The Bank of Ghana (BoG) has raised its policy rate by 100 basis points to 28% as part of efforts to re-anchor the disinflation process and maintain economic stability.

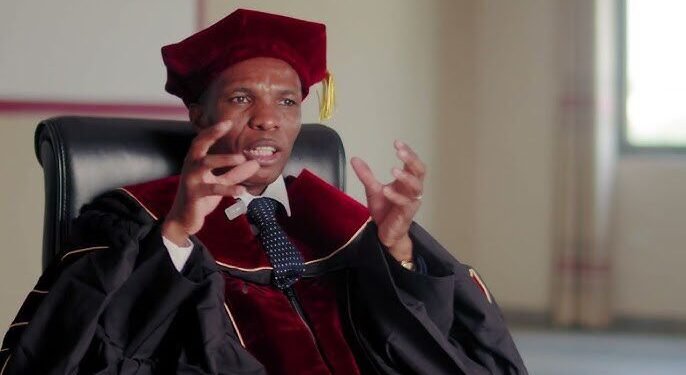

This move, announced during the first Monetary Policy Committee (MPC) press conference of Governor Dr. Johnson Asiama, is aimed at addressing inflationary pressures and ensuring macroeconomic resilience.

Speaking at the press conference, Dr. Asiama emphasized that the decision was influenced by prevailing economic uncertainties, particularly external developments that could drive inflation upwards. “As inflation becomes firmly anchored, the Committee will reassess the scope for a gradual easing in the policy stance,” he stated, highlighting the central bank’s commitment to a data-driven approach in setting monetary policy.

Inflation Concerns Persist

Despite a marginal decline in headline inflation, the BoG remains concerned about inflationary trends, particularly in food and non-food categories. Core inflation, which excludes volatile items, remains elevated, signaling underlying price pressures.

“While food inflation was driven largely by supply-side factors, preventing second-round effects from such increases will be essential,” Dr. Asiama explained. He further pointed out that inflation dynamics over the past year have been influenced by both fiscal and monetary policy missteps, necessitating a policy reset to sustain the disinflation process.

The BoG believes that restoring price stability will require a tight monetary policy stance, stronger liquidity management, and adherence to the 2025 budget, which aims to re-establish fiscal consolidation. “We need a coordinated policy approach to ensure that inflation expectations remain well-anchored,” the Governor added.

Global Economic Uncertainty and Domestic Implications

The decision to increase the policy rate also reflects global economic conditions. The MPC noted that uncertainty in global trade and economic policies, particularly the impact of tariffs imposed by the U.S. administration, could have spillover effects on emerging economies, including Ghana.

“The series of tariffs and trade tensions between major economies have already triggered downward revisions in global growth forecasts,” the BoG stated. This development, coupled with inflationary concerns, has necessitated a proactive stance in monetary policy to safeguard Ghana’s economic stability.

In addition to the policy rate adjustment, the BoG is introducing several operational measures to strengthen liquidity management and enhance monetary policy transmission. One of these measures is the introduction of a 273-day instrument, which will augment existing liquidity sterilization tools.

Furthermore, the central bank is intensifying its monitoring of banks’ Net Open Positions (NOPs) to ensure compliance with liquidity requirements. Additionally, a review of the Cash Reserve Ratio (CRR) structure is underway to assess its broader impact on liquidity conditions and financial intermediation.

Positive Economic Indicators Amid Tight Monetary Policy

Despite the tightening of monetary policy, the BoG’s real sector indicators point to a sustained improvement in economic activity. The Composite Index of Economic Activity (CIEA), a key measure of economic performance, recorded a 5.7% year-on-year increase in January 2025, compared to 3.5% in the same period of 2024.

This growth was driven by increased consumer spending, higher international trade activity, and a rebound in private sector credit. The latest confidence surveys conducted in February 2025 also show a significant improvement in both consumer and business sentiments, reflecting optimism about Ghana’s economic trajectory.

Another notable development is the recovery in private sector credit growth. According to the BoG, private sector credit recorded a 26.9% annual growth rate in February 2025, a significant improvement from the 5.1% growth observed in February 2024. In real terms, credit growth turned positive at 3.1%, compared to a contraction of 14.7% a year earlier.

The BoG attributes this rebound to improved banking sector liquidity and greater confidence among lenders. “Private sector credit is beginning to show signs of recovery, and this is essential for sustaining economic growth,” the Governor noted.

The Bank of Ghana’s latest policy decision underscores its commitment to restoring price stability and ensuring economic resilience. While the rate hike may pose short-term challenges for businesses and borrowers, it is a necessary step to prevent inflation from eroding economic gains.

Moving forward, the BoG will continue to monitor inflationary trends, global economic conditions, and domestic financial stability to determine the appropriate policy stance. “Our focus remains on maintaining a balance between controlling inflation and supporting economic growth,” Dr. Asiama affirmed.

With inflationary risks still present, the central bank’s firm approach signals a determined effort to sustain macroeconomic stability while creating a conducive environment for long-term investment and growth.

READ ALSO: Ghana’s Military Leadership Pledges Loyalty to President Mahama