The Bank of Ghana (BoG) has taken a decisive step towards strengthening its monetary policy formulation by appointing three eminent economists as advisors to the Monetary Policy Committee (MPC).

The appointments, announced by BoG Governor Dr. Johnson Pandit Asiama at the opening of the 124th MPC meeting in Accra on May 21, 2025, are part of ongoing reforms aimed at deepening technical input and broadening perspectives in macroeconomic management.

The newly appointed advisors are Dr. John Kwabena Kwakye, Director of Research at the Institute of Economic Affairs (IEA); Professor John Gatsi, Dean of the University of Cape Coast Business School; and Dr. Francis Kumah, a seasoned economist and former International Monetary Fund (IMF) Resident Representative.

These appointments signal the central bank’s commitment to enhancing evidence-based policymaking and ensuring robust responses to evolving economic challenges. Governor Asiama described the new advisors as “distinguished professionals with deep technical expertise and policy insight,” and emphasized their expected contribution to improving the quality and resilience of monetary policy decisions.

Strengthening Policy Formulation Through Expertise

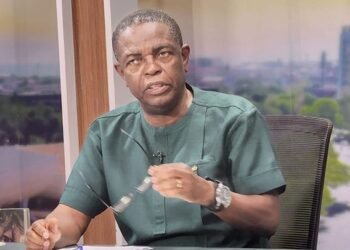

Each of the newly appointed advisors brings a unique set of competencies to the MPC. Dr. John Kwakye, with his extensive research background and advocacy work at the IEA, is well-regarded for his critical yet constructive analysis of Ghana’s monetary and fiscal policy. His appointment is expected to add rigorous scrutiny and independent economic reasoning to the MPC’s deliberations.

Professor John Gatsi, known for his academic and policy-oriented work in finance and macroeconomics, is also expected to play a pivotal role in shaping discussions within the committee. In addition to his broader macroeconomic contributions, Prof. Gatsi’s expertise will be crucial in supporting the BoG’s strategic interest in implementing non-interest (Islamic) banking in Ghana—a move that could expand financial inclusion and diversify the banking sector.

Dr. Francis Kumah’s international experience, particularly his tenure with the IMF, brings a global perspective and a deep understanding of how monetary policy interacts with global financial systems. His insight will be instrumental in helping the BoG navigate complex economic dynamics, especially in the face of external shocks.

A Timely Intervention Amid Economic Recovery

The latest MPC meeting, during which the new appointments were announced, is being held at a critical juncture for Ghana’s economy. The Ghana cedi has appreciated by approximately 19% year-to-date, driven by renewed market confidence, improved foreign exchange inflows, and easing inflationary pressures. However, sustainability remains a concern.

The central bank is currently evaluating whether the gains in the cedi’s value can be maintained in the medium term, as it continues to track inflation trends both globally and domestically. The advisors are expected to provide essential guidance in this assessment, offering insights that balance technical economic modelling with contextual understanding of Ghana’s unique macroeconomic realities.

Moreover, the inclusion of experienced economists in the MPC comes as Ghana seeks to consolidate gains under its IMF-supported programme and strengthen its policy credibility. The enriched composition of the MPC is anticipated to bolster investor confidence and enhance the transparency and effectiveness of monetary policy communication.

All eyes are now on the outcome of the 124th MPC meeting, with the central bank’s next monetary policy rate decision scheduled for announcement on Friday, May 23, 2025. The policy rate decision will be critical in determining the direction of interest rates amid Ghana’s ongoing disinflation process and macroeconomic recovery.

The input of the newly appointed advisors could play a key role in this decision, as they bring fresh analytical frameworks and policy alternatives to the table. Whether the Bank of Ghana opts to maintain its current policy stance or make adjustments will likely depend on the MPC’s assessment of inflation expectations, fiscal risks, and exchange rate stability.

READ ALSO: Zenith and CalBank Lead Ghana’s First-Ever Banking Customer Satisfaction Survey