The governor of the Central Bank has stated that the latest high-frequency indicators monitored by the Bank of Ghana have gained some momentum and reflect a much faster pace of recovery in economic activity than expected.

This faster pace of recovery according to him was due to the supportive policies, easing of COVID-19 restrictions, and strong liquidity flows to the economy.

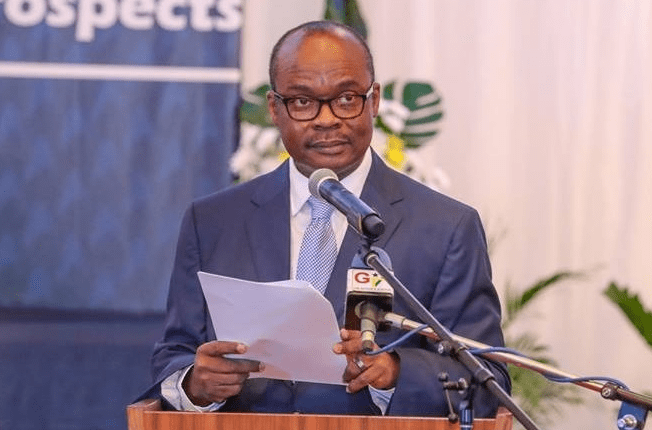

Speaking on the topic “resilience in the midst of the COVID-19 pandemic, and outlook for the sector” at the 2020 Annual Dinner Of The Chartered Institute Of Bankers, Dr. Addison indicated that the prompt fiscal and monetary policy actions that were taken at the onset of the COVID-19 pandemic have helped prevent a deeper contraction of the economy.

He indicated that Inflation pressures from events preceding the partial lockdown of the economy in April 2020 are easing. Headline inflation is currently at 10.1 percent, almost at the upper band of the medium-term target and the latest forecast indicates a return to target by mid-2021.

He further explained that the COVID 19 pandemic presented a major test to the resilience and robustness of the banking sector.

Dr. Addison noted that the Bank of Ghana has risen to the challenge with policy measures to protect the financial system and support the real economy. It is by providence that the financial sector clean-up was undertaken at the time that it took place as heading into the pandemic, Ghana had turned its banking system around and restored confidence in the sector.

All the financial soundness indicators, measured in terms of earnings, liquidity, and capital adequacy showed significant improvement.

“We had put into place a framework to strengthen banks capital. The overall capital adequacy ratio for banks had increased to 20 percent well above the regulatory requirement. The Non-performing loans ratio had declined from 21.3 percent at the end of December 2017 to 15.3 percent in October 2020. Liquidity in the industry had improved and profitability has been on the uptrend”.

The Governor further stated that the Bank of Ghana will continue to strengthen all the regulatory measures implemented over the last three and a half years to maintain confidence and safeguard financial stability.

According to him, in the next three years, “there will be the need to follow a careful unwinding of countercyclical measures that we have implemented and allowed the financial system to function without the regulatory forbearance that we have put into place”.

He admonished Banks to be vigilant and upgrade their capabilities, improve governance and risk culture and “we are optimistic that with this approach, we will build a robust, resilient, and capable financial sector to support Ghana’s Beyond Aid Agenda“.

Also, Dr. Addison revealed that the reforms in the financial markets are yielding the expected benefits to the securities market, with increased levels of bond settlements and transactions on the secondary market.

At the end of October 2020, GH¢ 86.2 billion secondary bond market transactions were settled through the banks on the Central Securities Depository (CSD) platform. This represents a 54.7 percent growth over the GH¢55.7 billion bond market transactions settled for 2019. Also, the reforms have broadly eliminated settlement delays and reduced its attendant systemic risks.

Dr. Addison also pointed out that another area that witnessed a significant expansion in the first ten months of the year is digital payments. The latest data on digital transactions and payments, especially mobile money transactions and GhIPSS Instant Pay (GIP) reflects significant growth.

“Cumulatively from January to October 2020, the number of mobile money transactions increased to 278 million, up from 188 million same times last year. In terms of values, total mobile money transactions more than doubled to GH¢58 billion, from GH¢28.4 billion last year”.

The GhIPSS Instant Pay (GIP) recorded exponential growth in both volumes and values as real-time electronic transfers between banks increased significantly.