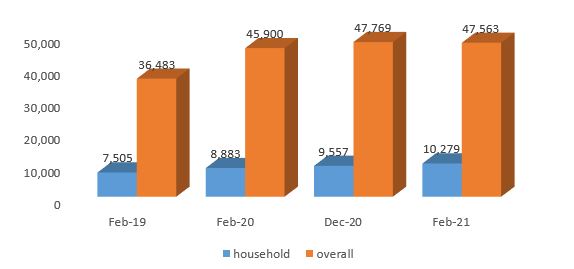

Households share in total credit has continued to see a gradual improvement over the past three years and is currently above pre-COVID levels. According to recent data from the Bank of Ghana, credit to households rose from GH¢8,883 million in February 2020 to GH¢10, 279 million as of February 2021. This represents a year-on-year growth of 15.7%.

The increase in household credit may reflect the impact of COVID-19 on the overall economic activity in the country. This is more so, when people lost their jobs as businesses were badly affected. This may force the typical household to borrow to take care of its basic needs.

Despite the slight growth, credit to households has been very small when compared to total credit. Moreover, it takes a small share in the total credit to the private sector which stands at GH¢47,563 million at the end of February 2021. This means that household credit accounted for 21.6% of the total outstanding credit in February 2021.

Moreover, one of the factors that banks consider before giving credit to any economic agent is the level of risk. As a result, banks devise several ways to access the level of risk, one of which is the level of Non-Performing Loans (NPLs) ratio. Overall, the NPL ratio, which is also a measure of asset quality, rose from 14.7% in January to 15.3% in February 2021. The rise in the overall NPLs perfectly reflects the development in the household default rate. According to BOG, the share of households in total NPLs rose marginally from 8.5% in February 2020 to 8.6% in February 2021. This is, however, lower than the 9.6% recorded in February 2019.

Chart 1: Credit to households (million GH¢)

Source: Bank of Ghana

Economic sectors

Furthermore, a critical look at the data from the BOG shows that the private sector continues to hold a greater portion of overall outstanding credit. Credit to the private sector accounted for nearly 91% of the total credit as of February 2021. As of End-February 2021, credit to the private sector stands at GH¢43,216 million, up from GH¢40,254 million in February 2020. This represents year-on-year growth of 7.4% in 2021 as compared to 21.6% last year.

Within the private sector, the majority of the credit goes to private enterprises. As of February 2021, credit to private enterprise stands at GH¢31,644 million. Overall, the private sector’s share in overall credit stands at 90.9% as of February 2021. Meanwhile, on a year-on-year basis, credit to private enterprise grew by 4.9% in February 2021, down from 22.2% in February 2020. Of this amount, GH¢27,526 million represents the credit to indigenous firms or Ghanaian firms.

Therefore, it unsurprising to note that majority of the NPLs are within the private sector. Currently, the private sector’s share in NPLs stands at 98.1% as of End-February 2021. The high default rate among private firms may be one of the reasons why firms are reluctant to lend to them. Meanwhile, credit is very crucial if the private sector of Ghana is to harness the full potential of the AfCFTA.

Call for a reduction in lending rates

The Ghana Traders Union (GUTA) has consistently petitioned the government to reduce the lending rate in the country. This, GUTA believes will help its member remain competitive amid the wide market the AfCFTA has created. Currently, the average lending rate stands at 21.02% as of the end of February 2021. But if the rate of NPL continues to remain the same among the private firms, then it may be difficult for us to see a reduction in the interest rate.

On the other hand, credit to the public sector stands at GH¢4,347 million as of End-February 2021. This is very much below pre-COVID levels of GH¢5,645 million in February 2020 and as such, represents a decline of 23% in February 2021. It is quite unclear what might be the reason behind the decline. However, it may be rationale to say that the public sector may not have resumed full operation as projects become more targeted.

READ ALSO: Fix The Country: We are not in normal times, our expectations should be measured