The Bank of Ghana’s Monetary Policy Committee (MPC) has acknowledged a widespread economic recovery.

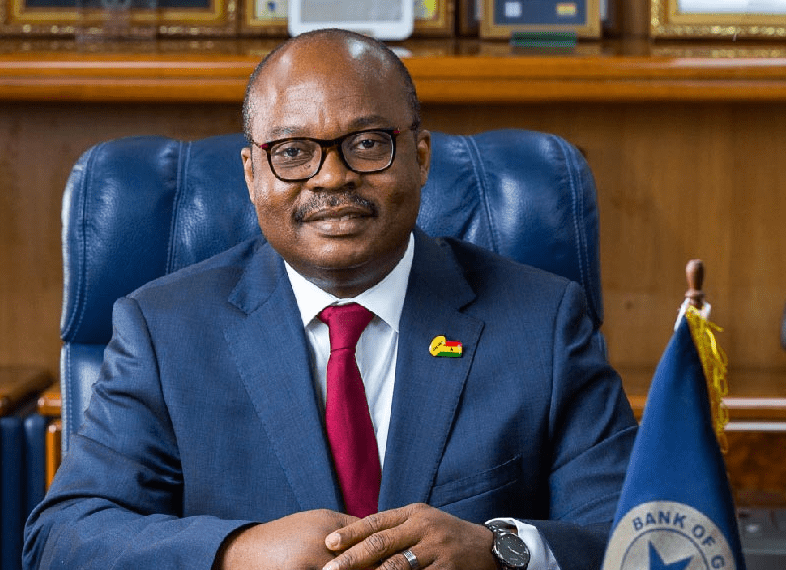

Dr. Ernest Addison, the committee’s chair and governor, affirmed the commitment to sustaining this recovery. In line with this objective, the committee has opted to maintain the policy rate at 30 percent.

Dr. Addison made this announcement during the 115th MPC Press Conference held in Accra.

“The committee has decided to maintain the policy rate at 30 percent until inflation is firmly anchored on a downward trend.”

Dr. Ernest Addison

He elaborated that the committee chose to maintain the policy rate at 30 percent due to the persistently high inflation rate, even though there has been a decline.

Earlier, the Government Statistician, Professor Samuel Annim, revealed a drop in the inflation rate for October 2023 to 35.2 percent, down from 38.1 percent in September 2023. This reduction in the overall inflation rate is linked to a slight decrease in food inflation, with a recorded rate of 44.8 percent, while non-food inflation stood at 27.7 percent during the same period.

Moreover, the inflation rate for domestically produced items was 34.4 percent, and for imported items, it stood at 34.4 percent, a decrease from the previous month’s 37.4 percent. In terms of regional disparities, the Eastern Region registered the highest food inflation rate, while the Upper East region reported the lowest.

Dr. Ernest Addison, the Governor of the Bank of Ghana (BoG), also indicated that Ghana anticipates a meeting of the International Monetary Fund (IMF) board before the year concludes to deliberate on the disbursement of the second tranche of the $3 billion fund. This development follows the positive review of the initial $600 million tranche.

“We expect the IMF board meeting to take place before the end of the year, which should also trigger another disbursement of foreign exchange.”

Dr. Ernest Addison

Impacts Of Monetary Policy Rate

Monetary policy is one of two tools central banks use to shape national economies. Monetary policy, is a pivotal factor in influencing borrowing costs, investments, and overall economic activity. The central bank’s adept management of these tools is instrumental in achieving macroeconomic stability and fostering an environment conducive to sustainable growth.

The primary goal of monetary policies is to maintain price stability through the control of money supply into an economy.

The effectiveness of monetary policies becomes even more critical in the context of Ghana’s developing and struggling economy, where external factors and commodity prices present unending challenges.

One notable aspect of the impact of the monetary policy rate is its effect on businesses. When the BoG adjusts the policy rate upward, it often leads to increased lending rates. This, in turn, raises borrowing costs for businesses, particularly those heavily reliant on debt financing. The repercussions extend to consumer spending, as higher interest rates may result in reduced consumer expenditures, affecting businesses dependent on robust consumer demand.

Notably, higher interest rates can attract foreign capital, impacting exchange rates and potentially contributing to a stronger local currency. While this can benefit businesses engaged in international trade, it may pose challenges for others.

Small and medium-sized enterprises (SMEs), often characterized by less financial flexibility, are particularly sensitive to changes in interest rates. Higher rates could challenge their financial sustainability, impacting their operations and growth plans.

In a clear indication of economic contraction, the Bank of Ghana seeks to maintain a firm-rooted downward inflation through the reduction of money supply in the economy. This is critical as the country heads for the festive season, an election year, and the second tranche of the IMF support program.

READ ALSO: Speaker Of Parliament Coronated As Nana Adasowko I