailout programme shall exchange their interests in the defunct FMCs for shares in the SPV. Allocations will be based on validated claims.

“Claimants shall receive a portion of their validated claims in tier one shares of the SPV and a portion in the tier two shares of the SPV,” he opined.

Touching on the allocation formula, he revealed that the beneficiaries have been put into six categories, with all individuals below 60 years getting up to GH¢70,000 or 20 per cent of their validated claims in tier one.

Also, all pensioners aged 60 years and above, as well as schools, Faith-based organisations and hospitals would receive all their validated claims in tier one, he alerted.

Rev. Ogbamey-Tetteh further asserted that all financial institutions, associations, welfare institutions, and credit unions would receive 50 per cent of their validated claims, while all other claimants would get 20 per cent of their validated claims in tier one.

The Managing Director of the GCB Capital Ltd, Mr Kofi El-Awuku, also notified that claimants have up to five years to receive all their funds, even though there is an annual withdrawal schedule.